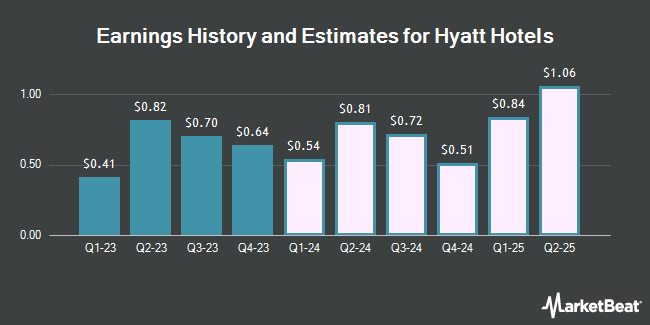

Hyatt Hotels Co. (NYSE:H - Free Report) - Zacks Research upped their FY2026 earnings estimates for Hyatt Hotels in a note issued to investors on Monday, October 28th. Zacks Research analyst M. Kaushik now anticipates that the company will post earnings of $4.85 per share for the year, up from their prior forecast of $4.83. The consensus estimate for Hyatt Hotels' current full-year earnings is $3.87 per share.

Hyatt Hotels (NYSE:H - Get Free Report) last released its quarterly earnings results on Tuesday, August 6th. The company reported $1.53 EPS for the quarter, beating analysts' consensus estimates of $0.95 by $0.58. Hyatt Hotels had a net margin of 14.55% and a return on equity of 10.25%. The firm had revenue of $1.70 billion for the quarter, compared to analyst estimates of $1.76 billion. During the same period in the previous year, the business earned $0.82 earnings per share.

H has been the topic of several other research reports. Barclays upped their price target on Hyatt Hotels from $146.00 to $151.00 and gave the company an "equal weight" rating in a research note on Wednesday, September 4th. Cfra set a $155.00 price objective on shares of Hyatt Hotels in a report on Thursday, October 17th. Wells Fargo & Company lifted their target price on shares of Hyatt Hotels from $167.00 to $178.00 and gave the stock an "overweight" rating in a report on Tuesday, October 22nd. Bank of America raised their price target on Hyatt Hotels from $165.00 to $175.00 and gave the stock a "buy" rating in a research report on Monday, October 21st. Finally, Deutsche Bank Aktiengesellschaft cut their target price on Hyatt Hotels from $127.00 to $120.00 and set a "hold" rating on the stock in a research note on Wednesday, August 7th. One equities research analyst has rated the stock with a sell rating, twelve have issued a hold rating and seven have assigned a buy rating to the stock. According to MarketBeat.com, Hyatt Hotels presently has a consensus rating of "Hold" and an average target price of $152.25.

Read Our Latest Report on Hyatt Hotels

Hyatt Hotels Price Performance

NYSE H traded up $0.61 on Wednesday, hitting $157.16. 867,303 shares of the company were exchanged, compared to its average volume of 584,229. The company has a current ratio of 0.82, a quick ratio of 0.82 and a debt-to-equity ratio of 0.70. The company has a market cap of $15.77 billion, a P/E ratio of 16.95 and a beta of 1.50. Hyatt Hotels has a 1-year low of $96.77 and a 1-year high of $162.24. The firm has a 50 day moving average of $151.00 and a two-hundred day moving average of $149.00.

Hyatt Hotels Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Tuesday, September 10th. Shareholders of record on Tuesday, August 27th were given a dividend of $0.15 per share. The ex-dividend date of this dividend was Tuesday, August 27th. This represents a $0.60 dividend on an annualized basis and a yield of 0.38%. Hyatt Hotels's dividend payout ratio (DPR) is 6.47%.

Insider Buying and Selling at Hyatt Hotels

In other Hyatt Hotels news, insider Mark Samuel Hoplamazian sold 51,388 shares of the firm's stock in a transaction that occurred on Thursday, August 29th. The shares were sold at an average price of $149.77, for a total transaction of $7,696,380.76. Following the completion of the sale, the insider now directly owns 623,556 shares in the company, valued at $93,389,982.12. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this hyperlink. Corporate insiders own 23.50% of the company's stock.

Institutional Investors Weigh In On Hyatt Hotels

Hedge funds have recently modified their holdings of the company. State of Michigan Retirement System increased its position in Hyatt Hotels by 2.8% in the 1st quarter. State of Michigan Retirement System now owns 10,900 shares of the company's stock valued at $1,740,000 after acquiring an additional 300 shares during the period. Retirement Systems of Alabama raised its position in Hyatt Hotels by 0.3% during the 1st quarter. Retirement Systems of Alabama now owns 55,530 shares of the company's stock worth $8,864,000 after purchasing an additional 146 shares during the last quarter. BNP Paribas Financial Markets lifted its holdings in Hyatt Hotels by 165.7% during the 1st quarter. BNP Paribas Financial Markets now owns 53,887 shares of the company's stock worth $8,601,000 after buying an additional 33,603 shares during the period. Hunter Associates Investment Management LLC grew its position in shares of Hyatt Hotels by 16.5% in the 1st quarter. Hunter Associates Investment Management LLC now owns 16,555 shares of the company's stock valued at $2,644,000 after buying an additional 2,343 shares during the last quarter. Finally, Fidelis Capital Partners LLC acquired a new stake in shares of Hyatt Hotels in the first quarter valued at about $85,000. Institutional investors and hedge funds own 71.02% of the company's stock.

About Hyatt Hotels

(

Get Free Report)

Hyatt Hotels Corporation operates as a hospitality company in the United States and internationally. It operates through Owned and Leased Hotels, Americas Management and Franchising, ASPAC Management and Franchising, EAME Management and Franchising, and Apple Leisure Group segments. The company manages, franchises, licenses, owns, and leases portfolio of properties, consisting of full-service hotels and resorts, select service hotels, and other properties, including timeshare, fractional, residential, vacation, and condominium units.

Further Reading

Before you consider Hyatt Hotels, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hyatt Hotels wasn't on the list.

While Hyatt Hotels currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.