Ceredex Value Advisors LLC lowered its stake in Fortive Co. (NYSE:FTV - Free Report) by 64.4% in the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 444,728 shares of the technology company's stock after selling 803,750 shares during the quarter. Ceredex Value Advisors LLC owned 0.13% of Fortive worth $35,102,000 at the end of the most recent reporting period.

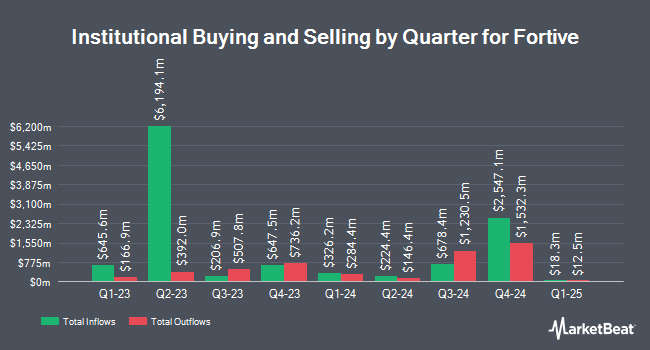

A number of other institutional investors also recently modified their holdings of the stock. Boston Partners increased its stake in Fortive by 19.3% in the first quarter. Boston Partners now owns 6,463,772 shares of the technology company's stock valued at $554,253,000 after purchasing an additional 1,045,245 shares in the last quarter. Janus Henderson Group PLC increased its position in Fortive by 47.1% in the 1st quarter. Janus Henderson Group PLC now owns 6,244,117 shares of the technology company's stock valued at $537,119,000 after buying an additional 1,999,792 shares in the last quarter. Dimensional Fund Advisors LP raised its stake in Fortive by 8.4% during the 2nd quarter. Dimensional Fund Advisors LP now owns 2,668,448 shares of the technology company's stock worth $197,726,000 after buying an additional 205,893 shares during the period. Select Equity Group L.P. boosted its holdings in Fortive by 6.8% in the second quarter. Select Equity Group L.P. now owns 2,641,314 shares of the technology company's stock worth $195,721,000 after acquiring an additional 168,368 shares in the last quarter. Finally, Canada Pension Plan Investment Board grew its stake in Fortive by 3.8% in the second quarter. Canada Pension Plan Investment Board now owns 2,565,443 shares of the technology company's stock valued at $190,099,000 after acquiring an additional 94,170 shares during the period. Institutional investors and hedge funds own 94.94% of the company's stock.

Wall Street Analyst Weigh In

FTV has been the topic of a number of recent research reports. Royal Bank of Canada cut their target price on Fortive from $85.00 to $77.00 and set a "sector perform" rating on the stock in a report on Thursday. Mizuho raised shares of Fortive from a "neutral" rating to an "outperform" rating and boosted their target price for the stock from $80.00 to $90.00 in a research report on Friday, September 6th. Morgan Stanley began coverage on shares of Fortive in a research report on Friday, September 6th. They issued an "overweight" rating and a $89.00 price target on the stock. Barclays cut their price target on Fortive from $98.00 to $95.00 and set an "overweight" rating for the company in a research note on Thursday. Finally, TD Cowen upgraded Fortive from a "hold" rating to a "buy" rating and raised their target price for the company from $75.00 to $90.00 in a report on Monday, July 8th. Four equities research analysts have rated the stock with a hold rating and nine have issued a buy rating to the stock. Based on data from MarketBeat, Fortive currently has an average rating of "Moderate Buy" and a consensus price target of $88.20.

Get Our Latest Stock Report on Fortive

Insider Activity at Fortive

In other Fortive news, SVP Jonathan L. Schwarz sold 14,223 shares of the business's stock in a transaction on Friday, September 13th. The stock was sold at an average price of $73.80, for a total value of $1,049,657.40. Following the sale, the senior vice president now directly owns 68,161 shares in the company, valued at $5,030,281.80. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website. In other Fortive news, SVP Jonathan L. Schwarz sold 14,223 shares of the stock in a transaction dated Friday, September 13th. The shares were sold at an average price of $73.80, for a total transaction of $1,049,657.40. Following the completion of the transaction, the senior vice president now owns 68,161 shares in the company, valued at $5,030,281.80. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, CFO Charles E. Mclaughlin sold 6,864 shares of the business's stock in a transaction that occurred on Friday, September 13th. The shares were sold at an average price of $74.03, for a total transaction of $508,141.92. Following the completion of the sale, the chief financial officer now directly owns 73,391 shares in the company, valued at approximately $5,433,135.73. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. 1.01% of the stock is owned by company insiders.

Fortive Stock Performance

NYSE:FTV traded down $0.09 during trading on Friday, reaching $71.34. The company's stock had a trading volume of 3,334,438 shares, compared to its average volume of 1,908,123. The firm has a market cap of $24.99 billion, a price-to-earnings ratio of 28.42, a price-to-earnings-growth ratio of 2.09 and a beta of 1.12. Fortive Co. has a 12 month low of $64.69 and a 12 month high of $87.10. The company has a debt-to-equity ratio of 0.33, a quick ratio of 0.95 and a current ratio of 1.25. The firm has a 50 day moving average of $75.27 and a 200-day moving average of $74.43.

Fortive (NYSE:FTV - Get Free Report) last posted its quarterly earnings results on Wednesday, October 30th. The technology company reported $0.97 earnings per share for the quarter, beating the consensus estimate of $0.93 by $0.04. The company had revenue of $1.53 billion during the quarter, compared to analyst estimates of $1.55 billion. Fortive had a net margin of 14.35% and a return on equity of 12.56%. The firm's revenue for the quarter was up 2.7% on a year-over-year basis. During the same quarter in the prior year, the business earned $0.85 earnings per share. Research analysts expect that Fortive Co. will post 3.85 EPS for the current fiscal year.

Fortive Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Friday, September 27th. Investors of record on Tuesday, September 17th were paid a $0.08 dividend. The ex-dividend date of this dividend was Friday, September 13th. This represents a $0.32 annualized dividend and a yield of 0.45%. Fortive's payout ratio is 12.75%.

Fortive Company Profile

(

Free Report)

Fortive Corporation designs, develops, manufactures, and services professional and engineered products, software, and services in the United States, China, and internationally. It operates in three segments: Intelligent Operating Solutions, Precision Technologies, and Advanced Healthcare Solutions. The Intelligent Operating Solutions segment provides advanced instrumentation, software, and services, including electrical test and measurement, facility and asset lifecycle software applications, and connected worker safety and compliance solutions for manufacturing, process industries, healthcare, utilities and power, communications and electronics, and other industries.

Featured Articles

Before you consider Fortive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fortive wasn't on the list.

While Fortive currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report