Nicholson Wealth Management Group LLC purchased a new position in shares of FactSet Research Systems Inc. (NYSE:FDS - Free Report) in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 1,727 shares of the business services provider's stock, valued at approximately $794,000.

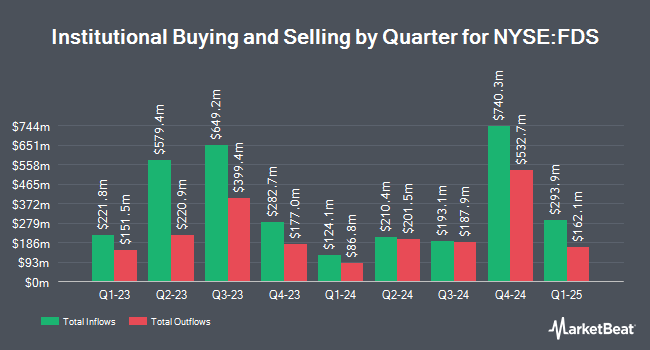

A number of other large investors have also recently bought and sold shares of the stock. Vanguard Group Inc. grew its position in FactSet Research Systems by 0.3% during the 1st quarter. Vanguard Group Inc. now owns 4,571,550 shares of the business services provider's stock worth $2,077,267,000 after acquiring an additional 11,974 shares during the last quarter. Ninety One UK Ltd increased its stake in shares of FactSet Research Systems by 0.9% in the second quarter. Ninety One UK Ltd now owns 1,216,461 shares of the business services provider's stock valued at $496,645,000 after buying an additional 10,928 shares in the last quarter. PineStone Asset Management Inc. raised its holdings in shares of FactSet Research Systems by 53.3% in the second quarter. PineStone Asset Management Inc. now owns 272,973 shares of the business services provider's stock valued at $111,447,000 after buying an additional 94,952 shares during the last quarter. Mitsubishi UFJ Asset Management Co. Ltd. lifted its position in FactSet Research Systems by 3.9% during the 1st quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 264,481 shares of the business services provider's stock worth $120,178,000 after buying an additional 9,925 shares in the last quarter. Finally, Tandem Investment Advisors Inc. grew its holdings in FactSet Research Systems by 1.4% during the 2nd quarter. Tandem Investment Advisors Inc. now owns 250,028 shares of the business services provider's stock worth $102,079,000 after acquiring an additional 3,485 shares during the last quarter. 91.24% of the stock is currently owned by institutional investors.

Insider Activity at FactSet Research Systems

In other FactSet Research Systems news, Director James J. Mcgonigle sold 5,410 shares of the firm's stock in a transaction on Thursday, September 26th. The stock was sold at an average price of $456.83, for a total transaction of $2,471,450.30. Following the completion of the sale, the director now owns 5,283 shares of the company's stock, valued at $2,413,432.89. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. In other news, Director James J. Mcgonigle sold 5,410 shares of the stock in a transaction that occurred on Thursday, September 26th. The stock was sold at an average price of $456.83, for a total transaction of $2,471,450.30. Following the transaction, the director now owns 5,283 shares in the company, valued at approximately $2,413,432.89. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, EVP Christopher R. Ellis sold 13,952 shares of FactSet Research Systems stock in a transaction that occurred on Thursday, September 26th. The stock was sold at an average price of $456.15, for a total value of $6,364,204.80. Following the sale, the executive vice president now directly owns 23,515 shares of the company's stock, valued at approximately $10,726,367.25. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders have sold 28,362 shares of company stock worth $12,688,945. Company insiders own 1.00% of the company's stock.

Analyst Upgrades and Downgrades

A number of research analysts have commented on FDS shares. Royal Bank of Canada increased their price objective on FactSet Research Systems from $464.00 to $503.00 and gave the company a "sector perform" rating in a research report on Friday, September 20th. Redburn Atlantic downgraded shares of FactSet Research Systems from a "neutral" rating to a "sell" rating and cut their target price for the company from $420.00 to $380.00 in a research report on Wednesday, October 9th. Evercore ISI initiated coverage on shares of FactSet Research Systems in a research report on Wednesday, October 2nd. They set an "inline" rating and a $470.00 price target for the company. Wells Fargo & Company increased their price objective on shares of FactSet Research Systems from $435.00 to $503.00 and gave the company an "equal weight" rating in a report on Friday, September 20th. Finally, Stifel Nicolaus lifted their target price on shares of FactSet Research Systems from $451.00 to $469.00 and gave the stock a "hold" rating in a report on Friday, September 20th. Five equities research analysts have rated the stock with a sell rating and nine have assigned a hold rating to the company. According to MarketBeat.com, the company currently has a consensus rating of "Hold" and an average price target of $443.57.

Check Out Our Latest Stock Report on FactSet Research Systems

FactSet Research Systems Stock Down 0.4 %

FDS traded down $1.69 during trading on Friday, reaching $454.94. 192,007 shares of the stock were exchanged, compared to its average volume of 262,575. The company has a debt-to-equity ratio of 0.65, a quick ratio of 1.79 and a current ratio of 1.25. The stock's 50 day moving average price is $445.18 and its two-hundred day moving average price is $428.91. FactSet Research Systems Inc. has a twelve month low of $391.84 and a twelve month high of $488.64. The stock has a market cap of $17.31 billion, a P/E ratio of 34.31, a price-to-earnings-growth ratio of 3.01 and a beta of 0.75.

FactSet Research Systems (NYSE:FDS - Get Free Report) last issued its earnings results on Thursday, September 19th. The business services provider reported $3.74 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $3.62 by $0.12. FactSet Research Systems had a net margin of 24.38% and a return on equity of 34.77%. The company had revenue of $562.20 million for the quarter, compared to analysts' expectations of $547.06 million. During the same period in the prior year, the firm earned $2.93 EPS. FactSet Research Systems's quarterly revenue was up 4.9% compared to the same quarter last year. Equities analysts expect that FactSet Research Systems Inc. will post 17.2 EPS for the current year.

FactSet Research Systems Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Thursday, September 19th. Investors of record on Friday, August 30th were issued a dividend of $1.04 per share. This represents a $4.16 dividend on an annualized basis and a dividend yield of 0.91%. The ex-dividend date was Friday, August 30th. FactSet Research Systems's payout ratio is presently 31.37%.

FactSet Research Systems Company Profile

(

Free Report)

FactSet Research Systems Inc, a financial data company, provides integrated financial information and analytical applications to the investment community in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company delivers insight and information through the workflow solutions of research, analytics and trading, content and technology solutions, and wealth.

Featured Articles

Before you consider FactSet Research Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FactSet Research Systems wasn't on the list.

While FactSet Research Systems currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report