Raymond James & Associates decreased its stake in Gates Industrial Corp PLC (NYSE:GTES - Free Report) by 21.3% in the third quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 506,228 shares of the company's stock after selling 136,909 shares during the quarter. Raymond James & Associates owned about 0.19% of Gates Industrial worth $8,884,000 at the end of the most recent reporting period.

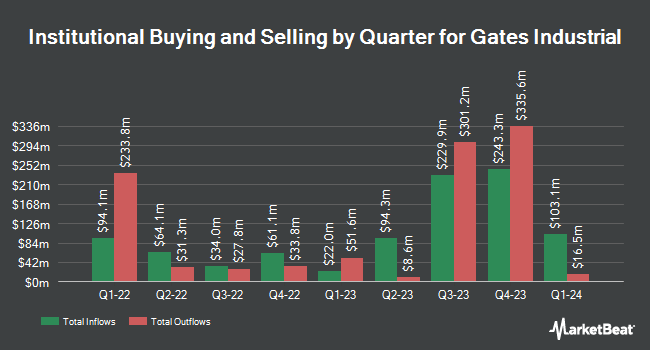

A number of other institutional investors and hedge funds have also recently modified their holdings of the stock. Bank of Montreal Can boosted its holdings in shares of Gates Industrial by 2.5% in the 2nd quarter. Bank of Montreal Can now owns 33,800 shares of the company's stock worth $535,000 after purchasing an additional 823 shares during the period. Principal Financial Group Inc. boosted its holdings in shares of Gates Industrial by 8.9% in the 2nd quarter. Principal Financial Group Inc. now owns 15,242 shares of the company's stock worth $241,000 after purchasing an additional 1,250 shares during the period. Headlands Technologies LLC boosted its holdings in shares of Gates Industrial by 341.1% in the 2nd quarter. Headlands Technologies LLC now owns 1,707 shares of the company's stock worth $27,000 after purchasing an additional 1,320 shares during the period. Zurcher Kantonalbank Zurich Cantonalbank boosted its holdings in shares of Gates Industrial by 4.8% in the 2nd quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 35,554 shares of the company's stock worth $560,000 after purchasing an additional 1,616 shares during the period. Finally, Savant Capital LLC boosted its holdings in shares of Gates Industrial by 1.6% in the 2nd quarter. Savant Capital LLC now owns 121,889 shares of the company's stock worth $1,927,000 after purchasing an additional 1,879 shares during the period. Hedge funds and other institutional investors own 98.50% of the company's stock.

Insider Activity

In related news, Director Wilson S. Neely purchased 11,952 shares of the business's stock in a transaction dated Wednesday, August 21st. The shares were acquired at an average cost of $16.80 per share, for a total transaction of $200,793.60. Following the acquisition, the director now owns 6,000 shares of the company's stock, valued at $100,800. The trade was a -200.00 % increase in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Company insiders own 2.30% of the company's stock.

Analyst Upgrades and Downgrades

GTES has been the subject of a number of recent research reports. The Goldman Sachs Group lifted their target price on Gates Industrial from $18.00 to $20.00 and gave the stock a "neutral" rating in a report on Thursday, August 1st. Evercore ISI raised their price target on Gates Industrial from $15.00 to $16.00 and gave the stock an "in-line" rating in a research note on Monday, August 19th. Robert W. Baird decreased their price target on Gates Industrial from $26.00 to $22.00 and set an "outperform" rating for the company in a research note on Thursday, August 1st. Morgan Stanley began coverage on Gates Industrial in a research note on Friday, September 6th. They set an "equal weight" rating and a $19.00 price target for the company. Finally, Royal Bank of Canada raised Gates Industrial from a "sector perform" rating to an "outperform" rating and raised their price target for the stock from $20.00 to $22.00 in a research note on Monday, August 19th. Four research analysts have rated the stock with a hold rating and six have given a buy rating to the stock. Based on data from MarketBeat, Gates Industrial has a consensus rating of "Moderate Buy" and an average target price of $19.40.

View Our Latest Report on Gates Industrial

Gates Industrial Stock Up 5.7 %

NYSE GTES traded up $1.04 on Wednesday, reaching $19.30. 6,695,955 shares of the stock traded hands, compared to its average volume of 3,012,373. The company has a debt-to-equity ratio of 0.68, a quick ratio of 2.20 and a current ratio of 3.11. The company has a fifty day moving average price of $17.64 and a 200-day moving average price of $17.10. The company has a market cap of $5.04 billion, a price-to-earnings ratio of 21.38 and a beta of 1.40. Gates Industrial Corp PLC has a 12 month low of $10.73 and a 12 month high of $20.01.

Gates Industrial (NYSE:GTES - Get Free Report) last issued its earnings results on Wednesday, July 31st. The company reported $0.34 earnings per share for the quarter, beating analysts' consensus estimates of $0.33 by $0.01. The business had revenue of $885.50 million during the quarter, compared to analyst estimates of $893.00 million. Gates Industrial had a return on equity of 10.27% and a net margin of 7.24%. As a group, research analysts forecast that Gates Industrial Corp PLC will post 1.23 EPS for the current fiscal year.

Gates Industrial declared that its Board of Directors has initiated a share buyback plan on Wednesday, July 31st that authorizes the company to repurchase $250.00 million in outstanding shares. This repurchase authorization authorizes the company to repurchase up to 5.4% of its stock through open market purchases. Stock repurchase plans are generally a sign that the company's management believes its stock is undervalued.

Gates Industrial Company Profile

(

Free Report)

Gates Industrial Corporation PLC designs and manufactures power transmission equipment. Its products serves harsh and hazardous industries such as agriculture, construction, manufacturing and energy, to everyday consumer applications such as printers, power washers, automatic doors and vacuum cleaners and virtually every form of transportation.

Further Reading

Before you consider Gates Industrial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gates Industrial wasn't on the list.

While Gates Industrial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.