Everest Group (NYSE:EG - Free Report) had its target price decreased by Wells Fargo & Company from $406.00 to $402.00 in a report published on Tuesday morning, Benzinga reports. Wells Fargo & Company currently has an equal weight rating on the stock.

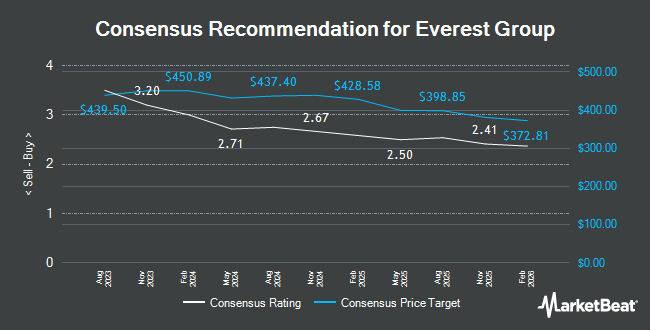

Several other research analysts have also commented on EG. Bank of America reduced their price target on Everest Group from $496.00 to $485.00 and set a "buy" rating for the company in a research report on Thursday, October 10th. Jefferies Financial Group boosted their target price on shares of Everest Group from $440.00 to $457.00 and gave the stock a "buy" rating in a report on Wednesday, October 9th. UBS Group upgraded shares of Everest Group to a "hold" rating in a report on Wednesday, October 9th. BMO Capital Markets reiterated a "market perform" rating and set a $403.00 price objective on shares of Everest Group in a research note on Friday, August 30th. Finally, Barclays lowered their target price on shares of Everest Group from $527.00 to $517.00 and set an "overweight" rating for the company in a research note on Thursday, October 31st. Five analysts have rated the stock with a hold rating, five have assigned a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $438.00.

View Our Latest Report on EG

Everest Group Stock Up 2.0 %

EG stock traded up $6.86 during trading on Tuesday, hitting $354.61. 492,524 shares of the company's stock traded hands, compared to its average volume of 346,933. The firm has a market capitalization of $15.27 billion, a P/E ratio of 5.50, a PEG ratio of 2.45 and a beta of 0.63. Everest Group has a 1 year low of $343.76 and a 1 year high of $417.92. The company has a quick ratio of 0.38, a current ratio of 0.38 and a debt-to-equity ratio of 0.22. The business has a fifty day simple moving average of $385.26 and a two-hundred day simple moving average of $380.80.

Everest Group Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Friday, September 27th. Investors of record on Monday, September 16th were given a $2.00 dividend. This represents a $8.00 annualized dividend and a dividend yield of 2.26%. The ex-dividend date of this dividend was Monday, September 16th. Everest Group's payout ratio is 12.52%.

Insiders Place Their Bets

In other Everest Group news, EVP Mike Karmilowicz sold 269 shares of Everest Group stock in a transaction that occurred on Monday, November 4th. The shares were sold at an average price of $348.48, for a total transaction of $93,741.12. Following the completion of the sale, the executive vice president now directly owns 12,726 shares in the company, valued at approximately $4,434,756.48. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is accessible through the SEC website. 1.20% of the stock is currently owned by insiders.

Institutional Investors Weigh In On Everest Group

Several hedge funds have recently bought and sold shares of EG. American National Bank purchased a new stake in shares of Everest Group during the 2nd quarter worth about $27,000. M&R Capital Management Inc. purchased a new position in Everest Group during the third quarter worth approximately $29,000. Bruce G. Allen Investments LLC grew its holdings in Everest Group by 200.0% in the third quarter. Bruce G. Allen Investments LLC now owns 78 shares of the company's stock valued at $31,000 after purchasing an additional 52 shares during the period. Eastern Bank purchased a new stake in shares of Everest Group in the third quarter valued at approximately $35,000. Finally, Massmutual Trust Co. FSB ADV raised its stake in shares of Everest Group by 36.9% during the 2nd quarter. Massmutual Trust Co. FSB ADV now owns 115 shares of the company's stock worth $44,000 after buying an additional 31 shares during the period. Hedge funds and other institutional investors own 92.64% of the company's stock.

About Everest Group

(

Get Free Report)

Everest Group, Ltd., through its subsidiaries, provides reinsurance and insurance products in the United States, Europe, and internationally. The company operates through two segment, Insurance and Reinsurance. The Reinsurance segment writes property and casualty reinsurance; and specialty lines of business through reinsurance brokers, as well as directly with ceding companies in the United States, Bermuda, Ireland, Canada, Singapore, Switzerland, and the United Kingdom.

See Also

Before you consider Everest Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Everest Group wasn't on the list.

While Everest Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.