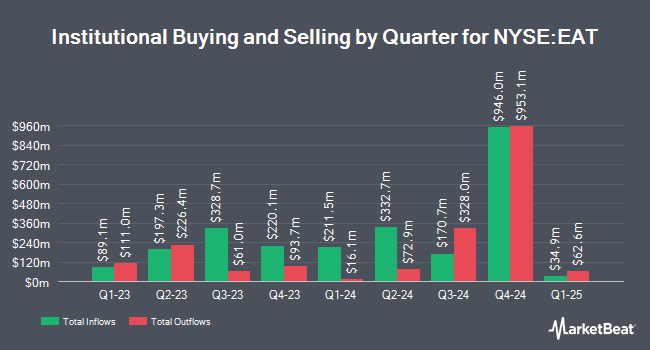

Allspring Global Investments Holdings LLC raised its holdings in Brinker International, Inc. (NYSE:EAT - Free Report) by 12.7% during the third quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 113,946 shares of the restaurant operator's stock after buying an additional 12,800 shares during the quarter. Allspring Global Investments Holdings LLC owned 0.26% of Brinker International worth $8,720,000 at the end of the most recent quarter.

A number of other large investors also recently modified their holdings of EAT. Vanguard Group Inc. increased its holdings in Brinker International by 0.6% in the 4th quarter. Vanguard Group Inc. now owns 5,399,920 shares of the restaurant operator's stock valued at $233,169,000 after buying an additional 30,861 shares during the period. Principal Financial Group Inc. boosted its stake in shares of Brinker International by 0.3% in the 1st quarter. Principal Financial Group Inc. now owns 230,397 shares of the restaurant operator's stock valued at $11,446,000 after purchasing an additional 577 shares in the last quarter. BNP Paribas Financial Markets lifted its holdings in Brinker International by 6.7% during the 1st quarter. BNP Paribas Financial Markets now owns 37,120 shares of the restaurant operator's stock valued at $1,844,000 after purchasing an additional 2,343 shares during the last quarter. Hollencrest Capital Management acquired a new position in Brinker International in the first quarter valued at about $50,000. Finally, Texas Permanent School Fund Corp grew its stake in Brinker International by 3.4% during the first quarter. Texas Permanent School Fund Corp now owns 38,707 shares of the restaurant operator's stock worth $1,923,000 after buying an additional 1,264 shares during the last quarter.

Brinker International Stock Up 1.2 %

Shares of NYSE:EAT traded up $1.09 during trading on Friday, hitting $94.89. 1,270,029 shares of the company's stock traded hands, compared to its average volume of 1,435,637. The company has a 50-day moving average price of $77.96 and a 200-day moving average price of $68.36. Brinker International, Inc. has a 52 week low of $32.02 and a 52 week high of $96.28. The company has a current ratio of 0.38, a quick ratio of 0.32 and a debt-to-equity ratio of 19.96. The company has a market cap of $4.22 billion, a price-to-earnings ratio of 28.16, a price-to-earnings-growth ratio of 1.35 and a beta of 2.51.

Brinker International (NYSE:EAT - Get Free Report) last issued its quarterly earnings data on Wednesday, August 14th. The restaurant operator reported $1.61 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.65 by ($0.04). The company had revenue of $1.21 billion for the quarter, compared to the consensus estimate of $1.17 billion. Brinker International had a negative return on equity of 274.62% and a net margin of 3.52%. The firm's revenue was up 12.3% on a year-over-year basis. During the same period in the prior year, the company earned $1.39 EPS. As a group, research analysts forecast that Brinker International, Inc. will post 4.66 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

Several research analysts have recently commented on the company. UBS Group boosted their target price on Brinker International from $70.00 to $94.00 and gave the stock a "neutral" rating in a report on Thursday, October 17th. Evercore ISI upped their price objective on Brinker International from $69.00 to $90.00 and gave the stock an "in-line" rating in a report on Tuesday, October 15th. Barclays lifted their target price on Brinker International from $66.00 to $76.00 and gave the company an "equal weight" rating in a research note on Tuesday, October 22nd. KeyCorp upped their price target on Brinker International from $72.00 to $100.00 and gave the company an "overweight" rating in a research note on Friday, October 18th. Finally, BMO Capital Markets lowered their price objective on Brinker International from $85.00 to $80.00 and set an "outperform" rating for the company in a research report on Thursday, August 15th. Two research analysts have rated the stock with a sell rating, eleven have issued a hold rating and five have given a buy rating to the company. According to data from MarketBeat.com, the company presently has a consensus rating of "Hold" and an average price target of $74.62.

Check Out Our Latest Stock Report on EAT

About Brinker International

(

Free Report)

Brinker International, Inc, together with its subsidiaries, engages in the ownership, development, operation, and franchising of casual dining restaurants in the United States and internationally. It operates and franchises Chili's Grill & Bar and Maggiano's Little Italy restaurant brands.

Featured Articles

Before you consider Brinker International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brinker International wasn't on the list.

While Brinker International currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.