State of Alaska Department of Revenue trimmed its position in FactSet Research Systems Inc. (NYSE:FDS - Free Report) by 18.2% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 16,173 shares of the business services provider's stock after selling 3,605 shares during the quarter. State of Alaska Department of Revenue's holdings in FactSet Research Systems were worth $7,436,000 at the end of the most recent reporting period.

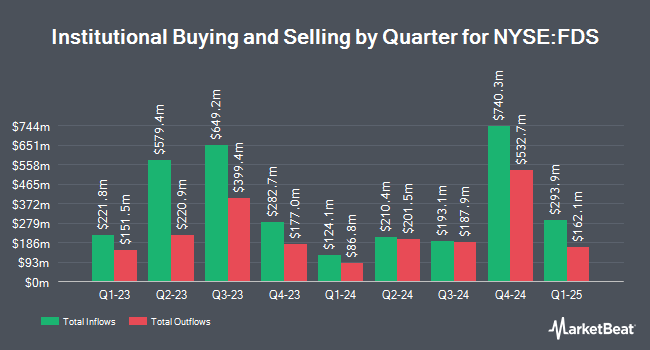

A number of other hedge funds have also added to or reduced their stakes in the company. Vanguard Group Inc. boosted its position in FactSet Research Systems by 0.3% in the first quarter. Vanguard Group Inc. now owns 4,571,550 shares of the business services provider's stock valued at $2,077,267,000 after buying an additional 11,974 shares in the last quarter. Ninety One UK Ltd lifted its holdings in shares of FactSet Research Systems by 0.9% during the second quarter. Ninety One UK Ltd now owns 1,216,461 shares of the business services provider's stock worth $496,645,000 after purchasing an additional 10,928 shares during the period. Boston Trust Walden Corp lifted its holdings in shares of FactSet Research Systems by 9.3% during the third quarter. Boston Trust Walden Corp now owns 296,329 shares of the business services provider's stock worth $136,267,000 after purchasing an additional 25,294 shares during the period. PineStone Asset Management Inc. lifted its holdings in shares of FactSet Research Systems by 53.3% during the second quarter. PineStone Asset Management Inc. now owns 272,973 shares of the business services provider's stock worth $111,447,000 after purchasing an additional 94,952 shares during the period. Finally, Mitsubishi UFJ Asset Management Co. Ltd. lifted its holdings in shares of FactSet Research Systems by 3.9% during the first quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 264,481 shares of the business services provider's stock worth $120,178,000 after purchasing an additional 9,925 shares during the period. 91.24% of the stock is owned by institutional investors.

Analyst Ratings Changes

A number of equities analysts have recently commented on FDS shares. Royal Bank of Canada lifted their price target on shares of FactSet Research Systems from $464.00 to $503.00 and gave the stock a "sector perform" rating in a report on Friday, September 20th. BMO Capital Markets lifted their price target on shares of FactSet Research Systems from $440.00 to $471.00 and gave the stock a "market perform" rating in a report on Friday, September 20th. Stifel Nicolaus lifted their price target on shares of FactSet Research Systems from $451.00 to $469.00 and gave the stock a "hold" rating in a report on Friday, September 20th. Evercore ISI initiated coverage on shares of FactSet Research Systems in a report on Wednesday, October 2nd. They issued an "inline" rating and a $470.00 target price on the stock. Finally, Wells Fargo & Company boosted their target price on shares of FactSet Research Systems from $435.00 to $503.00 and gave the company an "equal weight" rating in a report on Friday, September 20th. Five research analysts have rated the stock with a sell rating and nine have given a hold rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Hold" and a consensus target price of $443.57.

View Our Latest Research Report on FactSet Research Systems

FactSet Research Systems Stock Up 0.2 %

FDS traded up $0.80 during midday trading on Tuesday, hitting $460.09. The company had a trading volume of 210,486 shares, compared to its average volume of 261,830. FactSet Research Systems Inc. has a 52 week low of $391.84 and a 52 week high of $488.64. The company has a quick ratio of 1.79, a current ratio of 1.25 and a debt-to-equity ratio of 0.65. The company has a market capitalization of $17.50 billion, a price-to-earnings ratio of 33.10, a PEG ratio of 3.08 and a beta of 0.75. The stock's 50 day moving average price is $447.06 and its 200 day moving average price is $429.30.

FactSet Research Systems (NYSE:FDS - Get Free Report) last posted its earnings results on Thursday, September 19th. The business services provider reported $3.74 EPS for the quarter, topping the consensus estimate of $3.62 by $0.12. The company had revenue of $562.20 million during the quarter, compared to the consensus estimate of $547.06 million. FactSet Research Systems had a net margin of 24.38% and a return on equity of 34.77%. The firm's revenue for the quarter was up 4.9% on a year-over-year basis. During the same period in the previous year, the firm posted $2.93 earnings per share. On average, research analysts anticipate that FactSet Research Systems Inc. will post 17.2 earnings per share for the current fiscal year.

FactSet Research Systems Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Thursday, September 19th. Investors of record on Friday, August 30th were issued a dividend of $1.04 per share. This represents a $4.16 annualized dividend and a yield of 0.90%. The ex-dividend date was Friday, August 30th. FactSet Research Systems's dividend payout ratio (DPR) is presently 29.93%.

Insider Buying and Selling

In related news, CEO Frederick Philip Snow sold 3,000 shares of the business's stock in a transaction dated Tuesday, October 1st. The shares were sold at an average price of $455.09, for a total transaction of $1,365,270.00. Following the transaction, the chief executive officer now directly owns 12,987 shares in the company, valued at approximately $5,910,253.83. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. In other FactSet Research Systems news, Director James J. Mcgonigle sold 5,410 shares of the business's stock in a transaction dated Thursday, September 26th. The shares were sold at an average price of $456.83, for a total value of $2,471,450.30. Following the transaction, the director now directly owns 5,283 shares in the company, valued at $2,413,432.89. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, CEO Frederick Philip Snow sold 3,000 shares of the company's stock in a transaction that occurred on Tuesday, October 1st. The shares were sold at an average price of $455.09, for a total transaction of $1,365,270.00. Following the sale, the chief executive officer now owns 12,987 shares in the company, valued at $5,910,253.83. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 28,815 shares of company stock worth $12,873,751. 1.00% of the stock is owned by insiders.

FactSet Research Systems Profile

(

Free Report)

FactSet Research Systems Inc, a financial data company, provides integrated financial information and analytical applications to the investment community in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company delivers insight and information through the workflow solutions of research, analytics and trading, content and technology solutions, and wealth.

Further Reading

Before you consider FactSet Research Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FactSet Research Systems wasn't on the list.

While FactSet Research Systems currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report