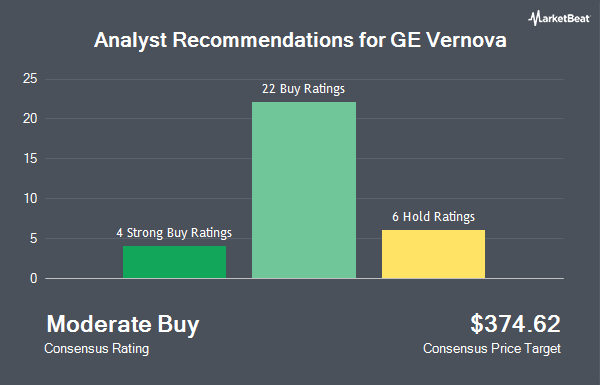

GE Vernova Inc. (NYSE:GEV - Get Free Report) has earned an average rating of "Moderate Buy" from the twenty-five research firms that are covering the firm, MarketBeat Ratings reports. Seven equities research analysts have rated the stock with a hold recommendation, seventeen have assigned a buy recommendation and one has issued a strong buy recommendation on the company. The average 1 year price objective among brokers that have issued a report on the stock in the last year is $261.40.

A number of analysts have recently weighed in on GEV shares. Mizuho boosted their price objective on shares of GE Vernova from $186.00 to $208.00 and gave the stock an "outperform" rating in a research note on Friday, July 26th. Raymond James lowered shares of GE Vernova from an "outperform" rating to a "market perform" rating in a research report on Wednesday, October 2nd. The Goldman Sachs Group raised their price target on GE Vernova from $220.00 to $308.00 and gave the company a "buy" rating in a research report on Thursday, October 10th. HSBC reissued a "hold" rating and set a $255.00 price objective (up previously from $240.00) on shares of GE Vernova in a research report on Friday, October 4th. Finally, William Blair began coverage on GE Vernova in a report on Thursday, August 29th. They issued an "outperform" rating on the stock.

View Our Latest Analysis on GEV

Institutional Inflows and Outflows

A number of institutional investors have recently modified their holdings of the company. Aspire Private Capital LLC bought a new position in GE Vernova in the 2nd quarter valued at $40,000. Legal & General Group Plc acquired a new stake in shares of GE Vernova in the second quarter valued at $293,699,000. Central Pacific Bank Trust Division increased its stake in shares of GE Vernova by 1,242.9% in the third quarter. Central Pacific Bank Trust Division now owns 2,350 shares of the company's stock valued at $599,000 after buying an additional 2,175 shares in the last quarter. Concourse Financial Group Securities Inc. raised its holdings in shares of GE Vernova by 75.6% in the third quarter. Concourse Financial Group Securities Inc. now owns 4,958 shares of the company's stock valued at $1,264,000 after buying an additional 2,134 shares during the last quarter. Finally, Park Avenue Securities LLC acquired a new position in GE Vernova during the 3rd quarter worth about $2,042,000.

GE Vernova Stock Down 0.2 %

Shares of GEV stock traded down $0.57 during trading on Friday, reaching $301.09. The company had a trading volume of 2,702,214 shares, compared to its average volume of 2,353,280. The firm's 50 day simple moving average is $246.45 and its two-hundred day simple moving average is $196.42. GE Vernova has a one year low of $115.00 and a one year high of $311.58.

GE Vernova Company Profile

(

Get Free ReportGE Vernova LLC, an energy business company, generates electricity. It operates under three segments: Power, Wind, and Electrification. The Power segments generates and sells electricity through hydro, gas, nuclear, and steam power. Wind segment engages in the manufacturing and sale of wind turbine blades; and Electrification segment provides grid solutions, power conversion, solar, and storage solutions.

Further Reading

Before you consider GE Vernova, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GE Vernova wasn't on the list.

While GE Vernova currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.