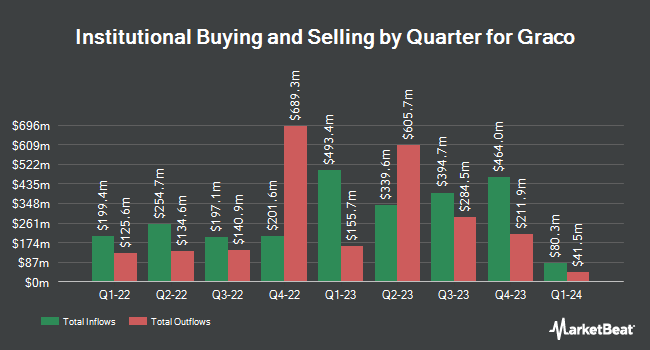

DekaBank Deutsche Girozentrale increased its holdings in shares of Graco Inc. (NYSE:GGG - Free Report) by 40.6% in the third quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 199,393 shares of the industrial products company's stock after purchasing an additional 57,580 shares during the quarter. DekaBank Deutsche Girozentrale owned 0.12% of Graco worth $17,297,000 as of its most recent filing with the SEC.

Other hedge funds have also recently bought and sold shares of the company. Gradient Investments LLC purchased a new stake in shares of Graco during the second quarter valued at approximately $27,000. New Covenant Trust Company N.A. acquired a new stake in shares of Graco during the first quarter valued at about $43,000. UMB Bank n.a. increased its position in shares of Graco by 187.8% during the third quarter. UMB Bank n.a. now owns 495 shares of the industrial products company's stock worth $43,000 after acquiring an additional 323 shares during the last quarter. Blue Trust Inc. lifted its stake in shares of Graco by 220.9% in the second quarter. Blue Trust Inc. now owns 690 shares of the industrial products company's stock worth $55,000 after acquiring an additional 475 shares in the last quarter. Finally, Tobam boosted its holdings in Graco by 90.2% in the first quarter. Tobam now owns 601 shares of the industrial products company's stock valued at $56,000 after purchasing an additional 285 shares during the last quarter. Hedge funds and other institutional investors own 93.88% of the company's stock.

Wall Street Analysts Forecast Growth

Several analysts recently issued reports on GGG shares. Royal Bank of Canada cut their price target on shares of Graco from $96.00 to $93.00 and set an "outperform" rating on the stock in a report on Friday, October 25th. Robert W. Baird cut their price objective on Graco from $88.00 to $85.00 and set a "neutral" rating on the stock in a research note on Friday, October 25th. Finally, DA Davidson reiterated a "neutral" rating and issued a $79.00 price target on shares of Graco in a report on Friday, September 27th. Four investment analysts have rated the stock with a hold rating and two have assigned a buy rating to the company's stock. According to MarketBeat.com, Graco presently has a consensus rating of "Hold" and an average target price of $89.25.

Get Our Latest Research Report on Graco

Graco Price Performance

NYSE:GGG traded up $0.11 during midday trading on Wednesday, reaching $81.61. 958,320 shares of the company traded hands, compared to its average volume of 730,701. The firm has a market capitalization of $13.80 billion, a price-to-earnings ratio of 28.11, a price-to-earnings-growth ratio of 2.82 and a beta of 0.81. The company has a fifty day moving average price of $83.97 and a 200 day moving average price of $82.46. Graco Inc. has a twelve month low of $73.03 and a twelve month high of $94.77.

Graco (NYSE:GGG - Get Free Report) last released its quarterly earnings data on Wednesday, October 23rd. The industrial products company reported $0.71 earnings per share for the quarter, missing analysts' consensus estimates of $0.76 by ($0.05). The firm had revenue of $519.21 million during the quarter, compared to analyst estimates of $538.19 million. Graco had a return on equity of 22.40% and a net margin of 23.16%. The firm's revenue was down 3.8% on a year-over-year basis. During the same period last year, the business earned $0.76 EPS. On average, equities research analysts forecast that Graco Inc. will post 2.98 earnings per share for the current fiscal year.

Graco Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, November 6th. Stockholders of record on Monday, October 21st will be paid a $0.255 dividend. The ex-dividend date is Monday, October 21st. This represents a $1.02 annualized dividend and a dividend yield of 1.25%. Graco's payout ratio is 35.17%.

Graco Company Profile

(

Free Report)

Graco Inc designs, manufactures, and markets systems and equipment used to move, measure, control, dispense, and spray fluid and powder materials worldwide. The Contractor segment offers sprayers to apply paint to walls and other structures; two-component proportioning systems that are used to spray polyurethane foam and polyurea coatings; and viscous coatings to roofs, as well as markings on roads, parking lots, athletic fields, and floors.

See Also

Before you consider Graco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Graco wasn't on the list.

While Graco currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.