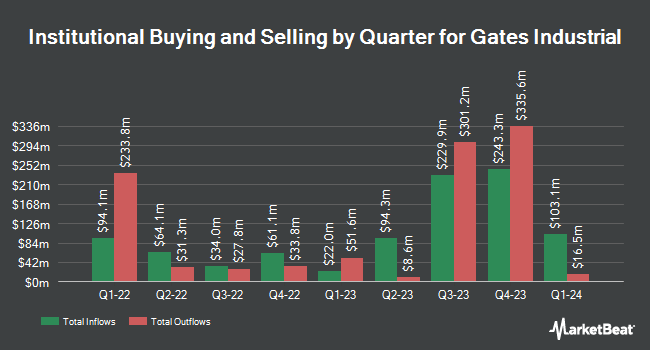

State of Alaska Department of Revenue grew its holdings in shares of Gates Industrial Corp PLC (NYSE:GTES - Free Report) by 49.9% during the third quarter, according to its most recent Form 13F filing with the SEC. The firm owned 387,868 shares of the company's stock after purchasing an additional 129,039 shares during the period. State of Alaska Department of Revenue owned approximately 0.15% of Gates Industrial worth $6,806,000 at the end of the most recent reporting period.

Other large investors also recently modified their holdings of the company. Vanguard Group Inc. boosted its stake in Gates Industrial by 17.5% during the first quarter. Vanguard Group Inc. now owns 18,008,743 shares of the company's stock valued at $318,935,000 after buying an additional 2,678,954 shares in the last quarter. Allspring Global Investments Holdings LLC boosted its stake in Gates Industrial by 2.1% during the third quarter. Allspring Global Investments Holdings LLC now owns 14,929,377 shares of the company's stock valued at $262,011,000 after buying an additional 303,353 shares in the last quarter. Dimensional Fund Advisors LP boosted its stake in Gates Industrial by 9.5% during the second quarter. Dimensional Fund Advisors LP now owns 11,921,356 shares of the company's stock valued at $188,477,000 after buying an additional 1,037,741 shares in the last quarter. LSV Asset Management boosted its stake in Gates Industrial by 19.9% during the second quarter. LSV Asset Management now owns 4,137,951 shares of the company's stock valued at $65,421,000 after buying an additional 686,080 shares in the last quarter. Finally, Fred Alger Management LLC boosted its stake in Gates Industrial by 156.8% during the second quarter. Fred Alger Management LLC now owns 2,665,632 shares of the company's stock valued at $42,144,000 after buying an additional 1,627,482 shares in the last quarter. 98.50% of the stock is owned by institutional investors and hedge funds.

Insiders Place Their Bets

In other Gates Industrial news, Director Wilson S. Neely purchased 11,952 shares of the company's stock in a transaction on Wednesday, August 21st. The shares were bought at an average cost of $16.80 per share, with a total value of $200,793.60. Following the transaction, the director now directly owns 6,000 shares in the company, valued at approximately $100,800. This represents a -200.00 % increase in their position. The purchase was disclosed in a legal filing with the SEC, which is accessible through the SEC website. Company insiders own 2.30% of the company's stock.

Wall Street Analysts Forecast Growth

Several research analysts recently weighed in on GTES shares. Robert W. Baird decreased their target price on Gates Industrial from $26.00 to $22.00 and set an "outperform" rating for the company in a research note on Thursday, August 1st. Morgan Stanley initiated coverage on Gates Industrial in a research report on Friday, September 6th. They issued an "equal weight" rating and a $19.00 price target for the company. Royal Bank of Canada upgraded Gates Industrial from a "sector perform" rating to an "outperform" rating and increased their price target for the company from $20.00 to $22.00 in a research report on Monday, August 19th. The Goldman Sachs Group raised their price objective on Gates Industrial from $18.00 to $20.00 and gave the stock a "neutral" rating in a research report on Thursday, August 1st. Finally, Evercore ISI raised their price objective on Gates Industrial from $15.00 to $16.00 and gave the stock an "in-line" rating in a research report on Monday, August 19th. Four investment analysts have rated the stock with a hold rating and six have assigned a buy rating to the stock. According to data from MarketBeat, Gates Industrial presently has an average rating of "Moderate Buy" and a consensus price target of $19.40.

View Our Latest Research Report on GTES

Gates Industrial Stock Down 1.3 %

Shares of GTES traded down $0.25 during midday trading on Tuesday, reaching $18.29. 4,880,280 shares of the stock were exchanged, compared to its average volume of 2,994,748. The firm has a 50 day simple moving average of $17.64 and a 200-day simple moving average of $17.10. The company has a quick ratio of 2.20, a current ratio of 3.11 and a debt-to-equity ratio of 0.68. Gates Industrial Corp PLC has a 12-month low of $10.73 and a 12-month high of $19.07. The company has a market cap of $4.78 billion, a price-to-earnings ratio of 20.10 and a beta of 1.40.

Gates Industrial (NYSE:GTES - Get Free Report) last issued its quarterly earnings data on Wednesday, July 31st. The company reported $0.34 earnings per share for the quarter, beating analysts' consensus estimates of $0.33 by $0.01. Gates Industrial had a return on equity of 10.27% and a net margin of 7.24%. The business had revenue of $885.50 million for the quarter, compared to the consensus estimate of $893.00 million. Research analysts forecast that Gates Industrial Corp PLC will post 1.23 EPS for the current year.

Gates Industrial announced that its board has initiated a share repurchase plan on Wednesday, July 31st that permits the company to buyback $250.00 million in outstanding shares. This buyback authorization permits the company to purchase up to 5.4% of its stock through open market purchases. Stock buyback plans are typically an indication that the company's management believes its stock is undervalued.

Gates Industrial Profile

(

Free Report)

Gates Industrial Corporation PLC designs and manufactures power transmission equipment. Its products serves harsh and hazardous industries such as agriculture, construction, manufacturing and energy, to everyday consumer applications such as printers, power washers, automatic doors and vacuum cleaners and virtually every form of transportation.

Further Reading

Before you consider Gates Industrial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gates Industrial wasn't on the list.

While Gates Industrial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.