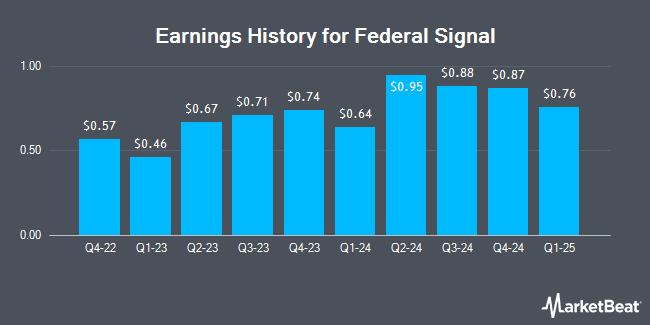

Federal Signal (NYSE:FSS - Get Free Report) will issue its quarterly earnings data before the market opens on Thursday, October 31st. Analysts expect the company to announce earnings of $0.82 per share for the quarter. Parties that wish to listen to the company's conference call can do so using this link.

Federal Signal (NYSE:FSS - Get Free Report) last announced its quarterly earnings data on Thursday, July 25th. The conglomerate reported $0.95 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.84 by $0.11. Federal Signal had a return on equity of 18.31% and a net margin of 11.16%. The firm had revenue of $490.40 million for the quarter, compared to analysts' expectations of $487.74 million. During the same period last year, the firm earned $0.67 earnings per share. The company's revenue for the quarter was up 10.8% compared to the same quarter last year. On average, analysts expect Federal Signal to post $3 EPS for the current fiscal year and $4 EPS for the next fiscal year.

Federal Signal Trading Up 0.3 %

Shares of NYSE:FSS traded up $0.23 on Thursday, reaching $84.98. 386,090 shares of the company traded hands, compared to its average volume of 341,193. The company has a current ratio of 2.89, a quick ratio of 1.35 and a debt-to-equity ratio of 0.23. The stock has a market capitalization of $5.20 billion, a P/E ratio of 25.83 and a beta of 0.93. Federal Signal has a 52 week low of $57.05 and a 52 week high of $102.18. The business's 50-day simple moving average is $90.54 and its 200 day simple moving average is $88.59.

Federal Signal Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Monday, December 2nd. Investors of record on Friday, November 15th will be paid a $0.12 dividend. The ex-dividend date is Friday, November 15th. This represents a $0.48 annualized dividend and a dividend yield of 0.56%. Federal Signal's payout ratio is presently 14.59%.

Insider Buying and Selling

In related news, Director Brenda Reichelderfer sold 25,685 shares of the firm's stock in a transaction dated Friday, August 30th. The stock was sold at an average price of $92.99, for a total value of $2,388,448.15. Following the sale, the director now directly owns 57,417 shares of the company's stock, valued at $5,339,206.83. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. 3.10% of the stock is owned by insiders.

Federal Signal Company Profile

(

Get Free Report)

Federal Signal Corp. engages in the design and manufacture of products and integrated solutions for municipal, governmental, industrial, and commercial customers. It operates through the Environmental Solutions Group and Safety and Security Systems Group segments. The Environment Solutions Group segment is involved in the manufacture and supply of street sweeper vehicles, sewer cleaners, vacuum loader trucks, hydro-excavation trucks, and water blasting equipment.

Featured Stories

Before you consider Federal Signal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Federal Signal wasn't on the list.

While Federal Signal currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.