Hudson Valley Investment Advisors Inc. ADV lifted its stake in Fluor Co. (NYSE:FLR - Free Report) by 16.4% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 171,472 shares of the construction company's stock after purchasing an additional 24,169 shares during the period. Hudson Valley Investment Advisors Inc. ADV owned 0.10% of Fluor worth $8,181,000 as of its most recent SEC filing.

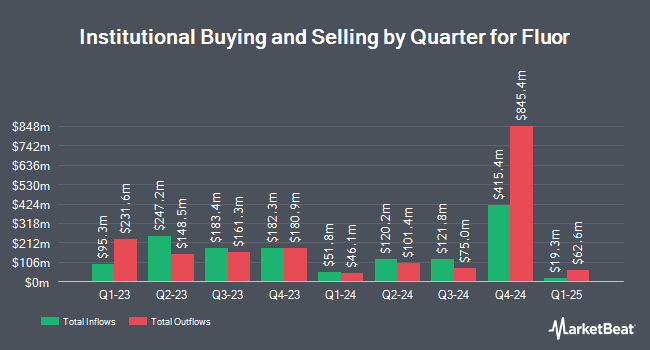

Several other institutional investors also recently modified their holdings of FLR. ORG Partners LLC bought a new stake in Fluor during the 2nd quarter valued at about $34,000. GAMMA Investing LLC grew its stake in shares of Fluor by 46.4% in the second quarter. GAMMA Investing LLC now owns 899 shares of the construction company's stock worth $39,000 after acquiring an additional 285 shares during the period. Allspring Global Investments Holdings LLC grew its stake in shares of Fluor by 6,642.9% in the second quarter. Allspring Global Investments Holdings LLC now owns 944 shares of the construction company's stock worth $41,000 after acquiring an additional 930 shares during the period. Ashton Thomas Private Wealth LLC bought a new stake in shares of Fluor in the second quarter worth approximately $51,000. Finally, Quest Partners LLC bought a new stake in shares of Fluor in the second quarter worth approximately $52,000. 88.07% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

FLR has been the topic of a number of research reports. Citigroup raised shares of Fluor from a "neutral" rating to a "buy" rating and raised their price objective for the stock from $52.00 to $65.00 in a report on Tuesday, October 22nd. DA Davidson boosted their price target on shares of Fluor from $50.00 to $58.00 and gave the stock a "buy" rating in a research report on Monday, August 5th. Truist Financial boosted their price target on shares of Fluor from $61.00 to $66.00 and gave the stock a "buy" rating in a research report on Wednesday, October 9th. Robert W. Baird boosted their price objective on shares of Fluor from $46.00 to $54.00 and gave the company an "outperform" rating in a research report on Monday, August 5th. Finally, Barclays boosted their price objective on shares of Fluor from $39.00 to $45.00 and gave the company an "equal weight" rating in a research report on Thursday, July 18th. One research analyst has rated the stock with a hold rating and six have assigned a buy rating to the stock. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $58.29.

Read Our Latest Stock Analysis on Fluor

Insider Activity

In other news, CFO Joseph L. Brennan sold 15,335 shares of the company's stock in a transaction dated Friday, September 20th. The shares were sold at an average price of $47.57, for a total transaction of $729,485.95. Following the transaction, the chief financial officer now owns 57,834 shares in the company, valued at $2,751,163.38. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink. In other news, CFO Joseph L. Brennan sold 15,335 shares of the firm's stock in a transaction that occurred on Friday, September 20th. The shares were sold at an average price of $47.57, for a total transaction of $729,485.95. Following the sale, the chief financial officer now owns 57,834 shares of the company's stock, valued at $2,751,163.38. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, CAO John C. Regan sold 13,000 shares of the stock in a transaction that occurred on Wednesday, August 14th. The shares were sold at an average price of $48.31, for a total value of $628,030.00. Following the transaction, the chief accounting officer now owns 55,965 shares in the company, valued at $2,703,669.15. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 44,261 shares of company stock worth $2,156,604 over the last 90 days. 1.70% of the stock is currently owned by corporate insiders.

Fluor Stock Down 1.6 %

NYSE:FLR traded down $0.84 during mid-day trading on Thursday, reaching $52.26. The company's stock had a trading volume of 1,653,663 shares, compared to its average volume of 1,566,286. Fluor Co. has a 1 year low of $32.31 and a 1 year high of $55.86. The stock has a fifty day moving average of $49.18 and a 200-day moving average of $45.77. The firm has a market capitalization of $8.95 billion, a PE ratio of 22.33, a price-to-earnings-growth ratio of 2.32 and a beta of 1.91. The company has a quick ratio of 1.77, a current ratio of 1.77 and a debt-to-equity ratio of 0.51.

Fluor (NYSE:FLR - Get Free Report) last released its quarterly earnings results on Friday, August 2nd. The construction company reported $0.85 EPS for the quarter, beating the consensus estimate of $0.68 by $0.17. The business had revenue of $4.23 billion during the quarter, compared to analyst estimates of $4.34 billion. Fluor had a net margin of 2.62% and a return on equity of 25.02%. The company's quarterly revenue was up 7.3% on a year-over-year basis. During the same period in the prior year, the firm posted $0.76 earnings per share. Equities research analysts forecast that Fluor Co. will post 2.88 earnings per share for the current year.

Fluor Profile

(

Free Report)

Fluor Corporation provides engineering, procurement, and construction (EPC); fabrication and modularization; operation and maintenance; asset integrity; and project management services worldwide. The company operates through Energy Solutions, Urban Solutions, Mission Solutions, and Other segments. The Energy Solutions segment provides solutions to the energy transition markets, including asset decarbonization, carbon capture, renewable fuels, waste-to-energy, green chemicals, hydrogen, nuclear power, and other low-carbon energy sources.

See Also

Before you consider Fluor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fluor wasn't on the list.

While Fluor currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.