EastGroup Properties (NYSE:EGP - Get Free Report) was downgraded by research analysts at StockNews.com from a "hold" rating to a "sell" rating in a research note issued on Monday.

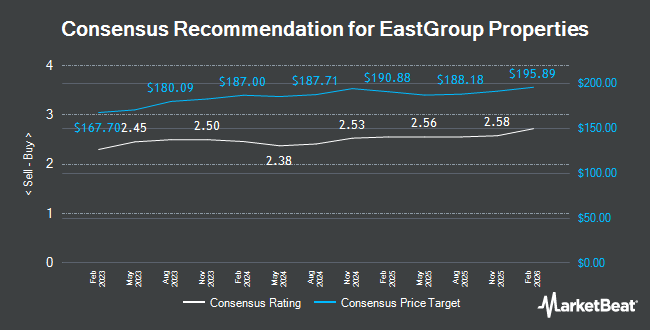

Several other research firms have also weighed in on EGP. Mizuho upgraded shares of EastGroup Properties from a "neutral" rating to an "outperform" rating and lifted their price objective for the company from $175.00 to $200.00 in a research note on Thursday, September 5th. Barclays decreased their target price on EastGroup Properties from $198.00 to $193.00 and set an "equal weight" rating for the company in a research report on Thursday, October 10th. Evercore ISI increased their price target on EastGroup Properties from $204.00 to $205.00 and gave the stock an "outperform" rating in a report on Monday, October 7th. Morgan Stanley boosted their price objective on EastGroup Properties from $158.00 to $186.00 and gave the company an "equal weight" rating in a report on Thursday, August 22nd. Finally, Truist Financial increased their target price on EastGroup Properties from $176.00 to $190.00 and gave the stock a "hold" rating in a report on Monday, August 5th. One investment analyst has rated the stock with a sell rating, six have given a hold rating and eight have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the company has a consensus rating of "Hold" and a consensus target price of $192.57.

Read Our Latest Report on EGP

EastGroup Properties Price Performance

Shares of EGP remained flat at $176.53 during trading hours on Monday. 416,049 shares of the stock traded hands, compared to its average volume of 298,367. EastGroup Properties has a 52 week low of $155.23 and a 52 week high of $192.61. The business's fifty day simple moving average is $183.96 and its 200-day simple moving average is $175.46. The company has a market capitalization of $8.60 billion, a price-to-earnings ratio of 36.93, a P/E/G ratio of 2.70 and a beta of 0.99. The company has a quick ratio of 0.21, a current ratio of 0.21 and a debt-to-equity ratio of 0.60.

EastGroup Properties (NYSE:EGP - Get Free Report) last issued its quarterly earnings results on Wednesday, October 23rd. The real estate investment trust reported $1.13 EPS for the quarter, missing analysts' consensus estimates of $2.10 by ($0.97). EastGroup Properties had a net margin of 37.16% and a return on equity of 8.69%. The firm had revenue of $162.88 million for the quarter, compared to the consensus estimate of $161.52 million. During the same period last year, the company posted $1.95 EPS. The business's revenue was up 11.2% compared to the same quarter last year. As a group, analysts forecast that EastGroup Properties will post 8.32 earnings per share for the current fiscal year.

Hedge Funds Weigh In On EastGroup Properties

Several hedge funds have recently modified their holdings of EGP. Vanguard Group Inc. boosted its position in EastGroup Properties by 3.2% in the first quarter. Vanguard Group Inc. now owns 6,863,129 shares of the real estate investment trust's stock worth $1,233,785,000 after purchasing an additional 210,207 shares during the last quarter. Ceredex Value Advisors LLC bought a new position in EastGroup Properties during the second quarter valued at about $35,131,000. Boston Partners increased its holdings in EastGroup Properties by 26.1% during the first quarter. Boston Partners now owns 953,736 shares of the real estate investment trust's stock worth $171,399,000 after buying an additional 197,427 shares during the last quarter. Zimmer Partners LP raised its position in EastGroup Properties by 465.6% in the first quarter. Zimmer Partners LP now owns 200,558 shares of the real estate investment trust's stock worth $36,054,000 after acquiring an additional 165,100 shares during the period. Finally, Millennium Management LLC raised its position in EastGroup Properties by 202.1% in the second quarter. Millennium Management LLC now owns 188,336 shares of the real estate investment trust's stock worth $32,036,000 after acquiring an additional 125,991 shares during the period. Institutional investors own 92.14% of the company's stock.

About EastGroup Properties

(

Get Free Report)

EastGroup Properties, Inc NYSE: EGP, a member of the S&P Mid-Cap 400 and Russell 1000 Indexes, is a self-administered equity real estate investment trust focused on the development, acquisition and operation of industrial properties in major Sunbelt markets throughout the United States with an emphasis in the states of Florida, Texas, Arizona, California and North Carolina.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider EastGroup Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EastGroup Properties wasn't on the list.

While EastGroup Properties currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.