Fluor (NYSE:FLR - Get Free Report) had its target price lifted by equities researchers at UBS Group from $51.00 to $63.00 in a research note issued on Wednesday, Benzinga reports. The brokerage currently has a "buy" rating on the construction company's stock. UBS Group's target price points to a potential upside of 19.34% from the stock's current price.

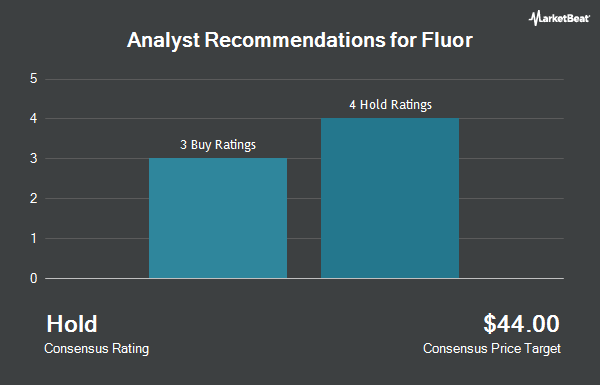

FLR has been the subject of several other research reports. Citigroup upgraded Fluor from a "neutral" rating to a "buy" rating and raised their target price for the stock from $52.00 to $65.00 in a research report on Tuesday. Robert W. Baird lifted their price objective on Fluor from $46.00 to $54.00 and gave the company an "outperform" rating in a report on Monday, August 5th. Barclays upped their target price on shares of Fluor from $39.00 to $45.00 and gave the stock an "equal weight" rating in a report on Thursday, July 18th. Truist Financial lifted their price target on shares of Fluor from $61.00 to $66.00 and gave the company a "buy" rating in a report on Wednesday, October 9th. Finally, DA Davidson upped their price objective on shares of Fluor from $50.00 to $58.00 and gave the stock a "buy" rating in a research note on Monday, August 5th. One investment analyst has rated the stock with a hold rating and six have given a buy rating to the company. Based on data from MarketBeat.com, Fluor has a consensus rating of "Moderate Buy" and a consensus price target of $58.29.

Get Our Latest Report on Fluor

Fluor Stock Performance

FLR stock traded down $0.88 during midday trading on Wednesday, hitting $52.79. The stock had a trading volume of 1,405,149 shares, compared to its average volume of 1,566,908. Fluor has a 52 week low of $32.31 and a 52 week high of $55.86. The company has a current ratio of 1.77, a quick ratio of 1.77 and a debt-to-equity ratio of 0.51. The stock has a 50-day simple moving average of $48.61 and a 200 day simple moving average of $45.28. The firm has a market capitalization of $9.04 billion, a price-to-earnings ratio of 30.95, a P/E/G ratio of 2.18 and a beta of 1.91.

Fluor (NYSE:FLR - Get Free Report) last released its quarterly earnings data on Friday, August 2nd. The construction company reported $0.85 EPS for the quarter, topping analysts' consensus estimates of $0.68 by $0.17. Fluor had a net margin of 2.62% and a return on equity of 25.02%. The company had revenue of $4.23 billion during the quarter, compared to the consensus estimate of $4.34 billion. During the same period last year, the firm earned $0.76 EPS. The firm's revenue for the quarter was up 7.3% compared to the same quarter last year. As a group, equities research analysts anticipate that Fluor will post 2.88 earnings per share for the current year.

Insiders Place Their Bets

In other news, CFO Joseph L. Brennan sold 4,012 shares of the company's stock in a transaction that occurred on Friday, October 4th. The shares were sold at an average price of $50.01, for a total transaction of $200,640.12. Following the transaction, the chief financial officer now directly owns 53,527 shares in the company, valued at approximately $2,676,885.27. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. In related news, CFO Joseph L. Brennan sold 11,619 shares of the firm's stock in a transaction dated Monday, October 7th. The stock was sold at an average price of $50.30, for a total value of $584,435.70. Following the transaction, the chief financial officer now owns 41,908 shares in the company, valued at $2,107,972.40. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CFO Joseph L. Brennan sold 4,012 shares of the business's stock in a transaction dated Friday, October 4th. The stock was sold at an average price of $50.01, for a total value of $200,640.12. Following the sale, the chief financial officer now directly owns 53,527 shares of the company's stock, valued at $2,676,885.27. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 44,261 shares of company stock valued at $2,156,604 in the last 90 days. 1.70% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

Hedge funds have recently modified their holdings of the business. Allworth Financial LP lifted its stake in shares of Fluor by 676.7% in the 3rd quarter. Allworth Financial LP now owns 6,128 shares of the construction company's stock valued at $292,000 after purchasing an additional 5,339 shares during the period. Highland Capital Management LLC bought a new stake in Fluor in the third quarter valued at about $208,000. HWG Holdings LP bought a new position in Fluor during the third quarter worth about $3,057,000. Mount Yale Investment Advisors LLC acquired a new position in shares of Fluor during the 3rd quarter worth about $300,000. Finally, Stanley Laman Group Ltd. increased its stake in shares of Fluor by 6.4% in the 3rd quarter. Stanley Laman Group Ltd. now owns 122,001 shares of the construction company's stock valued at $5,821,000 after acquiring an additional 7,339 shares during the last quarter. Institutional investors own 88.07% of the company's stock.

Fluor Company Profile

(

Get Free Report)

Fluor Corporation provides engineering, procurement, and construction (EPC); fabrication and modularization; operation and maintenance; asset integrity; and project management services worldwide. The company operates through Energy Solutions, Urban Solutions, Mission Solutions, and Other segments. The Energy Solutions segment provides solutions to the energy transition markets, including asset decarbonization, carbon capture, renewable fuels, waste-to-energy, green chemicals, hydrogen, nuclear power, and other low-carbon energy sources.

See Also

Before you consider Fluor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fluor wasn't on the list.

While Fluor currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.