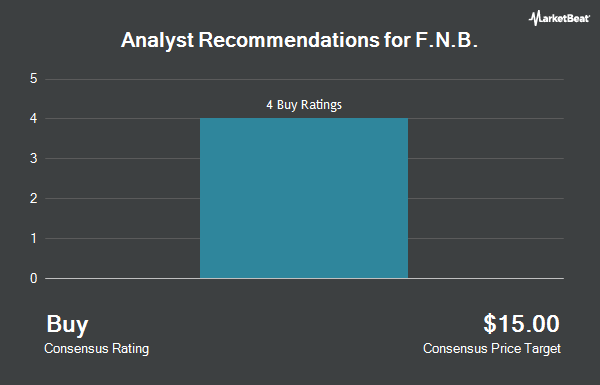

F.N.B. Co. (NYSE:FNB - Get Free Report) has received a consensus recommendation of "Moderate Buy" from the six research firms that are presently covering the company, Marketbeat reports. One investment analyst has rated the stock with a hold recommendation and five have given a buy recommendation to the company. The average 12 month price target among analysts that have issued ratings on the stock in the last year is $16.33.

A number of equities research analysts recently weighed in on the stock. Stephens boosted their price objective on shares of F.N.B. from $16.00 to $18.00 and gave the company an "overweight" rating in a research report on Monday, October 21st. Piper Sandler reiterated an "overweight" rating on shares of F.N.B. in a research report on Friday, October 18th. Finally, StockNews.com upgraded F.N.B. from a "sell" rating to a "hold" rating in a research note on Monday, October 21st.

Read Our Latest Stock Analysis on F.N.B.

Institutional Inflows and Outflows

A number of institutional investors have recently added to or reduced their stakes in FNB. Kathleen S. Wright Associates Inc. acquired a new stake in F.N.B. in the third quarter worth about $28,000. Richardson Financial Services Inc. boosted its holdings in shares of F.N.B. by 100.0% in the third quarter. Richardson Financial Services Inc. now owns 2,946 shares of the bank's stock valued at $41,000 after acquiring an additional 1,473 shares in the last quarter. LRI Investments LLC acquired a new position in shares of F.N.B. during the first quarter valued at approximately $45,000. GAMMA Investing LLC raised its holdings in F.N.B. by 113.8% during the second quarter. GAMMA Investing LLC now owns 3,314 shares of the bank's stock worth $45,000 after purchasing an additional 1,764 shares in the last quarter. Finally, UMB Bank n.a. lifted its position in F.N.B. by 82.3% in the third quarter. UMB Bank n.a. now owns 3,687 shares of the bank's stock worth $52,000 after purchasing an additional 1,665 shares during the period. Institutional investors and hedge funds own 79.25% of the company's stock.

F.N.B. Stock Performance

FNB stock traded down $0.19 during trading on Tuesday, hitting $14.39. 2,191,226 shares of the company's stock traded hands, compared to its average volume of 2,204,118. The stock has a fifty day moving average price of $14.23 and a two-hundred day moving average price of $13.94. The company has a quick ratio of 0.92, a current ratio of 0.93 and a debt-to-equity ratio of 0.40. F.N.B. has a 52 week low of $10.50 and a 52 week high of $15.65. The stock has a market capitalization of $5.18 billion, a price-to-earnings ratio of 11.76, a price-to-earnings-growth ratio of 10.58 and a beta of 0.96.

F.N.B. Company Profile

(

Get Free ReportF.N.B. Corporation, a bank and financial holding company, provides a range of financial products and services primarily to consumers, corporations, governments, and small- to medium-sized businesses in the United States. The company operates through three segments: Community Banking, Wealth Management, and Insurance.

Further Reading

Before you consider F.N.B., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and F.N.B. wasn't on the list.

While F.N.B. currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.