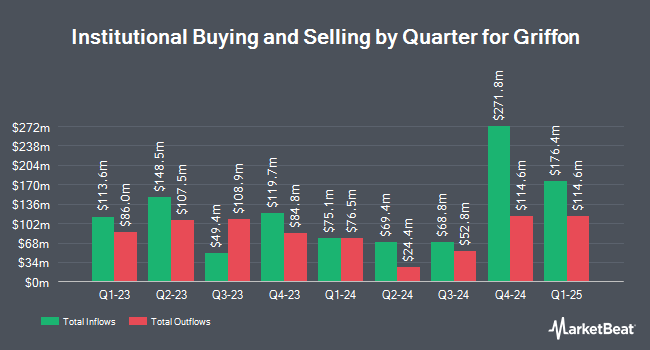

Allspring Global Investments Holdings LLC decreased its stake in shares of Griffon Co. (NYSE:GFF - Free Report) by 38.7% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 563,923 shares of the conglomerate's stock after selling 355,961 shares during the quarter. Allspring Global Investments Holdings LLC owned about 1.14% of Griffon worth $39,475,000 at the end of the most recent reporting period.

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Ritholtz Wealth Management grew its position in Griffon by 5.0% during the third quarter. Ritholtz Wealth Management now owns 3,913 shares of the conglomerate's stock valued at $274,000 after buying an additional 187 shares during the period. Evergreen Capital Management LLC raised its stake in Griffon by 5.3% during the second quarter. Evergreen Capital Management LLC now owns 4,011 shares of the conglomerate's stock worth $256,000 after purchasing an additional 201 shares during the period. Essex Investment Management Co. LLC grew its position in Griffon by 0.5% in the first quarter. Essex Investment Management Co. LLC now owns 39,526 shares of the conglomerate's stock worth $2,899,000 after acquiring an additional 213 shares during the period. SummerHaven Investment Management LLC increased its position in shares of Griffon by 1.3% during the 2nd quarter. SummerHaven Investment Management LLC now owns 17,753 shares of the conglomerate's stock worth $1,134,000 after purchasing an additional 231 shares during the last quarter. Finally, National Bank of Canada FI lifted its holdings in shares of Griffon by 2.2% in the 2nd quarter. National Bank of Canada FI now owns 14,562 shares of the conglomerate's stock worth $930,000 after acquiring an additional 311 shares during the last quarter. Institutional investors and hedge funds own 73.22% of the company's stock.

Wall Street Analyst Weigh In

Several equities research analysts recently weighed in on the stock. Stephens reaffirmed an "overweight" rating and set a $85.00 target price on shares of Griffon in a research note on Tuesday, September 10th. StockNews.com upgraded shares of Griffon from a "buy" rating to a "strong-buy" rating in a report on Saturday, October 12th. Finally, Robert W. Baird lifted their price target on Griffon from $84.00 to $92.00 and gave the stock an "outperform" rating in a research report on Monday. Three analysts have rated the stock with a buy rating and two have issued a strong buy rating to the company's stock. According to data from MarketBeat.com, Griffon currently has a consensus rating of "Buy" and a consensus target price of $83.50.

Check Out Our Latest Stock Analysis on GFF

Insider Transactions at Griffon

In other Griffon news, SVP Seth L. Kaplan sold 4,844 shares of the firm's stock in a transaction dated Wednesday, September 18th. The stock was sold at an average price of $70.00, for a total transaction of $339,080.00. Following the transaction, the senior vice president now directly owns 198,571 shares in the company, valued at $13,899,970. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. In other Griffon news, SVP Seth L. Kaplan sold 4,844 shares of Griffon stock in a transaction on Wednesday, September 18th. The shares were sold at an average price of $70.00, for a total transaction of $339,080.00. Following the sale, the senior vice president now owns 198,571 shares in the company, valued at $13,899,970. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, CEO Ronald J. Kramer sold 100,000 shares of the stock in a transaction on Wednesday, September 11th. The stock was sold at an average price of $62.26, for a total value of $6,226,000.00. Following the transaction, the chief executive officer now owns 2,260,746 shares of the company's stock, valued at $140,754,045.96. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 260,464 shares of company stock valued at $17,244,450 over the last three months. 16.10% of the stock is owned by corporate insiders.

Griffon Trading Down 0.9 %

Shares of GFF traded down $0.57 during mid-day trading on Wednesday, reaching $64.38. The company had a trading volume of 486,379 shares, compared to its average volume of 427,118. Griffon Co. has a fifty-two week low of $38.39 and a fifty-two week high of $77.99. The firm has a fifty day simple moving average of $66.48 and a 200-day simple moving average of $66.85. The company has a current ratio of 2.50, a quick ratio of 1.39 and a debt-to-equity ratio of 6.71. The stock has a market cap of $3.19 billion, a price-to-earnings ratio of 16.99 and a beta of 1.29.

Griffon (NYSE:GFF - Get Free Report) last posted its quarterly earnings data on Wednesday, August 7th. The conglomerate reported $1.24 EPS for the quarter, missing analysts' consensus estimates of $1.31 by ($0.07). Griffon had a net margin of 7.27% and a return on equity of 96.05%. The company had revenue of $647.80 million for the quarter, compared to the consensus estimate of $688.94 million. During the same quarter last year, the company earned $1.29 earnings per share. The company's revenue was down 5.2% compared to the same quarter last year. On average, sell-side analysts anticipate that Griffon Co. will post 4.87 EPS for the current fiscal year.

Griffon Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Thursday, September 19th. Shareholders of record on Wednesday, August 28th were paid a dividend of $0.15 per share. This represents a $0.60 annualized dividend and a yield of 0.93%. The ex-dividend date of this dividend was Wednesday, August 28th. Griffon's dividend payout ratio (DPR) is currently 15.83%.

Griffon Profile

(

Free Report)

Griffon Corporation, through its subsidiaries, provides consumer and professional, and home and building products in the United States, Europe, Canada, Australia, and internationally. The company operates through two segments: Home and Building Products, and Consumer and Professional Products. The Home and Building Products segment manufactures and markets residential and commercial sectional garage doors, rolling steel service doors, fire doors, shutters, steel security grilles, and room dividers for the use in commercial construction and repair, and home remodeling applications.

Featured Stories

Before you consider Griffon, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Griffon wasn't on the list.

While Griffon currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report