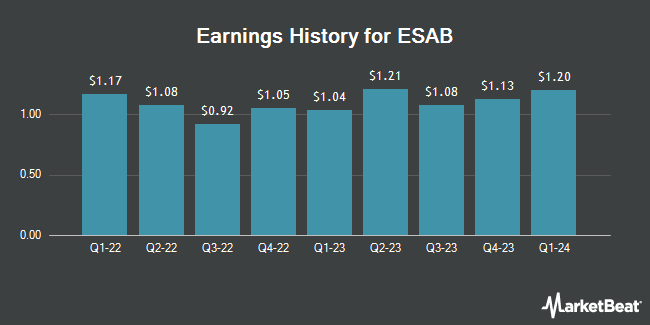

ESAB (NYSE:ESAB - Get Free Report) posted its earnings results on Tuesday. The company reported $1.25 EPS for the quarter, beating analysts' consensus estimates of $1.12 by $0.13, Briefing.com reports. ESAB had a net margin of 9.06% and a return on equity of 17.49%. The business had revenue of $673.00 million for the quarter, compared to the consensus estimate of $620.50 million. During the same quarter last year, the firm posted $1.08 EPS. The company's revenue for the quarter was down 1.2% on a year-over-year basis. ESAB updated its FY 2024 guidance to 4.800-4.950 EPS.

ESAB Stock Performance

Shares of ESAB stock traded up $0.01 during mid-day trading on Wednesday, reaching $125.54. The stock had a trading volume of 537,837 shares, compared to its average volume of 249,718. ESAB has a 1-year low of $62.57 and a 1-year high of $127.33. The firm has a market cap of $7.59 billion, a price-to-earnings ratio of 29.70, a PEG ratio of 1.93 and a beta of 1.42. The company has a current ratio of 1.86, a quick ratio of 1.21 and a debt-to-equity ratio of 0.62. The business's fifty day moving average is $104.72 and its 200-day moving average is $101.75.

ESAB Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Friday, October 11th. Shareholders of record on Friday, September 27th were given a dividend of $0.08 per share. The ex-dividend date was Friday, September 27th. This represents a $0.32 dividend on an annualized basis and a yield of 0.25%. ESAB's dividend payout ratio is currently 7.49%.

Wall Street Analyst Weigh In

ESAB has been the topic of a number of analyst reports. Evercore ISI cut their price target on ESAB from $107.00 to $102.00 and set an "in-line" rating on the stock in a report on Monday, August 19th. Oppenheimer reiterated an "outperform" rating and issued a $138.00 target price (up previously from $122.00) on shares of ESAB in a research note on Wednesday. Stifel Nicolaus reduced their target price on shares of ESAB from $130.00 to $120.00 and set a "buy" rating for the company in a report on Thursday, July 18th. Bank of America raised their price target on shares of ESAB from $115.00 to $130.00 and gave the company a "buy" rating in a report on Monday, August 5th. Finally, Loop Capital lifted their price objective on shares of ESAB from $105.00 to $120.00 and gave the stock a "hold" rating in a research report on Wednesday. Two research analysts have rated the stock with a hold rating and five have assigned a buy rating to the company. According to MarketBeat, ESAB presently has an average rating of "Moderate Buy" and an average target price of $119.00.

Check Out Our Latest Stock Analysis on ESAB

About ESAB

(

Get Free Report)

ESAB Corporation engages in the formulation, development, manufacture, and supply of consumable products and equipment for use in cutting, joining, automated welding, and gas control equipment. Its comprehensive range of welding consumables includes electrodes, cored and solid wires, and fluxes using a range of specialty and other materials; and cutting consumables comprising electrodes, nozzles, shields, and tips.

See Also

Before you consider ESAB, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ESAB wasn't on the list.

While ESAB currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.