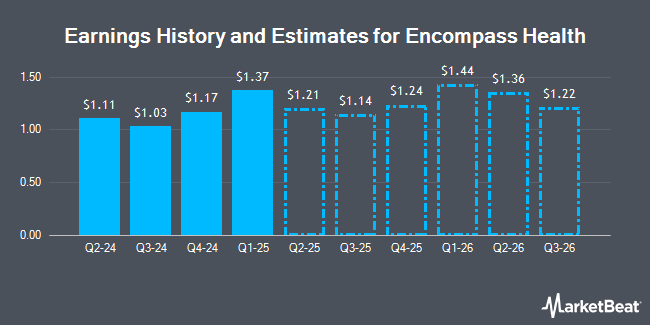

Encompass Health Co. (NYSE:EHC - Free Report) - Equities research analysts at William Blair cut their Q1 2025 earnings per share (EPS) estimates for Encompass Health in a report released on Tuesday, October 29th. William Blair analyst J. Haase now forecasts that the company will earn $1.29 per share for the quarter, down from their prior forecast of $1.32. The consensus estimate for Encompass Health's current full-year earnings is $4.18 per share. William Blair also issued estimates for Encompass Health's Q2 2025 earnings at $1.24 EPS and Q3 2025 earnings at $1.26 EPS.

Encompass Health (NYSE:EHC - Get Free Report) last announced its quarterly earnings data on Monday, October 28th. The company reported $1.03 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.94 by $0.09. Encompass Health had a return on equity of 17.83% and a net margin of 7.88%. The firm had revenue of $1.35 billion for the quarter, compared to analysts' expectations of $1.33 billion. During the same period last year, the firm earned $0.86 earnings per share. The company's revenue for the quarter was up 11.9% compared to the same quarter last year.

A number of other research analysts have also recently issued reports on the company. Leerink Partnrs raised Encompass Health to a "strong-buy" rating in a research note on Wednesday, July 10th. Barclays increased their target price on shares of Encompass Health from $109.00 to $116.00 and gave the stock an "overweight" rating in a report on Tuesday. Royal Bank of Canada increased their target price on shares of Encompass Health from $105.00 to $110.00 and gave the stock an "outperform" rating in a report on Wednesday. UBS Group increased their target price on shares of Encompass Health from $100.00 to $110.00 and gave the stock a "buy" rating in a report on Wednesday, September 25th. Finally, Stephens reiterated an "overweight" rating and set a $105.00 target price on shares of Encompass Health in a report on Tuesday, August 6th. Nine equities research analysts have rated the stock with a buy rating and two have given a strong buy rating to the company. According to data from MarketBeat.com, Encompass Health currently has an average rating of "Buy" and an average target price of $107.11.

Read Our Latest Report on Encompass Health

Encompass Health Trading Down 1.9 %

Shares of NYSE:EHC traded down $1.92 on Thursday, reaching $99.42. 863,294 shares of the company traded hands, compared to its average volume of 640,090. The business's 50-day simple moving average is $94.33 and its 200 day simple moving average is $88.69. Encompass Health has a 52 week low of $61.08 and a 52 week high of $102.36. The stock has a market capitalization of $10.00 billion, a P/E ratio of 24.01, a price-to-earnings-growth ratio of 1.45 and a beta of 0.88. The company has a current ratio of 1.35, a quick ratio of 1.35 and a debt-to-equity ratio of 1.08.

Hedge Funds Weigh In On Encompass Health

A number of institutional investors and hedge funds have recently made changes to their positions in the business. Vanguard Group Inc. increased its stake in shares of Encompass Health by 1.7% during the first quarter. Vanguard Group Inc. now owns 10,166,147 shares of the company's stock valued at $839,520,000 after purchasing an additional 169,113 shares in the last quarter. TD Asset Management Inc increased its position in shares of Encompass Health by 16.0% during the first quarter. TD Asset Management Inc now owns 2,283,674 shares of the company's stock valued at $188,586,000 after acquiring an additional 314,488 shares in the last quarter. Dimensional Fund Advisors LP increased its position in shares of Encompass Health by 1.2% during the second quarter. Dimensional Fund Advisors LP now owns 1,819,345 shares of the company's stock valued at $156,083,000 after acquiring an additional 22,311 shares in the last quarter. Epoch Investment Partners Inc. increased its position in shares of Encompass Health by 14.2% during the first quarter. Epoch Investment Partners Inc. now owns 1,598,042 shares of the company's stock valued at $131,966,000 after acquiring an additional 198,701 shares in the last quarter. Finally, 8 Knots Management LLC increased its position in shares of Encompass Health by 14.0% during the first quarter. 8 Knots Management LLC now owns 1,288,815 shares of the company's stock valued at $106,430,000 after acquiring an additional 158,356 shares in the last quarter. Institutional investors own 97.25% of the company's stock.

Insiders Place Their Bets

In other Encompass Health news, CFO Douglas E. Coltharp sold 12,260 shares of the firm's stock in a transaction dated Tuesday, August 13th. The shares were sold at an average price of $86.34, for a total value of $1,058,528.40. Following the completion of the sale, the chief financial officer now directly owns 136,227 shares in the company, valued at $11,761,839.18. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at this link. 2.10% of the stock is currently owned by company insiders.

Encompass Health announced that its board has approved a share repurchase program on Wednesday, July 24th that authorizes the company to repurchase $500.00 million in shares. This repurchase authorization authorizes the company to buy up to 5.4% of its shares through open market purchases. Shares repurchase programs are generally an indication that the company's management believes its stock is undervalued.

Encompass Health Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, January 15th. Shareholders of record on Thursday, January 2nd will be issued a $0.17 dividend. The ex-dividend date is Thursday, January 2nd. This represents a $0.68 annualized dividend and a yield of 0.68%. Encompass Health's dividend payout ratio (DPR) is presently 16.43%.

About Encompass Health

(

Get Free Report)

Encompass Health Corporation provides post-acute healthcare services in the United States and Puerto Rico. It owns and operates inpatient rehabilitation hospitals that provide medical, nursing, therapy, and ancillary services. The company provides specialized rehabilitative treatment on an inpatient basis to patients who have experienced physical or cognitive disabilities or injuries due to medical conditions, such as strokes, hip fractures, and various debilitating neurological conditions.

Further Reading

Before you consider Encompass Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Encompass Health wasn't on the list.

While Encompass Health currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.