Forsta AP Fonden raised its stake in Fortis Inc. (NYSE:FTS - Free Report) by 15.2% during the third quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 151,200 shares of the utilities provider's stock after buying an additional 20,000 shares during the period. Forsta AP Fonden's holdings in Fortis were worth $6,878,000 as of its most recent SEC filing.

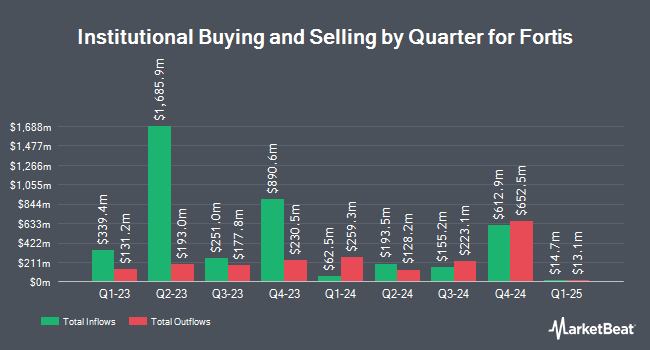

Several other institutional investors and hedge funds also recently made changes to their positions in the stock. EverSource Wealth Advisors LLC raised its stake in Fortis by 123.5% during the first quarter. EverSource Wealth Advisors LLC now owns 666 shares of the utilities provider's stock worth $26,000 after buying an additional 368 shares during the last quarter. Ridgewood Investments LLC bought a new position in shares of Fortis in the 2nd quarter worth about $32,000. Bessemer Group Inc. raised its position in shares of Fortis by 53.6% in the 1st quarter. Bessemer Group Inc. now owns 992 shares of the utilities provider's stock worth $40,000 after acquiring an additional 346 shares in the last quarter. Headlands Technologies LLC bought a new position in shares of Fortis in the 1st quarter worth about $69,000. Finally, Cromwell Holdings LLC raised its position in shares of Fortis by 52.2% in the 3rd quarter. Cromwell Holdings LLC now owns 1,837 shares of the utilities provider's stock worth $83,000 after acquiring an additional 630 shares in the last quarter. Institutional investors and hedge funds own 57.77% of the company's stock.

Fortis Stock Down 1.4 %

Shares of FTS traded down $0.61 during trading hours on Tuesday, hitting $43.28. The stock had a trading volume of 551,725 shares, compared to its average volume of 699,565. The company has a debt-to-equity ratio of 1.26, a current ratio of 0.69 and a quick ratio of 0.58. The firm has a 50 day simple moving average of $44.52 and a 200-day simple moving average of $41.68. The firm has a market capitalization of $21.43 billion, a P/E ratio of 18.92, a price-to-earnings-growth ratio of 3.95 and a beta of 0.47. Fortis Inc. has a 1-year low of $36.86 and a 1-year high of $46.06.

Fortis (NYSE:FTS - Get Free Report) last issued its earnings results on Wednesday, July 31st. The utilities provider reported $0.49 EPS for the quarter, beating the consensus estimate of $0.47 by $0.02. The company had revenue of $1.95 billion during the quarter, compared to the consensus estimate of $1.96 billion. Fortis had a return on equity of 7.04% and a net margin of 13.90%. Sell-side analysts predict that Fortis Inc. will post 2.35 EPS for the current fiscal year.

Fortis Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Sunday, December 1st. Investors of record on Monday, November 18th will be given a $0.615 dividend. This is a boost from Fortis's previous quarterly dividend of $0.43. The ex-dividend date of this dividend is Monday, November 18th. This represents a $2.46 annualized dividend and a yield of 5.68%. Fortis's dividend payout ratio (DPR) is presently 78.02%.

Analyst Upgrades and Downgrades

Several research analysts have recently weighed in on the company. Bank of America assumed coverage on Fortis in a research report on Friday, September 20th. They issued an "underperform" rating for the company. UBS Group raised Fortis to a "strong sell" rating in a research report on Tuesday, September 10th. Finally, StockNews.com raised Fortis from a "sell" rating to a "hold" rating in a research report on Sunday, August 4th.

Read Our Latest Analysis on FTS

Fortis Company Profile

(

Free Report)

Fortis Inc operates as an electric and gas utility company in Canada, the United States, and the Caribbean countries. It generates, transmits, and distributes electricity to approximately 447,000 retail customers in southeastern Arizona; and 103,000 retail customers in Arizona's Mohave and Santa Cruz counties with an aggregate capacity of 3,408 megawatts (MW), including 68 MW of solar capacity and 250 MV of wind capacity.

See Also

Before you consider Fortis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fortis wasn't on the list.

While Fortis currently has a "Strong Sell" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.