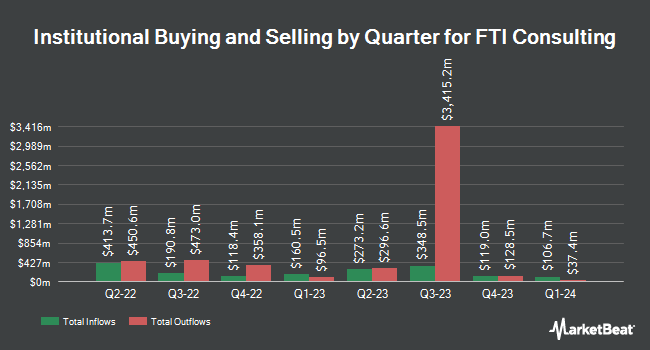

Dakota Wealth Management lowered its position in FTI Consulting, Inc. (NYSE:FCN - Free Report) by 79.2% during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 973 shares of the business services provider's stock after selling 3,697 shares during the period. Dakota Wealth Management's holdings in FTI Consulting were worth $221,000 as of its most recent SEC filing.

A number of other institutional investors also recently bought and sold shares of the stock. Whittier Trust Co. of Nevada Inc. increased its holdings in FTI Consulting by 629.5% in the 3rd quarter. Whittier Trust Co. of Nevada Inc. now owns 642 shares of the business services provider's stock worth $146,000 after acquiring an additional 554 shares in the last quarter. Allspring Global Investments Holdings LLC boosted its position in shares of FTI Consulting by 3.6% during the 3rd quarter. Allspring Global Investments Holdings LLC now owns 3,721 shares of the business services provider's stock valued at $847,000 after acquiring an additional 129 shares during the last quarter. Cadent Capital Advisors LLC acquired a new position in shares of FTI Consulting during the 3rd quarter valued at about $211,000. Raymond James & Associates lifted its position in FTI Consulting by 3.6% in the third quarter. Raymond James & Associates now owns 143,305 shares of the business services provider's stock valued at $32,610,000 after buying an additional 5,044 shares during the last quarter. Finally, Blue Trust Inc. lifted its position in FTI Consulting by 88.8% in the third quarter. Blue Trust Inc. now owns 1,578 shares of the business services provider's stock valued at $340,000 after buying an additional 742 shares during the last quarter. 99.36% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

A number of research firms have commented on FCN. StockNews.com cut shares of FTI Consulting from a "buy" rating to a "hold" rating in a research report on Friday. Truist Financial increased their price target on shares of FTI Consulting from $255.00 to $275.00 and gave the stock a "buy" rating in a research report on Wednesday, September 25th.

Read Our Latest Stock Analysis on FCN

FTI Consulting Stock Up 1.5 %

Shares of FCN traded up $2.91 during mid-day trading on Tuesday, hitting $201.20. 394,653 shares of the company's stock were exchanged, compared to its average volume of 174,715. The company has a market cap of $7.18 billion, a price-to-earnings ratio of 23.39 and a beta of 0.10. FTI Consulting, Inc. has a fifty-two week low of $185.93 and a fifty-two week high of $243.60. The company has a debt-to-equity ratio of 0.03, a quick ratio of 2.20 and a current ratio of 2.20. The stock's 50-day moving average is $223.15 and its 200-day moving average is $219.35.

FTI Consulting (NYSE:FCN - Get Free Report) last released its earnings results on Thursday, October 24th. The business services provider reported $1.85 earnings per share for the quarter, missing analysts' consensus estimates of $2.06 by ($0.21). FTI Consulting had a return on equity of 16.34% and a net margin of 8.90%. The firm had revenue of $926.00 million for the quarter, compared to analysts' expectations of $946.16 million. During the same quarter in the previous year, the company posted $2.34 earnings per share. The firm's quarterly revenue was up 3.7% on a year-over-year basis. On average, sell-side analysts anticipate that FTI Consulting, Inc. will post 8.48 earnings per share for the current fiscal year.

About FTI Consulting

(

Free Report)

FTI Consulting, Inc provides business advisory services to manage change, mitigate risk, and resolve disputes worldwide. The company operates through Corporate Finance & Restructuring, Forensic and Litigation Consulting, Economic Consulting, Technology, and Strategic Communications segments. The Corporate Finance & Restructuring segment provides business transformation and strategy, transactions, and turnaround and restructuring services.

Featured Articles

Before you consider FTI Consulting, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FTI Consulting wasn't on the list.

While FTI Consulting currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.