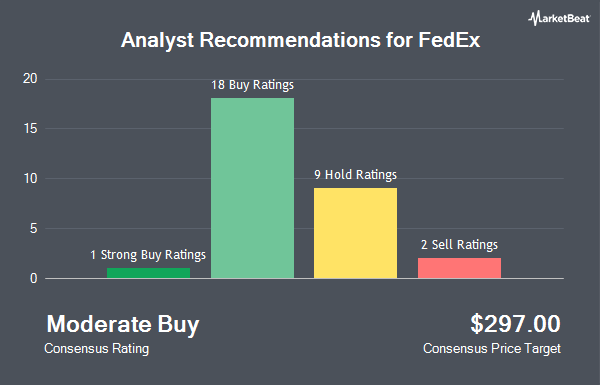

Shares of FedEx Co. (NYSE:FDX - Get Free Report) have been assigned a consensus rating of "Moderate Buy" from the twenty-seven analysts that are currently covering the stock, MarketBeat Ratings reports. Two equities research analysts have rated the stock with a sell rating, eight have assigned a hold rating and seventeen have assigned a buy rating to the company. The average 12 month price target among analysts that have issued a report on the stock in the last year is $314.17.

Several brokerages have recently weighed in on FDX. HSBC downgraded FedEx from a "buy" rating to a "hold" rating and set a $300.00 price target on the stock. in a report on Friday, September 20th. The Goldman Sachs Group reduced their price target on shares of FedEx from $333.00 to $332.00 in a research note on Friday, September 20th. Hsbc Global Res cut shares of FedEx from a "strong-buy" rating to a "hold" rating in a research report on Friday, September 20th. UBS Group reduced their target price on shares of FedEx from $333.00 to $311.00 and set a "buy" rating on the stock in a research report on Friday, September 20th. Finally, Susquehanna dropped their price objective on FedEx from $345.00 to $330.00 and set a "positive" rating on the stock in a research note on Friday, September 20th.

Get Our Latest Analysis on FDX

Institutional Trading of FedEx

Institutional investors have recently modified their holdings of the stock. SeaCrest Wealth Management LLC boosted its stake in FedEx by 0.6% during the 2nd quarter. SeaCrest Wealth Management LLC now owns 5,615 shares of the shipping service provider's stock worth $1,683,000 after purchasing an additional 34 shares during the last quarter. LRI Investments LLC raised its holdings in FedEx by 8.6% in the 2nd quarter. LRI Investments LLC now owns 455 shares of the shipping service provider's stock valued at $137,000 after acquiring an additional 36 shares during the last quarter. Ascent Wealth Partners LLC raised its holdings in FedEx by 0.5% in the 2nd quarter. Ascent Wealth Partners LLC now owns 7,690 shares of the shipping service provider's stock valued at $2,306,000 after acquiring an additional 36 shares during the last quarter. Detalus Advisors LLC lifted its stake in FedEx by 2.4% in the 2nd quarter. Detalus Advisors LLC now owns 1,602 shares of the shipping service provider's stock worth $480,000 after purchasing an additional 37 shares in the last quarter. Finally, Sachetta LLC grew its position in shares of FedEx by 29.1% in the second quarter. Sachetta LLC now owns 164 shares of the shipping service provider's stock valued at $49,000 after purchasing an additional 37 shares in the last quarter. Institutional investors and hedge funds own 84.47% of the company's stock.

FedEx Price Performance

FDX stock traded up $1.10 during trading on Friday, hitting $274.95. 633,452 shares of the company's stock traded hands, compared to its average volume of 1,816,196. The business has a fifty day simple moving average of $277.56 and a 200 day simple moving average of $274.90. FedEx has a 52 week low of $234.45 and a 52 week high of $313.84. The company has a debt-to-equity ratio of 0.72, a quick ratio of 1.24 and a current ratio of 1.28. The stock has a market capitalization of $67.18 billion, a price-to-earnings ratio of 17.01, a P/E/G ratio of 1.10 and a beta of 1.17.

FedEx (NYSE:FDX - Get Free Report) last issued its quarterly earnings data on Thursday, September 19th. The shipping service provider reported $3.60 earnings per share for the quarter, missing the consensus estimate of $4.82 by ($1.22). The company had revenue of $21.58 billion for the quarter, compared to the consensus estimate of $21.87 billion. FedEx had a return on equity of 15.61% and a net margin of 4.62%. The company's revenue was down .5% compared to the same quarter last year. During the same period in the previous year, the firm earned $4.55 earnings per share. As a group, research analysts expect that FedEx will post 19.59 EPS for the current fiscal year.

FedEx Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Tuesday, October 1st. Investors of record on Monday, September 9th were issued a $1.38 dividend. This represents a $5.52 annualized dividend and a yield of 2.01%. The ex-dividend date was Monday, September 9th. FedEx's payout ratio is presently 34.05%.

FedEx Company Profile

(

Get Free ReportFedEx Corporation provides transportation, e-commerce, and business services in the United States and internationally. It operates through FedEx Express, FedEx Ground, FedEx Freight, and FedEx Services segments. The FedEx Express segment offers express transportation, small-package ground delivery, and freight transportation services; and time-critical transportation services.

Recommended Stories

Before you consider FedEx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FedEx wasn't on the list.

While FedEx currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.