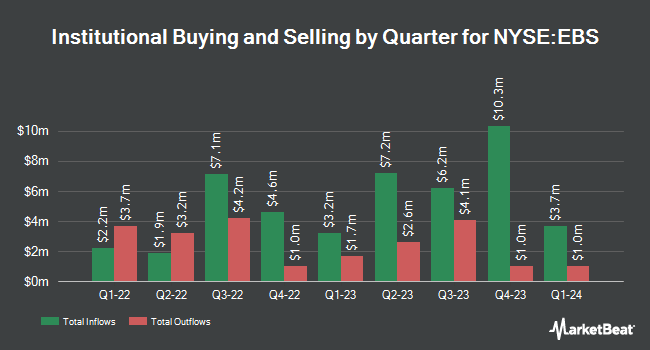

Assenagon Asset Management S.A. increased its holdings in Emergent BioSolutions Inc. (NYSE:EBS - Free Report) by 74.5% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 741,552 shares of the biopharmaceutical company's stock after acquiring an additional 316,700 shares during the quarter. Assenagon Asset Management S.A. owned approximately 1.42% of Emergent BioSolutions worth $6,192,000 as of its most recent SEC filing.

A number of other institutional investors have also added to or reduced their stakes in the business. CWM LLC increased its holdings in Emergent BioSolutions by 32,706.7% during the second quarter. CWM LLC now owns 4,921 shares of the biopharmaceutical company's stock valued at $34,000 after buying an additional 4,906 shares during the period. Meeder Asset Management Inc. purchased a new position in shares of Emergent BioSolutions in the 2nd quarter valued at $41,000. Verus Capital Partners LLC bought a new position in shares of Emergent BioSolutions in the 2nd quarter worth $68,000. Avidian Wealth Solutions LLC purchased a new stake in shares of Emergent BioSolutions during the 1st quarter worth $33,000. Finally, Tidal Investments LLC bought a new stake in Emergent BioSolutions during the first quarter valued at about $34,000. Hedge funds and other institutional investors own 78.40% of the company's stock.

Analyst Ratings Changes

EBS has been the subject of several analyst reports. Benchmark reissued a "buy" rating and set a $8.00 price target on shares of Emergent BioSolutions in a research report on Friday, August 16th. Rodman & Renshaw reissued a "buy" rating and set a $16.00 target price on shares of Emergent BioSolutions in a research report on Friday, September 13th.

Check Out Our Latest Stock Analysis on EBS

Emergent BioSolutions Stock Down 3.5 %

Shares of EBS traded down $0.34 during mid-day trading on Tuesday, hitting $9.33. 722,064 shares of the company traded hands, compared to its average volume of 3,469,942. The company has a market capitalization of $488.91 million, a PE ratio of -0.88 and a beta of 1.59. The company has a quick ratio of 0.54, a current ratio of 1.06 and a debt-to-equity ratio of 1.16. The business has a 50 day moving average of $8.37 and a 200 day moving average of $7.33. Emergent BioSolutions Inc. has a 1-year low of $1.42 and a 1-year high of $15.10.

Emergent BioSolutions (NYSE:EBS - Get Free Report) last posted its quarterly earnings results on Tuesday, August 6th. The biopharmaceutical company reported ($2.32) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.97) by ($1.35). The company had revenue of $254.70 million during the quarter, compared to analysts' expectations of $199.47 million. Emergent BioSolutions had a negative return on equity of 34.38% and a negative net margin of 53.26%. During the same period in the prior year, the business posted ($1.06) EPS. Equities research analysts anticipate that Emergent BioSolutions Inc. will post -1.3 EPS for the current year.

About Emergent BioSolutions

(

Free Report)

Emergent BioSolutions Inc, a life sciences company, provides preparedness and response solutions for accidental, deliberate, and naturally occurring public health threats in the United States. The company offers NARCAN Nasal Spray for the emergency treatment of known or suspected opioid overdose; Vaxchora vaccine for the prevention of cholera; Vivotif vaccine for oral administration for the prevention of typhoid fever; Anthrasil for the treatment of inhalational anthrax; BioThrax, an anthrax vaccine; CYFENDUS for post-exposure prophylaxis of disease following suspected or confirmed exposure to Bacillus anthracis; and Raxibacumab injection for the treatment and prophylaxis of inhalational anthrax.

Featured Articles

Before you consider Emergent BioSolutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Emergent BioSolutions wasn't on the list.

While Emergent BioSolutions currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.