EMCOR Group (NYSE:EME - Get Free Report) is scheduled to announce its earnings results before the market opens on Thursday, October 31st. Analysts expect the company to announce earnings of $4.99 per share for the quarter. Investors that wish to register for the company's conference call can do so using this link.

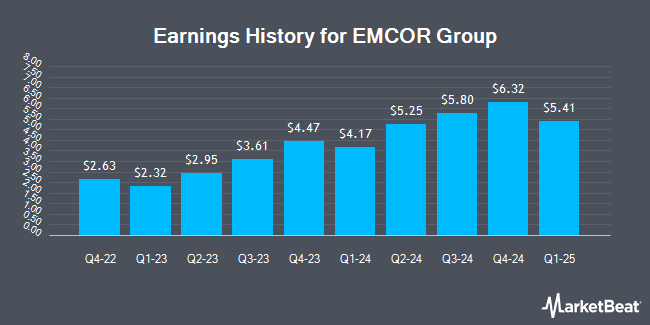

EMCOR Group (NYSE:EME - Get Free Report) last announced its earnings results on Thursday, July 25th. The construction company reported $5.25 earnings per share (EPS) for the quarter, beating the consensus estimate of $3.76 by $1.49. The firm had revenue of $3.67 billion during the quarter, compared to analyst estimates of $3.52 billion. EMCOR Group had a return on equity of 32.73% and a net margin of 6.01%. The business's revenue was up 20.4% compared to the same quarter last year. During the same period last year, the firm posted $2.95 EPS. On average, analysts expect EMCOR Group to post $20 EPS for the current fiscal year and $20 EPS for the next fiscal year.

EMCOR Group Stock Up 0.1 %

EME traded up $0.49 during trading on Thursday, hitting $446.11. 265,331 shares of the company traded hands, compared to its average volume of 430,121. EMCOR Group has a one year low of $191.50 and a one year high of $456.16. The stock's fifty day moving average is $409.24 and its 200 day moving average is $382.48. The firm has a market cap of $20.97 billion, a P/E ratio of 29.38 and a beta of 1.07.

EMCOR Group Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Wednesday, October 30th. Stockholders of record on Tuesday, October 15th will be given a dividend of $0.25 per share. This represents a $1.00 dividend on an annualized basis and a dividend yield of 0.22%. The ex-dividend date of this dividend is Tuesday, October 15th. EMCOR Group's dividend payout ratio is currently 6.60%.

Insider Activity

In related news, Director Robin A. Walker-Lee sold 1,300 shares of the firm's stock in a transaction that occurred on Monday, July 29th. The shares were sold at an average price of $370.79, for a total value of $482,027.00. Following the completion of the transaction, the director now directly owns 8,637 shares of the company's stock, valued at approximately $3,202,513.23. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Insiders own 1.26% of the company's stock.

Wall Street Analysts Forecast Growth

EME has been the topic of several research analyst reports. StockNews.com upgraded EMCOR Group from a "buy" rating to a "strong-buy" rating in a research note on Wednesday, October 9th. DA Davidson upped their price target on EMCOR Group from $410.00 to $430.00 and gave the company a "buy" rating in a research report on Friday, July 26th.

Read Our Latest Research Report on EME

About EMCOR Group

(

Get Free Report)

EMCOR Group, Inc provides construction and facilities, building, and industrial services in the United States and the United Kingdom. It offers design, integration, installation, start-up, operation, and maintenance services related to power transmission, distribution, and generation systems; energy solutions; premises electrical and lighting systems; process instrumentation; low-voltage systems; voice and data communications systems; roadway and transit lighting, signaling, and fiber optic lines; computerized traffic control systems, and signal and communication equipment; heating, ventilation, air conditioning, refrigeration, and geothermal solutions; clean-room process ventilation systems; fire protection and suppression systems; plumbing, process, and high-purity piping systems; controls and filtration systems; water and wastewater treatment systems; central plant heating and cooling systems; crane and rigging services; millwright services; and steel fabrication, erection, and welding services.

Featured Articles

Before you consider EMCOR Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EMCOR Group wasn't on the list.

While EMCOR Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.