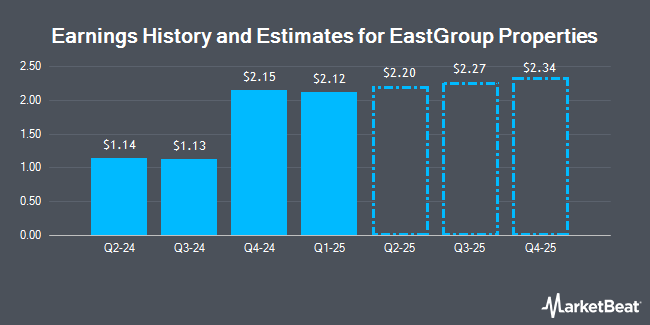

EastGroup Properties, Inc. (NYSE:EGP - Free Report) - Stock analysts at Wedbush raised their FY2024 EPS estimates for shares of EastGroup Properties in a note issued to investors on Friday, October 25th. Wedbush analyst R. Anderson now expects that the real estate investment trust will post earnings of $8.36 per share for the year, up from their previous estimate of $8.34. Wedbush currently has a "Outperform" rating and a $209.00 price target on the stock. The consensus estimate for EastGroup Properties' current full-year earnings is $8.32 per share. Wedbush also issued estimates for EastGroup Properties' FY2025 earnings at $9.05 EPS.

EastGroup Properties (NYSE:EGP - Get Free Report) last issued its quarterly earnings data on Wednesday, October 23rd. The real estate investment trust reported $1.13 EPS for the quarter, missing analysts' consensus estimates of $2.10 by ($0.97). EastGroup Properties had a return on equity of 8.69% and a net margin of 37.16%. The firm had revenue of $162.88 million during the quarter, compared to analyst estimates of $161.52 million. During the same quarter in the prior year, the firm earned $1.95 EPS. The business's quarterly revenue was up 11.2% compared to the same quarter last year.

EGP has been the topic of a number of other research reports. Evercore ISI boosted their price objective on shares of EastGroup Properties from $204.00 to $205.00 and gave the stock an "outperform" rating in a report on Monday, October 7th. Royal Bank of Canada upped their target price on shares of EastGroup Properties from $172.00 to $186.00 and gave the company a "sector perform" rating in a research note on Tuesday, July 30th. StockNews.com lowered shares of EastGroup Properties from a "hold" rating to a "sell" rating in a research note on Monday. Truist Financial upped their target price on shares of EastGroup Properties from $176.00 to $190.00 and gave the company a "hold" rating in a research note on Monday, August 5th. Finally, Mizuho upgraded shares of EastGroup Properties from a "neutral" rating to an "outperform" rating and upped their target price for the company from $175.00 to $200.00 in a research note on Thursday, September 5th. One analyst has rated the stock with a sell rating, six have given a hold rating and eight have assigned a buy rating to the company. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus target price of $192.57.

View Our Latest Stock Report on EastGroup Properties

EastGroup Properties Stock Performance

EGP stock remained flat at $176.53 during trading on Monday. 416,049 shares of the company's stock were exchanged, compared to its average volume of 298,367. EastGroup Properties has a 52-week low of $155.23 and a 52-week high of $192.61. The company has a debt-to-equity ratio of 0.60, a current ratio of 0.21 and a quick ratio of 0.21. The firm has a market capitalization of $8.60 billion, a P/E ratio of 36.93, a P/E/G ratio of 2.70 and a beta of 0.99. The company has a fifty day moving average of $183.96 and a two-hundred day moving average of $175.46.

Institutional Investors Weigh In On EastGroup Properties

Institutional investors and hedge funds have recently modified their holdings of the stock. CANADA LIFE ASSURANCE Co lifted its position in shares of EastGroup Properties by 5.9% during the 1st quarter. CANADA LIFE ASSURANCE Co now owns 95,952 shares of the real estate investment trust's stock valued at $17,242,000 after acquiring an additional 5,342 shares during the last quarter. Tidal Investments LLC lifted its holdings in shares of EastGroup Properties by 30.4% in the first quarter. Tidal Investments LLC now owns 18,316 shares of the real estate investment trust's stock valued at $3,293,000 after purchasing an additional 4,271 shares in the last quarter. Atria Investments Inc lifted its holdings in shares of EastGroup Properties by 48.9% in the first quarter. Atria Investments Inc now owns 11,389 shares of the real estate investment trust's stock valued at $2,047,000 after purchasing an additional 3,740 shares in the last quarter. Vaughan Nelson Investment Management L.P. lifted its holdings in shares of EastGroup Properties by 30.1% in the second quarter. Vaughan Nelson Investment Management L.P. now owns 280,759 shares of the real estate investment trust's stock valued at $47,757,000 after purchasing an additional 64,984 shares in the last quarter. Finally, Vanguard Group Inc. lifted its holdings in shares of EastGroup Properties by 3.2% in the first quarter. Vanguard Group Inc. now owns 6,863,129 shares of the real estate investment trust's stock valued at $1,233,785,000 after purchasing an additional 210,207 shares in the last quarter. Institutional investors and hedge funds own 92.14% of the company's stock.

EastGroup Properties Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Tuesday, October 15th. Stockholders of record on Monday, September 30th were given a dividend of $1.40 per share. This represents a $5.60 dividend on an annualized basis and a dividend yield of 3.17%. The ex-dividend date of this dividend was Monday, September 30th. This is an increase from EastGroup Properties's previous quarterly dividend of $1.27. EastGroup Properties's dividend payout ratio is 117.15%.

EastGroup Properties Company Profile

(

Get Free Report)

EastGroup Properties, Inc NYSE: EGP, a member of the S&P Mid-Cap 400 and Russell 1000 Indexes, is a self-administered equity real estate investment trust focused on the development, acquisition and operation of industrial properties in major Sunbelt markets throughout the United States with an emphasis in the states of Florida, Texas, Arizona, California and North Carolina.

Featured Stories

Before you consider EastGroup Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EastGroup Properties wasn't on the list.

While EastGroup Properties currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.