Everest Group (NYSE:EG - Get Free Report) had its target price cut by analysts at Bank of America from $496.00 to $485.00 in a report issued on Thursday, Benzinga reports. The brokerage presently has a "buy" rating on the stock. Bank of America's price objective suggests a potential upside of 23.14% from the company's previous close.

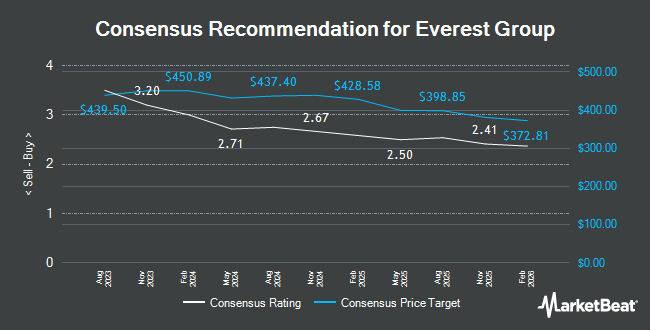

Several other equities analysts have also weighed in on EG. Jefferies Financial Group increased their price target on shares of Everest Group from $440.00 to $457.00 and gave the company a "buy" rating in a research report on Wednesday. TD Cowen reduced their target price on shares of Everest Group from $419.00 to $405.00 and set a "hold" rating for the company in a research report on Tuesday, August 13th. Keefe, Bruyette & Woods lowered their price target on shares of Everest Group from $454.00 to $438.00 and set an "outperform" rating on the stock in a report on Thursday, August 8th. BMO Capital Markets reiterated a "market perform" rating and issued a $403.00 price objective on shares of Everest Group in a research note on Friday, August 30th. Finally, Wells Fargo & Company raised their target price on Everest Group from $393.00 to $406.00 and gave the stock an "equal weight" rating in a research report on Thursday. Four investment analysts have rated the stock with a hold rating, five have assigned a buy rating and one has given a strong buy rating to the stock. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $439.27.

Read Our Latest Stock Report on Everest Group

Everest Group Stock Up 1.3 %

NYSE:EG traded up $4.97 on Thursday, hitting $393.86. The stock had a trading volume of 460,274 shares, compared to its average volume of 340,119. Everest Group has a 1 year low of $343.76 and a 1 year high of $417.92. The firm's fifty day simple moving average is $381.79 and its two-hundred day simple moving average is $380.58. The company has a debt-to-equity ratio of 0.24, a quick ratio of 0.38 and a current ratio of 0.38. The stock has a market cap of $16.96 billion, a P/E ratio of 5.86, a price-to-earnings-growth ratio of 2.83 and a beta of 0.61.

Everest Group (NYSE:EG - Get Free Report) last issued its quarterly earnings results on Wednesday, July 31st. The company reported $16.85 EPS for the quarter, missing analysts' consensus estimates of $16.97 by ($0.12). The business had revenue of $4.23 billion for the quarter, compared to analysts' expectations of $4.32 billion. Everest Group had a net margin of 18.36% and a return on equity of 24.09%. The business's revenue was up 15.8% compared to the same quarter last year. During the same period in the previous year, the business posted $15.21 earnings per share. Analysts predict that Everest Group will post 61.66 earnings per share for the current year.

Institutional Trading of Everest Group

Hedge funds and other institutional investors have recently bought and sold shares of the company. Vanguard Group Inc. bought a new stake in Everest Group during the fourth quarter valued at approximately $1,886,055,000. Wellington Management Group LLP purchased a new position in Everest Group in the fourth quarter worth $751,457,000. Boston Partners increased its stake in Everest Group by 29.1% in the first quarter. Boston Partners now owns 1,197,457 shares of the company's stock valued at $475,750,000 after acquiring an additional 269,665 shares during the last quarter. AQR Capital Management LLC raised its position in Everest Group by 1.8% during the second quarter. AQR Capital Management LLC now owns 1,032,479 shares of the company's stock valued at $393,395,000 after purchasing an additional 17,885 shares in the last quarter. Finally, Champlain Investment Partners LLC lifted its stake in Everest Group by 5.3% during the first quarter. Champlain Investment Partners LLC now owns 906,100 shares of the company's stock worth $360,175,000 after purchasing an additional 45,705 shares during the last quarter. Institutional investors own 92.64% of the company's stock.

Everest Group Company Profile

(

Get Free Report)

Everest Group, Ltd., through its subsidiaries, provides reinsurance and insurance products in the United States, Europe, and internationally. The company operates through two segment, Insurance and Reinsurance. The Reinsurance segment writes property and casualty reinsurance; and specialty lines of business through reinsurance brokers, as well as directly with ceding companies in the United States, Bermuda, Ireland, Canada, Singapore, Switzerland, and the United Kingdom.

Read More

Before you consider Everest Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Everest Group wasn't on the list.

While Everest Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.