Global Payments (NYSE:GPN - Get Free Report) had its price target dropped by equities research analysts at JPMorgan Chase & Co. from $118.00 to $115.00 in a report released on Tuesday, Benzinga reports. The firm presently has a "neutral" rating on the business services provider's stock. JPMorgan Chase & Co.'s target price would suggest a potential upside of 16.10% from the stock's current price.

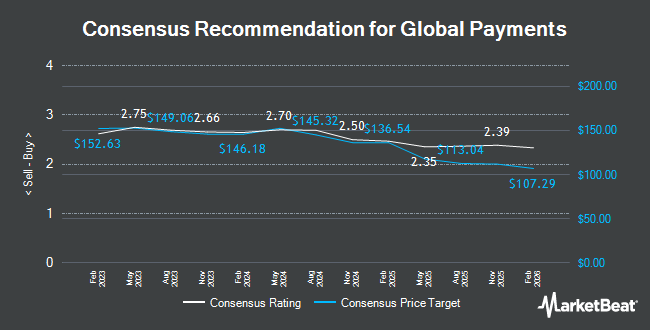

A number of other analysts also recently issued reports on the stock. Sanford C. Bernstein downgraded shares of Global Payments from an "outperform" rating to a "market perform" rating and lowered their price objective for the company from $135.00 to $112.00 in a report on Tuesday, October 22nd. KeyCorp lowered their price target on shares of Global Payments from $145.00 to $135.00 and set an "overweight" rating on the stock in a research note on Wednesday, September 25th. William Blair cut shares of Global Payments from an "outperform" rating to a "market perform" rating in a research report on Wednesday, September 25th. Barclays decreased their price objective on Global Payments from $145.00 to $120.00 and set an "overweight" rating for the company in a report on Monday, September 30th. Finally, Keefe, Bruyette & Woods dropped their target price on Global Payments from $150.00 to $140.00 and set an "outperform" rating on the stock in a report on Monday, July 8th. One equities research analyst has rated the stock with a sell rating, eleven have issued a hold rating and sixteen have given a buy rating to the stock. According to MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $137.52.

View Our Latest Stock Report on GPN

Global Payments Stock Down 2.7 %

GPN stock traded down $2.71 during mid-day trading on Tuesday, hitting $99.05. 2,264,476 shares of the company were exchanged, compared to its average volume of 2,257,984. The company has a debt-to-equity ratio of 0.68, a quick ratio of 0.92 and a current ratio of 0.92. Global Payments has a 1-year low of $91.60 and a 1-year high of $141.77. The firm's 50 day simple moving average is $104.95 and its 200 day simple moving average is $104.38. The firm has a market cap of $25.28 billion, a P/E ratio of 19.65, a P/E/G ratio of 0.74 and a beta of 0.98.

Global Payments (NYSE:GPN - Get Free Report) last issued its quarterly earnings data on Wednesday, August 7th. The business services provider reported $2.93 EPS for the quarter, topping analysts' consensus estimates of $2.90 by $0.03. The business had revenue of $2.57 billion for the quarter, compared to analyst estimates of $2.32 billion. Global Payments had a net margin of 14.26% and a return on equity of 11.93%. The firm's quarterly revenue was up 4.7% on a year-over-year basis. During the same period last year, the business posted $2.48 earnings per share. On average, sell-side analysts predict that Global Payments will post 11.06 EPS for the current fiscal year.

Insider Buying and Selling at Global Payments

In related news, CAO David M. Sheffield sold 1,651 shares of the business's stock in a transaction that occurred on Thursday, August 8th. The stock was sold at an average price of $100.73, for a total value of $166,305.23. Following the completion of the sale, the chief accounting officer now directly owns 20,531 shares in the company, valued at approximately $2,068,087.63. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is accessible through this link. Insiders own 0.98% of the company's stock.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently bought and sold shares of the stock. Cromwell Holdings LLC acquired a new position in Global Payments during the third quarter valued at approximately $25,000. New Covenant Trust Company N.A. acquired a new position in shares of Global Payments during the 1st quarter worth $31,000. LRI Investments LLC bought a new stake in shares of Global Payments during the 1st quarter worth $32,000. POM Investment Strategies LLC acquired a new stake in Global Payments in the second quarter valued at about $32,000. Finally, Whittier Trust Co. of Nevada Inc. grew its position in Global Payments by 59.6% in the third quarter. Whittier Trust Co. of Nevada Inc. now owns 383 shares of the business services provider's stock valued at $39,000 after acquiring an additional 143 shares during the last quarter. Institutional investors and hedge funds own 89.76% of the company's stock.

Global Payments Company Profile

(

Get Free Report)

Global Payments Inc provides payment technology and software solutions for card, check, and digital-based payments in the Americas, Europe, and the Asia-Pacific. It operates through two segments, Merchant Solutions and Issuer Solutions. The Merchant Solutions segment offers authorization, settlement and funding, customer support, chargeback resolution, terminal rental, sales and deployment, payment security, and consolidated billing and reporting services.

See Also

Before you consider Global Payments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Global Payments wasn't on the list.

While Global Payments currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.