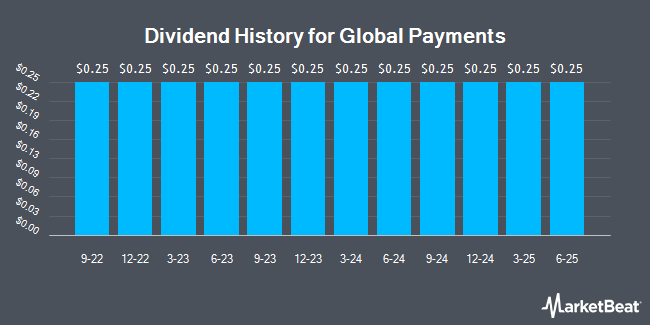

Global Payments Inc. (NYSE:GPN - Get Free Report) announced a quarterly dividend on Wednesday, October 30th, RTT News reports. Investors of record on Friday, December 13th will be paid a dividend of 0.25 per share by the business services provider on Friday, December 27th. This represents a $1.00 dividend on an annualized basis and a yield of 0.97%.

Global Payments has raised its dividend payment by an average of 8.6% annually over the last three years. Global Payments has a dividend payout ratio of 7.8% indicating that its dividend is sufficiently covered by earnings. Analysts expect Global Payments to earn $12.27 per share next year, which means the company should continue to be able to cover its $1.00 annual dividend with an expected future payout ratio of 8.1%.

Global Payments Trading Up 4.4 %

NYSE GPN traded up $4.32 during trading on Wednesday, hitting $103.37. The company had a trading volume of 3,989,607 shares, compared to its average volume of 2,266,235. The company has a current ratio of 0.92, a quick ratio of 0.92 and a debt-to-equity ratio of 0.68. Global Payments has a one year low of $91.60 and a one year high of $141.77. The company's fifty day moving average is $104.95 and its 200-day moving average is $104.38. The company has a market cap of $26.39 billion, a price-to-earnings ratio of 20.01, a price-to-earnings-growth ratio of 0.74 and a beta of 0.98.

Global Payments (NYSE:GPN - Get Free Report) last announced its earnings results on Wednesday, August 7th. The business services provider reported $2.93 EPS for the quarter, beating analysts' consensus estimates of $2.90 by $0.03. Global Payments had a net margin of 14.26% and a return on equity of 11.93%. The firm had revenue of $2.57 billion for the quarter, compared to analysts' expectations of $2.32 billion. During the same quarter in the previous year, the business posted $2.48 EPS. The company's quarterly revenue was up 4.7% on a year-over-year basis. On average, sell-side analysts predict that Global Payments will post 11.06 earnings per share for the current year.

Analysts Set New Price Targets

Several research analysts have recently weighed in on GPN shares. StockNews.com cut Global Payments from a "buy" rating to a "hold" rating in a research note on Thursday, September 26th. Monness Crespi & Hardt cut their target price on shares of Global Payments from $165.00 to $155.00 and set a "buy" rating for the company in a research report on Wednesday, September 25th. BNP Paribas upgraded Global Payments to a "strong sell" rating in a research note on Wednesday, September 4th. B. Riley dropped their target price on Global Payments from $204.00 to $194.00 and set a "buy" rating on the stock in a research report on Wednesday, September 25th. Finally, Morgan Stanley lowered their price objective on shares of Global Payments from $164.00 to $156.00 and set an "overweight" rating on the stock in a research note on Wednesday, September 25th. One analyst has rated the stock with a sell rating, eleven have given a hold rating and sixteen have assigned a buy rating to the company. According to data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average target price of $137.52.

View Our Latest Research Report on Global Payments

Insider Buying and Selling at Global Payments

In other Global Payments news, CAO David M. Sheffield sold 1,651 shares of the firm's stock in a transaction dated Thursday, August 8th. The shares were sold at an average price of $100.73, for a total value of $166,305.23. Following the completion of the sale, the chief accounting officer now owns 20,531 shares of the company's stock, valued at $2,068,087.63. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this hyperlink. Company insiders own 0.98% of the company's stock.

Global Payments Company Profile

(

Get Free Report)

Global Payments Inc provides payment technology and software solutions for card, check, and digital-based payments in the Americas, Europe, and the Asia-Pacific. It operates through two segments, Merchant Solutions and Issuer Solutions. The Merchant Solutions segment offers authorization, settlement and funding, customer support, chargeback resolution, terminal rental, sales and deployment, payment security, and consolidated billing and reporting services.

See Also

Before you consider Global Payments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Global Payments wasn't on the list.

While Global Payments currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.