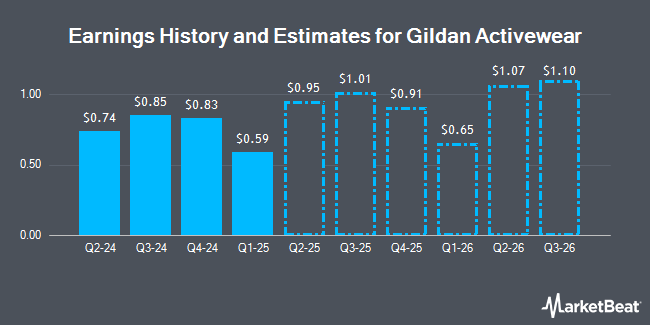

Gildan Activewear Inc. (NYSE:GIL - Free Report) TSE: GIL - Equities research analysts at Desjardins lifted their Q3 2024 earnings estimates for shares of Gildan Activewear in a report released on Thursday, October 24th. Desjardins analyst C. Li now anticipates that the textile maker will post earnings per share of $0.84 for the quarter, up from their prior estimate of $0.83. The consensus estimate for Gildan Activewear's current full-year earnings is $2.93 per share. Desjardins also issued estimates for Gildan Activewear's FY2024 earnings at $2.97 EPS and FY2025 earnings at $3.40 EPS.

Several other equities research analysts also recently commented on GIL. TD Securities lifted their target price on shares of Gildan Activewear from $50.00 to $56.00 and gave the stock a "buy" rating in a research report on Wednesday, October 16th. Royal Bank of Canada boosted their price target on shares of Gildan Activewear from $41.00 to $44.00 and gave the stock an "outperform" rating in a research report on Friday, August 2nd. Stifel Nicolaus boosted their price target on shares of Gildan Activewear from $51.00 to $54.00 and gave the stock a "buy" rating in a research report on Thursday, October 3rd. Finally, BMO Capital Markets boosted their price target on shares of Gildan Activewear from $43.00 to $47.00 and gave the stock an "outperform" rating in a research report on Friday, August 2nd. Four investment analysts have rated the stock with a hold rating and ten have assigned a buy rating to the stock. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus price target of $45.68.

Read Our Latest Stock Analysis on GIL

Gildan Activewear Trading Up 0.6 %

NYSE:GIL traded up $0.28 during mid-day trading on Monday, hitting $48.36. 393,230 shares of the company's stock were exchanged, compared to its average volume of 713,248. The company has a 50 day simple moving average of $45.82 and a 200-day simple moving average of $40.48. The company has a current ratio of 2.35, a quick ratio of 0.97 and a debt-to-equity ratio of 0.55. Gildan Activewear has a fifty-two week low of $27.61 and a fifty-two week high of $48.96. The firm has a market capitalization of $8.01 billion, a P/E ratio of 16.36, a PEG ratio of 1.78 and a beta of 1.43.

Gildan Activewear (NYSE:GIL - Get Free Report) TSE: GIL last posted its earnings results on Thursday, August 1st. The textile maker reported $0.74 EPS for the quarter, topping the consensus estimate of $0.71 by $0.03. Gildan Activewear had a net margin of 13.01% and a return on equity of 24.96%. The business had revenue of $862.20 million for the quarter, compared to the consensus estimate of $851.10 million. During the same period last year, the company earned $0.63 EPS. The firm's revenue was up 2.6% compared to the same quarter last year.

Institutional Trading of Gildan Activewear

A number of hedge funds and other institutional investors have recently bought and sold shares of GIL. Intact Investment Management Inc. increased its stake in Gildan Activewear by 204.8% during the 2nd quarter. Intact Investment Management Inc. now owns 881,100 shares of the textile maker's stock valued at $33,416,000 after purchasing an additional 591,980 shares in the last quarter. National Bank of Canada FI grew its stake in shares of Gildan Activewear by 43.8% in the 1st quarter. National Bank of Canada FI now owns 1,762,761 shares of the textile maker's stock worth $65,451,000 after acquiring an additional 537,215 shares in the last quarter. EdgePoint Investment Group Inc. grew its stake in shares of Gildan Activewear by 28.0% in the 2nd quarter. EdgePoint Investment Group Inc. now owns 1,863,618 shares of the textile maker's stock worth $70,696,000 after acquiring an additional 407,113 shares in the last quarter. Vaughan Nelson Investment Management L.P. grew its stake in shares of Gildan Activewear by 31.5% in the 2nd quarter. Vaughan Nelson Investment Management L.P. now owns 1,573,695 shares of the textile maker's stock worth $59,674,000 after acquiring an additional 377,135 shares in the last quarter. Finally, The Manufacturers Life Insurance Company grew its stake in shares of Gildan Activewear by 14.4% in the 2nd quarter. The Manufacturers Life Insurance Company now owns 2,568,733 shares of the textile maker's stock worth $97,290,000 after acquiring an additional 324,304 shares in the last quarter. Institutional investors own 82.83% of the company's stock.

Gildan Activewear Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Monday, September 16th. Shareholders of record on Thursday, August 22nd were paid a dividend of $0.205 per share. The ex-dividend date of this dividend was Thursday, August 22nd. This represents a $0.82 dividend on an annualized basis and a yield of 1.70%. Gildan Activewear's dividend payout ratio (DPR) is presently 27.70%.

About Gildan Activewear

(

Get Free Report)

Gildan Activewear Inc manufactures and sells various apparel products in the United States, North America, Europe, Asia-Pacific, and Latin America. It provides various activewear products, including T-shirts, fleece tops and bottoms, and sports shirts under the Gildan, Gildan Performance, Gildan Hammer, Glidan Softstyle, Gildan Heavy Cotton, Gildan Ultra Cotton, Gildan DryBlend, Gildan HeavyBlend, Comfort Colors, and American Apparel brands.

Featured Articles

Before you consider Gildan Activewear, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gildan Activewear wasn't on the list.

While Gildan Activewear currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.