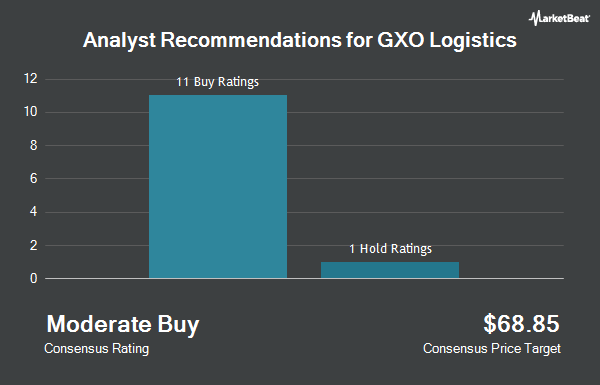

GXO Logistics, Inc. (NYSE:GXO - Get Free Report) has been assigned an average rating of "Moderate Buy" from the eleven analysts that are presently covering the company, MarketBeat reports. One investment analyst has rated the stock with a hold recommendation and ten have given a buy recommendation to the company. The average 12 month target price among brokers that have updated their coverage on the stock in the last year is $66.91.

A number of brokerages have recently commented on GXO. Susquehanna lowered their price target on GXO Logistics from $75.00 to $73.00 and set a "positive" rating on the stock in a report on Thursday, September 26th. Citigroup started coverage on shares of GXO Logistics in a research report on Wednesday, October 9th. They set a "buy" rating and a $60.00 price target on the stock. JPMorgan Chase & Co. increased their price objective on shares of GXO Logistics from $61.00 to $63.00 and gave the company an "overweight" rating in a report on Tuesday, July 9th. Finally, UBS Group dropped their target price on GXO Logistics from $71.00 to $66.00 and set a "buy" rating on the stock in a report on Wednesday, August 7th.

Get Our Latest Stock Report on GXO

GXO Logistics Stock Up 2.5 %

NYSE GXO traded up $1.52 during mid-day trading on Wednesday, reaching $61.94. 1,414,132 shares of the company's stock traded hands, compared to its average volume of 919,040. The company has a current ratio of 0.86, a quick ratio of 0.86 and a debt-to-equity ratio of 0.87. GXO Logistics has a 1-year low of $46.07 and a 1-year high of $63.33. The company has a fifty day simple moving average of $53.56 and a 200-day simple moving average of $51.57. The company has a market cap of $7.40 billion, a price-to-earnings ratio of 52.94, a P/E/G ratio of 1.81 and a beta of 1.59.

GXO Logistics (NYSE:GXO - Get Free Report) last issued its quarterly earnings data on Tuesday, August 6th. The company reported $0.55 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.57 by ($0.02). GXO Logistics had a return on equity of 9.86% and a net margin of 1.35%. The business had revenue of $2.85 billion for the quarter, compared to analyst estimates of $2.73 billion. During the same quarter in the prior year, the firm posted $0.70 earnings per share. The business's quarterly revenue was up 18.9% on a year-over-year basis. As a group, equities research analysts expect that GXO Logistics will post 2.78 EPS for the current year.

Institutional Investors Weigh In On GXO Logistics

Institutional investors and hedge funds have recently modified their holdings of the stock. Vanguard Group Inc. raised its position in shares of GXO Logistics by 0.7% during the first quarter. Vanguard Group Inc. now owns 11,228,350 shares of the company's stock worth $603,636,000 after purchasing an additional 82,485 shares during the period. American Century Companies Inc. raised its holdings in GXO Logistics by 25.2% during the 2nd quarter. American Century Companies Inc. now owns 3,221,818 shares of the company's stock worth $162,702,000 after buying an additional 648,547 shares during the period. Clearbridge Investments LLC lifted its stake in GXO Logistics by 0.5% during the first quarter. Clearbridge Investments LLC now owns 2,956,981 shares of the company's stock valued at $158,967,000 after buying an additional 15,463 shares in the last quarter. Fort Pitt Capital Group LLC boosted its holdings in shares of GXO Logistics by 2.1% in the third quarter. Fort Pitt Capital Group LLC now owns 2,467,814 shares of the company's stock worth $128,499,000 after buying an additional 51,208 shares during the period. Finally, Dimensional Fund Advisors LP increased its position in shares of GXO Logistics by 11.2% in the second quarter. Dimensional Fund Advisors LP now owns 2,398,933 shares of the company's stock worth $121,140,000 after acquiring an additional 240,766 shares in the last quarter. Institutional investors and hedge funds own 90.67% of the company's stock.

GXO Logistics Company Profile

(

Get Free ReportGXO Logistics, Inc, together with its subsidiaries, provides logistics services worldwide. The company provides warehousing and distribution, order fulfilment, e-commerce, reverse logistics, and other supply chain services. As of December 31, 2023, it operated in approximately 974 facilities. The company serves various customers in the e-commerce, omnichannel retail, technology and consumer electronics, food and beverage, industrial and manufacturing, consumer packaged goods, and others.

Featured Articles

Before you consider GXO Logistics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GXO Logistics wasn't on the list.

While GXO Logistics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.