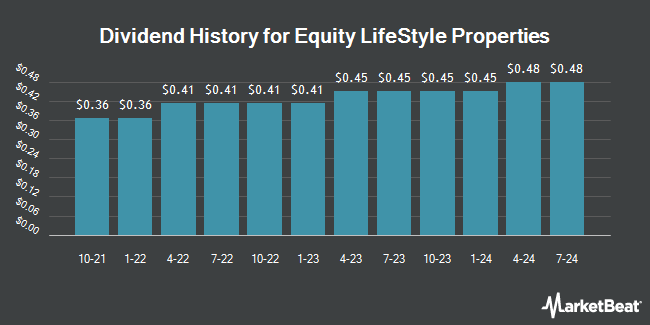

Equity LifeStyle Properties, Inc. (NYSE:ELS - Get Free Report) declared a quarterly dividend on Wednesday, October 30th, Zacks reports. Shareholders of record on Friday, December 27th will be given a dividend of 0.477 per share by the real estate investment trust on Friday, January 10th. This represents a $1.91 dividend on an annualized basis and a yield of 2.74%. The ex-dividend date of this dividend is Friday, December 27th.

Equity LifeStyle Properties has raised its dividend by an average of 18.9% per year over the last three years and has raised its dividend every year for the last 20 years. Equity LifeStyle Properties has a dividend payout ratio of 97.4% indicating that its dividend is currently covered by earnings, but may not be in the future if the company's earnings tumble. Research analysts expect Equity LifeStyle Properties to earn $3.10 per share next year, which means the company should continue to be able to cover its $1.91 annual dividend with an expected future payout ratio of 61.6%.

Equity LifeStyle Properties Stock Down 0.9 %

Shares of NYSE ELS traded down $0.61 during midday trading on Friday, reaching $69.51. The company's stock had a trading volume of 586,291 shares, compared to its average volume of 1,203,671. The stock has a 50 day simple moving average of $71.05 and a 200-day simple moving average of $67.07. The company has a current ratio of 0.03, a quick ratio of 0.03 and a debt-to-equity ratio of 0.35. The stock has a market capitalization of $12.96 billion, a price-to-earnings ratio of 36.19, a PEG ratio of 3.82 and a beta of 0.79. Equity LifeStyle Properties has a fifty-two week low of $59.82 and a fifty-two week high of $76.60.

Equity LifeStyle Properties (NYSE:ELS - Get Free Report) last released its quarterly earnings results on Monday, October 21st. The real estate investment trust reported $0.44 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.72 by ($0.28). The firm had revenue of $387.30 million during the quarter, compared to the consensus estimate of $315.78 million. Equity LifeStyle Properties had a net margin of 23.97% and a return on equity of 24.10%. The business's revenue for the quarter was down .4% compared to the same quarter last year. During the same quarter last year, the firm earned $0.71 earnings per share. Equities research analysts predict that Equity LifeStyle Properties will post 2.9 earnings per share for the current year.

Insiders Place Their Bets

In related news, COO Patrick Waite sold 20,820 shares of the company's stock in a transaction that occurred on Friday, August 16th. The shares were sold at an average price of $70.23, for a total transaction of $1,462,188.60. Following the completion of the transaction, the chief operating officer now directly owns 221,777 shares in the company, valued at $15,575,398.71. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. In related news, COO Patrick Waite sold 20,820 shares of the firm's stock in a transaction on Friday, August 16th. The stock was sold at an average price of $70.23, for a total transaction of $1,462,188.60. Following the sale, the chief operating officer now owns 221,777 shares of the company's stock, valued at $15,575,398.71. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, CFO Paul Seavey sold 31,988 shares of the business's stock in a transaction on Tuesday, September 17th. The stock was sold at an average price of $74.83, for a total value of $2,393,662.04. Following the sale, the chief financial officer now owns 148,463 shares in the company, valued at $11,109,486.29. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 85,808 shares of company stock valued at $6,348,011. 1.40% of the stock is currently owned by corporate insiders.

Wall Street Analysts Forecast Growth

Several research analysts have recently commented on ELS shares. Robert W. Baird raised their target price on shares of Equity LifeStyle Properties from $71.00 to $72.00 and gave the stock an "outperform" rating in a report on Tuesday, October 22nd. Evercore ISI raised their price objective on Equity LifeStyle Properties from $76.00 to $77.00 and gave the stock an "in-line" rating in a research note on Monday, October 21st. Jefferies Financial Group initiated coverage on Equity LifeStyle Properties in a report on Thursday, October 17th. They issued a "hold" rating and a $72.00 price objective for the company. Royal Bank of Canada reissued a "sector perform" rating and set a $68.00 target price on shares of Equity LifeStyle Properties in a report on Wednesday, July 24th. Finally, UBS Group raised Equity LifeStyle Properties to a "strong-buy" rating in a research note on Thursday, October 10th. Seven equities research analysts have rated the stock with a hold rating, four have issued a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average target price of $72.40.

Get Our Latest Stock Report on Equity LifeStyle Properties

Equity LifeStyle Properties Company Profile

(

Get Free Report)

We are a self-administered, self-managed real estate investment trust (REIT) with headquarters in Chicago. As of January 29, 2024, we own or have an interest in 451 properties in 35 states and British Columbia consisting of 172,465 sites.

Recommended Stories

Before you consider Equity LifeStyle Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Equity LifeStyle Properties wasn't on the list.

While Equity LifeStyle Properties currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.