Raymond James & Associates raised its stake in Global Payments Inc. (NYSE:GPN - Free Report) by 19.0% during the 3rd quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 396,658 shares of the business services provider's stock after buying an additional 63,240 shares during the quarter. Raymond James & Associates owned 0.16% of Global Payments worth $40,626,000 at the end of the most recent reporting period.

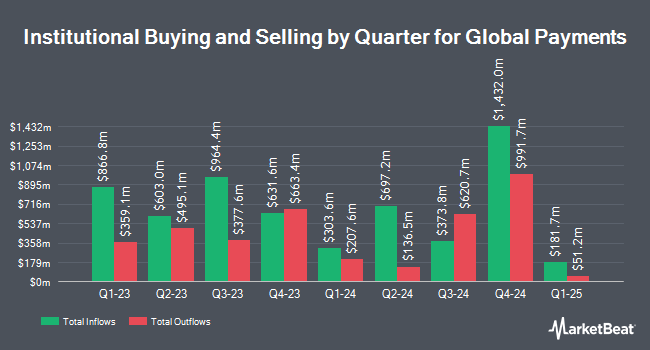

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Stanley Capital Management LLC increased its stake in shares of Global Payments by 18.9% in the second quarter. Stanley Capital Management LLC now owns 125,608 shares of the business services provider's stock worth $12,146,000 after acquiring an additional 20,000 shares during the last quarter. CANADA LIFE ASSURANCE Co lifted its holdings in shares of Global Payments by 12.3% during the 1st quarter. CANADA LIFE ASSURANCE Co now owns 267,483 shares of the business services provider's stock valued at $35,775,000 after buying an additional 29,289 shares during the last quarter. LRI Investments LLC bought a new stake in shares of Global Payments in the 1st quarter valued at approximately $32,000. State Board of Administration of Florida Retirement System increased its holdings in Global Payments by 8.8% in the first quarter. State Board of Administration of Florida Retirement System now owns 302,364 shares of the business services provider's stock worth $40,414,000 after buying an additional 24,415 shares during the last quarter. Finally, Gradient Investments LLC increased its holdings in Global Payments by 20.6% in the second quarter. Gradient Investments LLC now owns 172,939 shares of the business services provider's stock worth $16,723,000 after buying an additional 29,503 shares during the last quarter. Hedge funds and other institutional investors own 89.76% of the company's stock.

Global Payments Price Performance

GPN stock traded up $0.57 during trading on Wednesday, hitting $99.88. The company had a trading volume of 1,946,379 shares, compared to its average volume of 2,264,866. The company has a market cap of $25.49 billion, a P/E ratio of 19.71, a P/E/G ratio of 0.74 and a beta of 0.98. The company has a fifty day moving average price of $105.79 and a two-hundred day moving average price of $105.30. Global Payments Inc. has a fifty-two week low of $91.60 and a fifty-two week high of $141.77. The company has a current ratio of 0.92, a quick ratio of 0.92 and a debt-to-equity ratio of 0.68.

Global Payments (NYSE:GPN - Get Free Report) last announced its earnings results on Wednesday, August 7th. The business services provider reported $2.93 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.90 by $0.03. The business had revenue of $2.57 billion during the quarter, compared to analysts' expectations of $2.32 billion. Global Payments had a net margin of 14.26% and a return on equity of 11.93%. The firm's revenue for the quarter was up 4.7% on a year-over-year basis. During the same quarter last year, the company posted $2.48 EPS. Equities research analysts expect that Global Payments Inc. will post 11.07 earnings per share for the current fiscal year.

Global Payments Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Friday, September 27th. Shareholders of record on Friday, September 13th were paid a $0.25 dividend. This represents a $1.00 dividend on an annualized basis and a yield of 1.00%. The ex-dividend date was Friday, September 13th. Global Payments's dividend payout ratio is currently 19.84%.

Insider Transactions at Global Payments

In other Global Payments news, CAO David M. Sheffield sold 1,651 shares of the business's stock in a transaction dated Thursday, August 8th. The shares were sold at an average price of $100.73, for a total value of $166,305.23. Following the completion of the transaction, the chief accounting officer now directly owns 20,531 shares of the company's stock, valued at approximately $2,068,087.63. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Company insiders own 0.98% of the company's stock.

Analyst Upgrades and Downgrades

A number of research analysts have recently weighed in on GPN shares. Oppenheimer assumed coverage on shares of Global Payments in a report on Tuesday, October 1st. They set a "market perform" rating on the stock. Morgan Stanley reduced their price target on Global Payments from $164.00 to $156.00 and set an "overweight" rating for the company in a research report on Wednesday, September 25th. Seaport Res Ptn lowered Global Payments from a "strong-buy" rating to a "hold" rating in a report on Tuesday, September 24th. Evercore ISI reduced their target price on Global Payments from $170.00 to $160.00 and set an "outperform" rating for the company in a report on Tuesday, June 25th. Finally, B. Riley lowered their price target on Global Payments from $204.00 to $194.00 and set a "buy" rating on the stock in a report on Wednesday, September 25th. One investment analyst has rated the stock with a sell rating, eleven have assigned a hold rating and sixteen have given a buy rating to the company. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $137.65.

Read Our Latest Stock Report on Global Payments

About Global Payments

(

Free Report)

Global Payments Inc provides payment technology and software solutions for card, check, and digital-based payments in the Americas, Europe, and the Asia-Pacific. It operates through two segments, Merchant Solutions and Issuer Solutions. The Merchant Solutions segment offers authorization, settlement and funding, customer support, chargeback resolution, terminal rental, sales and deployment, payment security, and consolidated billing and reporting services.

Further Reading

Before you consider Global Payments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Global Payments wasn't on the list.

While Global Payments currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.