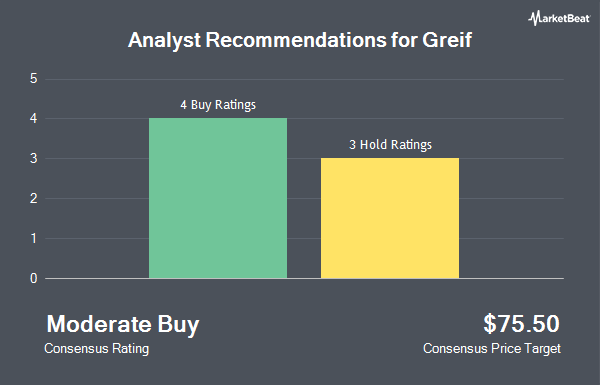

Shares of Greif, Inc. (NYSE:GEF - Get Free Report) have been given a consensus rating of "Moderate Buy" by the five analysts that are currently covering the firm, MarketBeat reports. Two analysts have rated the stock with a hold recommendation and three have given a buy recommendation to the company. The average 12 month target price among brokers that have updated their coverage on the stock in the last year is $76.00.

A number of research firms have commented on GEF. Stifel Nicolaus reaffirmed a "buy" rating and set a $88.00 target price on shares of Greif in a report on Monday, August 26th. StockNews.com lowered shares of Greif from a "buy" rating to a "hold" rating in a report on Wednesday, July 10th. Truist Financial reissued a "hold" rating and issued a $67.00 price target (down previously from $69.00) on shares of Greif in a report on Friday, August 30th. Wells Fargo & Company decreased their price target on shares of Greif from $80.00 to $76.00 and set an "overweight" rating for the company in a report on Monday, August 26th. Finally, Raymond James initiated coverage on shares of Greif in a report on Friday, July 19th. They issued a "market perform" rating for the company.

Check Out Our Latest Report on Greif

Greif Trading Down 0.6 %

GEF traded down $0.36 during trading on Friday, reaching $62.58. 137,440 shares of the company's stock were exchanged, compared to its average volume of 165,682. The company's fifty day moving average price is $62.22 and its 200-day moving average price is $62.04. The company has a debt-to-equity ratio of 1.35, a quick ratio of 1.28 and a current ratio of 1.70. Greif has a fifty-two week low of $55.95 and a fifty-two week high of $71.36. The firm has a market capitalization of $2.95 billion, a PE ratio of 13.46 and a beta of 0.91.

Greif (NYSE:GEF - Get Free Report) last released its earnings results on Wednesday, August 28th. The industrial products company reported $1.03 EPS for the quarter, missing analysts' consensus estimates of $1.17 by ($0.14). Greif had a return on equity of 13.28% and a net margin of 4.99%. The business had revenue of $1.45 billion for the quarter, compared to analyst estimates of $1.43 billion. As a group, equities analysts forecast that Greif will post 4.2 EPS for the current year.

Greif Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Tuesday, October 1st. Investors of record on Monday, September 16th were paid a $0.54 dividend. The ex-dividend date of this dividend was Monday, September 16th. This is a positive change from Greif's previous quarterly dividend of $0.52. This represents a $2.16 dividend on an annualized basis and a yield of 3.45%. Greif's dividend payout ratio is presently 46.45%.

Institutional Investors Weigh In On Greif

Several institutional investors and hedge funds have recently added to or reduced their stakes in the business. Denali Advisors LLC lifted its position in Greif by 20.2% during the 1st quarter. Denali Advisors LLC now owns 77,313 shares of the industrial products company's stock worth $5,338,000 after buying an additional 13,018 shares in the last quarter. Russell Investments Group Ltd. lifted its position in Greif by 24,865.2% during the 1st quarter. Russell Investments Group Ltd. now owns 5,742 shares of the industrial products company's stock worth $396,000 after buying an additional 5,719 shares in the last quarter. ProShare Advisors LLC lifted its position in Greif by 4.6% during the 1st quarter. ProShare Advisors LLC now owns 5,616 shares of the industrial products company's stock worth $388,000 after buying an additional 246 shares in the last quarter. Mirova bought a new stake in Greif during the 1st quarter worth about $2,597,000. Finally, Quadrature Capital Ltd raised its holdings in shares of Greif by 133.9% in the 1st quarter. Quadrature Capital Ltd now owns 13,047 shares of the industrial products company's stock valued at $902,000 after purchasing an additional 7,468 shares during the period. 45.74% of the stock is owned by institutional investors.

Greif Company Profile

(

Get Free ReportGreif, Inc engages in the production and sale of industrial packaging products and services worldwide. The company operates through Global Industrial Packaging; Paper Packaging & Services; and Land Management segments. The Global Industrial Packaging segment produces and sells industrial packaging products, including steel, fiber, and plastic drums; rigid and flexible intermediate bulk containers; closure systems for industrial packaging products; transit protection products; water bottles, and remanufactured and reconditioned industrial containers; and various services, such as container life cycle management, filling, logistics, warehousing, and other packaging services to chemicals, paints and pigments, food and beverage, petroleum, industrial coatings, agriculture, pharmaceuticals, mineral product, and other industries.

Featured Stories

Before you consider Greif, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Greif wasn't on the list.

While Greif currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.