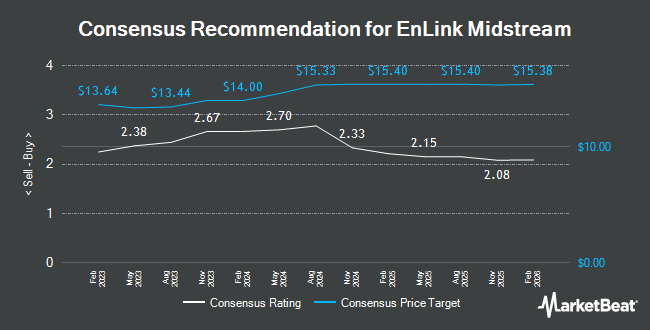

UBS Group cut shares of EnLink Midstream (NYSE:ENLC - Free Report) from a buy rating to a neutral rating in a research note issued to investors on Monday, Marketbeat Ratings reports. UBS Group currently has $16.00 price target on the pipeline company's stock.

Several other equities research analysts have also recently commented on ENLC. StockNews.com upgraded EnLink Midstream from a hold rating to a buy rating in a research note on Tuesday, September 10th. Tudor, Pickering, Holt & Co. upgraded shares of EnLink Midstream from a hold rating to a buy rating and set a $15.00 target price for the company in a research note on Friday, August 16th. Stifel Nicolaus lowered shares of EnLink Midstream from a buy rating to a hold rating and set a $15.00 price target on the stock. in a research note on Friday, August 30th. Tudor Pickering raised EnLink Midstream to a strong-buy rating in a report on Friday, August 16th. Finally, Capital One Financial reaffirmed an equal weight rating and set a $16.00 price objective on shares of EnLink Midstream in a report on Tuesday, September 3rd. Seven investment analysts have rated the stock with a hold rating, four have given a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, EnLink Midstream currently has a consensus rating of Moderate Buy and a consensus target price of $15.44.

Get Our Latest Analysis on ENLC

EnLink Midstream Price Performance

NYSE ENLC remained flat at $14.51 on Monday. The company's stock had a trading volume of 882,957 shares, compared to its average volume of 2,081,650. The company's 50-day moving average price is $13.71 and its two-hundred day moving average price is $13.52. EnLink Midstream has a 52 week low of $11.44 and a 52 week high of $14.80. The company has a market capitalization of $6.55 billion, a price-to-earnings ratio of 41.40 and a beta of 2.40. The company has a quick ratio of 0.65, a current ratio of 0.65 and a debt-to-equity ratio of 1.72.

EnLink Midstream (NYSE:ENLC - Get Free Report) last issued its earnings results on Tuesday, August 6th. The pipeline company reported $0.07 earnings per share for the quarter, missing the consensus estimate of $0.13 by ($0.06). EnLink Midstream had a net margin of 2.15% and a return on equity of 8.22%. The firm had revenue of $1.55 billion during the quarter, compared to analyst estimates of $1.90 billion. During the same period last year, the business earned $0.12 EPS. The firm's revenue was up 1.4% compared to the same quarter last year. Sell-side analysts forecast that EnLink Midstream will post 0.59 earnings per share for the current fiscal year.

EnLink Midstream Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Wednesday, August 14th. Stockholders of record on Friday, August 2nd were issued a $0.1325 dividend. This is an increase from EnLink Midstream's previous quarterly dividend of $0.13. This represents a $0.53 annualized dividend and a dividend yield of 3.65%. The ex-dividend date was Friday, August 2nd. EnLink Midstream's payout ratio is presently 151.43%.

Hedge Funds Weigh In On EnLink Midstream

A number of hedge funds and other institutional investors have recently made changes to their positions in ENLC. Healthcare of Ontario Pension Plan Trust Fund grew its position in shares of EnLink Midstream by 1.0% in the 2nd quarter. Healthcare of Ontario Pension Plan Trust Fund now owns 371,300 shares of the pipeline company's stock valued at $5,109,000 after purchasing an additional 3,800 shares during the period. Newbridge Financial Services Group Inc. acquired a new position in shares of EnLink Midstream during the 2nd quarter worth approximately $56,000. Sanctuary Advisors LLC acquired a new position in shares of EnLink Midstream in the second quarter valued at $384,000. Sunbelt Securities Inc. boosted its holdings in shares of EnLink Midstream by 21.9% during the 2nd quarter. Sunbelt Securities Inc. now owns 8,396 shares of the pipeline company's stock worth $116,000 after buying an additional 1,511 shares during the period. Finally, Algert Global LLC acquired a new stake in EnLink Midstream during the second quarter worth approximately $425,000. 45.87% of the stock is owned by institutional investors.

EnLink Midstream Company Profile

(

Get Free Report)

EnLink Midstream, LLC provides midstream energy services in the United States. The company operates through Permian, Louisiana, Oklahoma, North Texas, and Corporate segments. It is involved in gathering, compressing, treating, processing, transporting, storing, and selling natural gas; fractionating, transporting, storing, and selling natural gas liquids; and gathering, transporting, stabilizing, storing, trans-loading, and selling crude oil and condensate, as well as providing brine disposal services.

Featured Stories

Before you consider EnLink Midstream, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EnLink Midstream wasn't on the list.

While EnLink Midstream currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.