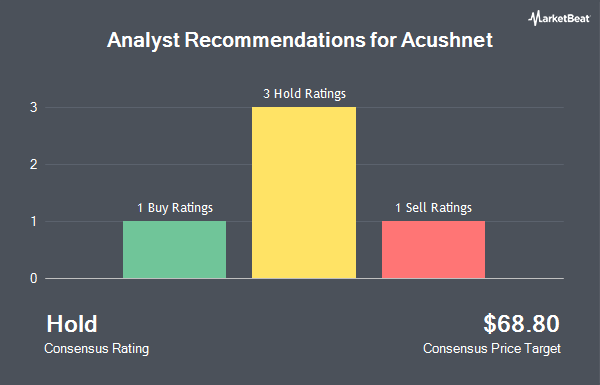

Acushnet Holdings Corp. (NYSE:GOLF - Get Free Report) has received an average recommendation of "Hold" from the seven research firms that are presently covering the firm, MarketBeat.com reports. Five equities research analysts have rated the stock with a hold recommendation and two have issued a buy recommendation on the company. The average 1 year price objective among brokers that have issued a report on the stock in the last year is $67.43.

Several brokerages recently commented on GOLF. Compass Point decreased their price target on Acushnet from $78.00 to $76.00 and set a "buy" rating on the stock in a research note on Wednesday, August 7th. Jefferies Financial Group cut shares of Acushnet from a "buy" rating to a "hold" rating and dropped their target price for the stock from $86.00 to $75.00 in a research report on Tuesday, September 17th. Finally, Truist Financial lifted their price target on shares of Acushnet from $63.00 to $65.00 and gave the company a "hold" rating in a report on Wednesday, August 7th.

View Our Latest Research Report on GOLF

Insider Buying and Selling

In related news, Director Holdings Corp. Fila sold 1,110,000 shares of the stock in a transaction that occurred on Friday, August 9th. The shares were sold at an average price of $64.19, for a total value of $71,250,900.00. Following the transaction, the director now directly owns 31,412,966 shares in the company, valued at $2,016,398,287.54. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Corporate insiders own 54.60% of the company's stock.

Hedge Funds Weigh In On Acushnet

Several hedge funds have recently added to or reduced their stakes in the stock. Sei Investments Co. grew its holdings in Acushnet by 29.0% during the first quarter. Sei Investments Co. now owns 96,624 shares of the company's stock valued at $6,372,000 after purchasing an additional 21,730 shares during the period. Capstone Investment Advisors LLC bought a new position in Acushnet during the first quarter worth about $2,026,000. Quantbot Technologies LP acquired a new position in Acushnet in the first quarter valued at about $1,842,000. Vanguard Group Inc. increased its holdings in shares of Acushnet by 0.5% in the first quarter. Vanguard Group Inc. now owns 3,010,318 shares of the company's stock worth $198,530,000 after acquiring an additional 15,088 shares in the last quarter. Finally, State Board of Administration of Florida Retirement System raised its position in shares of Acushnet by 95.4% during the first quarter. State Board of Administration of Florida Retirement System now owns 36,994 shares of the company's stock worth $2,440,000 after purchasing an additional 18,064 shares during the period. Institutional investors and hedge funds own 53.12% of the company's stock.

Acushnet Stock Performance

NYSE GOLF traded up $0.49 during trading on Wednesday, hitting $61.65. The company's stock had a trading volume of 417,821 shares, compared to its average volume of 306,889. Acushnet has a 52 week low of $49.42 and a 52 week high of $74.77. The firm has a market cap of $3.89 billion, a P/E ratio of 21.24 and a beta of 0.84. The firm has a 50 day moving average price of $64.09 and a 200 day moving average price of $64.57. The company has a quick ratio of 1.27, a current ratio of 2.28 and a debt-to-equity ratio of 0.81.

Acushnet (NYSE:GOLF - Get Free Report) last announced its quarterly earnings data on Tuesday, August 6th. The company reported $1.11 EPS for the quarter, missing analysts' consensus estimates of $1.20 by ($0.09). Acushnet had a net margin of 7.91% and a return on equity of 21.17%. The company had revenue of $683.90 million for the quarter, compared to analyst estimates of $709.83 million. During the same period in the prior year, the company posted $1.09 EPS. The firm's quarterly revenue was down .8% on a year-over-year basis. Equities research analysts forecast that Acushnet will post 3.02 earnings per share for the current fiscal year.

Acushnet Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Friday, September 20th. Stockholders of record on Friday, September 6th were paid a dividend of $0.215 per share. This represents a $0.86 annualized dividend and a dividend yield of 1.39%. The ex-dividend date of this dividend was Friday, September 6th. Acushnet's dividend payout ratio (DPR) is presently 29.86%.

About Acushnet

(

Get Free ReportAcushnet Holdings Corp. designs, develops, manufactures, and distributes golf products in the United States, Europe, the Middle East, Africa, Japan, Korea, and internationally. The company operates through four segments: Titleist Golf Balls, Titleist Golf Clubs, Titleist Golf Gear, and FootJoy Golf Wear.

Recommended Stories

Before you consider Acushnet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Acushnet wasn't on the list.

While Acushnet currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.