EnerSys (NYSE:ENS - Get Free Report) is scheduled to be issuing its quarterly earnings data after the market closes on Wednesday, November 6th. Analysts expect the company to announce earnings of $2.07 per share for the quarter. Individual interested in participating in the company's earnings conference call can do so using this link.

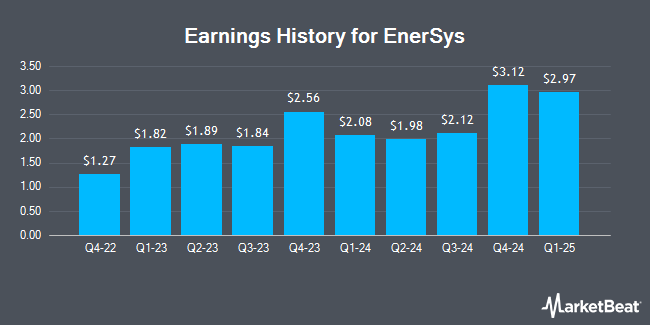

EnerSys (NYSE:ENS - Get Free Report) last posted its quarterly earnings results on Wednesday, August 7th. The industrial products company reported $1.98 earnings per share for the quarter, topping analysts' consensus estimates of $1.97 by $0.01. EnerSys had a net margin of 7.73% and a return on equity of 19.98%. The business had revenue of $852.90 million for the quarter, compared to the consensus estimate of $877.52 million. During the same period in the prior year, the business posted $1.89 earnings per share. EnerSys's revenue for the quarter was down 6.1% compared to the same quarter last year. On average, analysts expect EnerSys to post $9 EPS for the current fiscal year and $10 EPS for the next fiscal year.

EnerSys Stock Performance

ENS stock traded down $1.62 during mid-day trading on Wednesday, reaching $98.02. 198,124 shares of the stock traded hands, compared to its average volume of 241,957. The company has a quick ratio of 1.66, a current ratio of 2.70 and a debt-to-equity ratio of 0.48. EnerSys has a 52 week low of $83.27 and a 52 week high of $112.53. The business has a 50-day moving average of $99.94 and a two-hundred day moving average of $100.36. The firm has a market capitalization of $3.94 billion, a PE ratio of 15.08, a P/E/G ratio of 0.62 and a beta of 1.23.

EnerSys Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Monday, September 30th. Investors of record on Monday, September 16th were paid a $0.24 dividend. This represents a $0.96 annualized dividend and a dividend yield of 0.98%. The ex-dividend date was Monday, September 16th. This is a boost from EnerSys's previous quarterly dividend of $0.23. EnerSys's dividend payout ratio (DPR) is presently 14.77%.

Insider Buying and Selling

In other news, insider Chad C. Uplinger sold 500 shares of the firm's stock in a transaction that occurred on Friday, August 30th. The shares were sold at an average price of $100.87, for a total transaction of $50,435.00. Following the completion of the sale, the insider now owns 17,175 shares of the company's stock, valued at approximately $1,732,442.25. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through this link. In other news, insider Chad C. Uplinger sold 500 shares of the firm's stock in a transaction that occurred on Friday, August 30th. The shares were sold at an average price of $100.87, for a total transaction of $50,435.00. Following the completion of the sale, the insider now owns 17,175 shares of the company's stock, valued at approximately $1,732,442.25. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through this link. Also, CEO David M. Shaffer sold 2,400 shares of the stock in a transaction that occurred on Monday, August 26th. The shares were sold at an average price of $100.00, for a total transaction of $240,000.00. Following the sale, the chief executive officer now directly owns 244,140 shares in the company, valued at $24,414,000. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 22,700 shares of company stock valued at $2,271,843 over the last quarter. Corporate insiders own 1.61% of the company's stock.

Analysts Set New Price Targets

ENS has been the subject of several research reports. Roth Mkm reiterated a "buy" rating and issued a $120.00 target price on shares of EnerSys in a research note on Monday, September 23rd. StockNews.com cut shares of EnerSys from a "strong-buy" rating to a "buy" rating in a research note on Tuesday, October 15th. Finally, Roth Capital upgraded shares of EnerSys to a "strong-buy" rating in a research note on Tuesday, August 27th. Three investment analysts have rated the stock with a hold rating, two have assigned a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus target price of $118.00.

Get Our Latest Stock Analysis on EnerSys

EnerSys Company Profile

(

Get Free Report)

EnerSys engages in the provision of stored energy solutions for industrial applications worldwide. It operates in four segments: Energy Systems, Motive Power, Specialty, and New Ventures. The Energy Systems segment offers uninterruptible power systems (UPS) applications for computer and computer-controlled systems, as well as telecommunications systems; switchgear and electrical control systems used in industrial facilities and electric utilities, large-scale energy storage, and energy pipelines; integrated power solutions and services to broadband, telecom, data center, and renewable and industrial customers; and thermally managed cabinets and enclosures for electronic equipment and batteries.

Recommended Stories

Before you consider EnerSys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EnerSys wasn't on the list.

While EnerSys currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.