Raymond James & Associates increased its holdings in Globant S.A. (NYSE:GLOB - Free Report) by 27.4% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 79,234 shares of the information technology services provider's stock after purchasing an additional 17,035 shares during the period. Raymond James & Associates owned 0.18% of Globant worth $15,699,000 as of its most recent SEC filing.

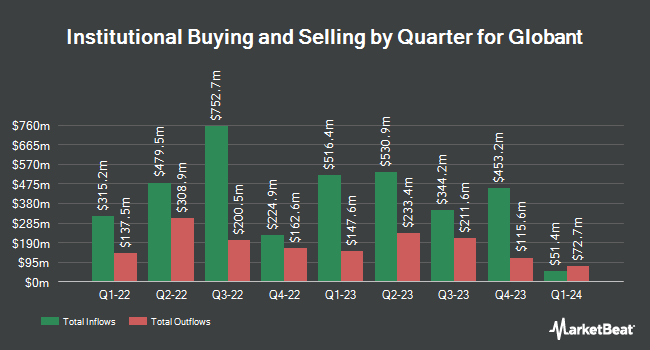

A number of other institutional investors and hedge funds also recently modified their holdings of the stock. Wasatch Advisors LP grew its stake in Globant by 6.8% during the 1st quarter. Wasatch Advisors LP now owns 3,336,764 shares of the information technology services provider's stock valued at $673,693,000 after purchasing an additional 213,049 shares in the last quarter. Manning & Napier Advisors LLC bought a new position in Globant during the second quarter valued at about $99,396,000. Sei Investments Co. boosted its stake in shares of Globant by 43.4% during the 2nd quarter. Sei Investments Co. now owns 512,916 shares of the information technology services provider's stock worth $91,432,000 after acquiring an additional 155,112 shares in the last quarter. Dimensional Fund Advisors LP raised its holdings in shares of Globant by 57.5% during the second quarter. Dimensional Fund Advisors LP now owns 442,312 shares of the information technology services provider's stock valued at $78,851,000 after acquiring an additional 161,512 shares during the period. Finally, Clearbridge Investments LLC boosted its position in shares of Globant by 28.4% in the second quarter. Clearbridge Investments LLC now owns 339,790 shares of the information technology services provider's stock worth $60,571,000 after buying an additional 75,192 shares during the period. Institutional investors and hedge funds own 91.60% of the company's stock.

Globant Stock Down 0.5 %

Shares of GLOB traded down $1.01 during mid-day trading on Friday, hitting $218.04. 367,946 shares of the company's stock were exchanged, compared to its average volume of 479,525. Globant S.A. has a 52 week low of $151.68 and a 52 week high of $251.50. The stock's 50-day simple moving average is $202.75 and its 200-day simple moving average is $187.27. The firm has a market cap of $9.40 billion, a price-to-earnings ratio of 56.93, a price-to-earnings-growth ratio of 2.70 and a beta of 1.39.

Globant (NYSE:GLOB - Get Free Report) last issued its quarterly earnings data on Thursday, August 15th. The information technology services provider reported $1.51 earnings per share for the quarter, topping analysts' consensus estimates of $1.50 by $0.01. The business had revenue of $587.46 million for the quarter, compared to analyst estimates of $586.72 million. Globant had a return on equity of 11.68% and a net margin of 7.39%. Globant's quarterly revenue was up 18.1% compared to the same quarter last year. During the same quarter in the previous year, the company posted $1.04 EPS. Analysts forecast that Globant S.A. will post 5.02 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

Several research firms have commented on GLOB. Needham & Company LLC boosted their target price on shares of Globant from $200.00 to $245.00 and gave the stock a "buy" rating in a research report on Friday, August 16th. TD Cowen lifted their price objective on Globant from $220.00 to $230.00 and gave the stock a "buy" rating in a report on Friday, August 16th. Canaccord Genuity Group increased their price objective on shares of Globant from $175.00 to $205.00 and gave the company a "hold" rating in a research note on Wednesday, August 21st. Scotiabank lifted their target price on shares of Globant from $200.00 to $210.00 and gave the company a "sector perform" rating in a research note on Wednesday, August 21st. Finally, JPMorgan Chase & Co. raised their price objective on shares of Globant from $226.00 to $237.00 and gave the company an "overweight" rating in a research note on Friday, September 6th. One investment analyst has rated the stock with a sell rating, seven have issued a hold rating and thirteen have assigned a buy rating to the company. According to MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average price target of $224.00.

Get Our Latest Stock Analysis on GLOB

About Globant

(

Free Report)

Globant SA, together with its subsidiaries, provides technology services worldwide. It provides digital solutions comprising blockchain, cloud technologies, cybersecurity, data and artificial intelligence, digital experience and performance, code, Internet of Things, metaverse, and engineering and testing; and enterprise technology solutions and services, such as Agile organization, Cultural Hacking, process optimization services, as well as AWS, Google Cloud, Microsoft, Oracle, SalesForce, SAP, and ServiceNow technology solutions.

Featured Articles

Before you consider Globant, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Globant wasn't on the list.

While Globant currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.