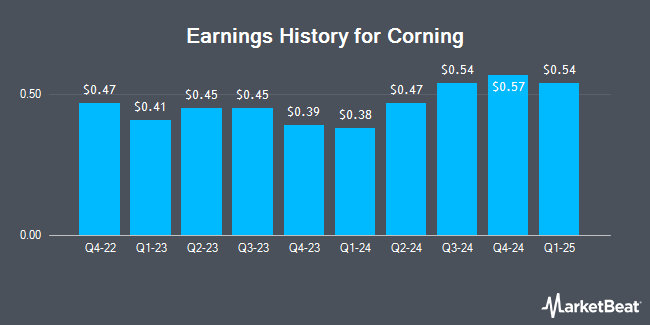

Corning (NYSE:GLW - Get Free Report) issued its earnings results on Tuesday. The electronics maker reported $0.54 earnings per share for the quarter, topping analysts' consensus estimates of $0.53 by $0.01, Briefing.com reports. The firm had revenue of $3.39 billion during the quarter, compared to analyst estimates of $3.72 billion. Corning had a net margin of 3.53% and a return on equity of 12.69%. Corning's revenue for the quarter was up 6.9% on a year-over-year basis. During the same quarter in the prior year, the business earned $0.45 earnings per share. Corning updated its Q4 guidance to $0.53-0.57 EPS and its Q4 2024 guidance to 0.530-0.570 EPS.

Corning Trading Down 2.0 %

NYSE GLW traded down $0.99 during trading on Wednesday, hitting $48.04. The stock had a trading volume of 7,933,686 shares, compared to its average volume of 5,745,736. Corning has a one year low of $26.41 and a one year high of $51.03. The stock has a 50 day simple moving average of $44.27 and a 200 day simple moving average of $40.16. The stock has a market capitalization of $41.15 billion, a price-to-earnings ratio of 67.66, a P/E/G ratio of 1.73 and a beta of 1.04. The company has a debt-to-equity ratio of 0.63, a quick ratio of 0.98 and a current ratio of 1.57.

Corning Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, December 13th. Investors of record on Friday, November 15th will be given a $0.28 dividend. This represents a $1.12 dividend on an annualized basis and a yield of 2.33%. The ex-dividend date of this dividend is Friday, November 15th. Corning's dividend payout ratio (DPR) is currently 157.75%.

Analysts Set New Price Targets

A number of research analysts have recently weighed in on GLW shares. Morgan Stanley restated an "equal weight" rating and set a $39.00 price objective on shares of Corning in a research report on Friday, July 26th. Hsbc Global Res upgraded Corning from a "moderate sell" rating to a "hold" rating in a report on Tuesday, July 9th. Bank of America lifted their price objective on Corning from $46.00 to $51.00 and gave the stock a "buy" rating in a research note on Friday, September 20th. Barclays increased their target price on Corning from $40.00 to $53.00 and gave the company an "equal weight" rating in a research report on Tuesday. Finally, Mizuho upgraded shares of Corning from a "neutral" rating to an "outperform" rating and boosted their price target for the stock from $44.00 to $47.00 in a research report on Wednesday, August 21st. Six equities research analysts have rated the stock with a hold rating and nine have given a buy rating to the company's stock. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of $50.08.

Check Out Our Latest Analysis on GLW

About Corning

(

Get Free Report)

Corning Incorporated engages in the display technologies, optical communications, environmental technologies, specialty materials, and life sciences businesses in the United States and internationally. The company's Display Technologies segment offers glass substrates for flat panel displays, including liquid crystal displays and organic light-emitting diodes that are used in televisions, notebook computers, desktop monitors, tablets, and handheld devices.

See Also

Before you consider Corning, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Corning wasn't on the list.

While Corning currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.