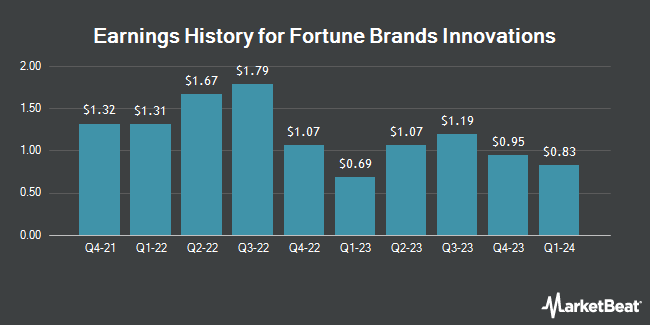

Fortune Brands Innovations (NYSE:FBIN - Get Free Report) is scheduled to issue its quarterly earnings data after the market closes on Wednesday, November 6th. Analysts expect the company to announce earnings of $1.15 per share for the quarter. Persons interested in listening to the company's earnings conference call can do so using this link.

Fortune Brands Innovations Price Performance

FBIN stock traded up $0.10 during midday trading on Wednesday, reaching $83.99. The company had a trading volume of 814,995 shares, compared to its average volume of 1,176,253. Fortune Brands Innovations has a 1-year low of $55.47 and a 1-year high of $90.54. The stock has a 50 day moving average price of $84.45 and a 200-day moving average price of $75.87. The company has a debt-to-equity ratio of 1.03, a current ratio of 1.34 and a quick ratio of 0.71. The company has a market capitalization of $10.51 billion, a price-to-earnings ratio of 25.65, a price-to-earnings-growth ratio of 2.76 and a beta of 1.51.

Fortune Brands Innovations Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, December 11th. Shareholders of record on Friday, November 22nd will be issued a dividend of $0.24 per share. This represents a $0.96 dividend on an annualized basis and a yield of 1.14%. The ex-dividend date of this dividend is Friday, November 22nd. Fortune Brands Innovations's payout ratio is 29.36%.

Analyst Upgrades and Downgrades

Several equities research analysts have weighed in on FBIN shares. Truist Financial lifted their price target on shares of Fortune Brands Innovations from $75.00 to $82.00 and gave the company a "buy" rating in a research note on Friday, July 26th. JPMorgan Chase & Co. increased their price target on Fortune Brands Innovations from $82.00 to $84.00 and gave the stock a "neutral" rating in a report on Tuesday, July 30th. Robert W. Baird boosted their price objective on Fortune Brands Innovations from $82.00 to $94.00 and gave the company a "neutral" rating in a report on Monday, October 21st. BMO Capital Markets increased their target price on Fortune Brands Innovations from $84.00 to $95.00 and gave the stock a "market perform" rating in a report on Tuesday, October 22nd. Finally, Jefferies Financial Group boosted their price target on shares of Fortune Brands Innovations from $100.00 to $111.00 and gave the company a "buy" rating in a research note on Wednesday, October 9th. Seven equities research analysts have rated the stock with a hold rating and four have given a buy rating to the company. According to data from MarketBeat.com, Fortune Brands Innovations has a consensus rating of "Hold" and a consensus price target of $90.20.

Read Our Latest Analysis on Fortune Brands Innovations

About Fortune Brands Innovations

(

Get Free Report)

Fortune Brands Innovations, Inc provides home and security products for residential home repair, remodeling, new construction, and security applications in the United States and internationally. The company operates through three segments: Water, Outdoors, and Security. The Water segment manufactures or assembles, and sells faucets, accessories, kitchen sinks, and waste disposals under the Moen, ROHL, Riobel, Victoria+Albert, Perrin & Rowe, Aqualisa, Shaws, Emtek, and Schaub brands.

Read More

Before you consider Fortune Brands Innovations, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fortune Brands Innovations wasn't on the list.

While Fortune Brands Innovations currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.