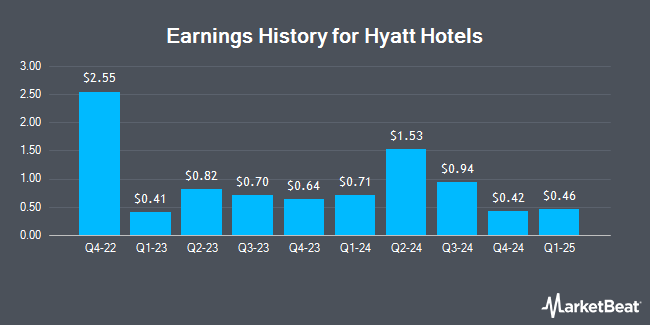

Hyatt Hotels (NYSE:H - Get Free Report) issued its earnings results on Thursday. The company reported $0.94 earnings per share for the quarter, beating analysts' consensus estimates of $0.90 by $0.04, Briefing.com reports. The firm had revenue of $1.63 billion for the quarter, compared to the consensus estimate of $1.64 billion. Hyatt Hotels had a return on equity of 10.75% and a net margin of 20.55%. During the same quarter last year, the business posted $0.70 EPS.

Hyatt Hotels Stock Down 0.3 %

H stock traded down $0.41 during mid-day trading on Friday, reaching $145.04. 645,290 shares of the company traded hands, compared to its average volume of 462,781. The stock has a market cap of $14.55 billion, a price-to-earnings ratio of 10.93 and a beta of 1.50. The company has a quick ratio of 0.82, a current ratio of 0.82 and a debt-to-equity ratio of 0.70. Hyatt Hotels has a fifty-two week low of $96.77 and a fifty-two week high of $162.24. The firm's 50 day moving average price is $150.93 and its 200 day moving average price is $148.93.

Hyatt Hotels Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, December 6th. Shareholders of record on Friday, November 22nd will be paid a dividend of $0.15 per share. The ex-dividend date of this dividend is Friday, November 22nd. This represents a $0.60 dividend on an annualized basis and a yield of 0.41%. Hyatt Hotels's dividend payout ratio (DPR) is currently 4.52%.

Insider Buying and Selling at Hyatt Hotels

In other Hyatt Hotels news, insider Mark Samuel Hoplamazian sold 51,388 shares of Hyatt Hotels stock in a transaction dated Thursday, August 29th. The stock was sold at an average price of $149.77, for a total transaction of $7,696,380.76. Following the completion of the transaction, the insider now owns 623,556 shares in the company, valued at approximately $93,389,982.12. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Company insiders own 23.50% of the company's stock.

Analyst Upgrades and Downgrades

H has been the subject of a number of research reports. Barclays dropped their price target on Hyatt Hotels from $151.00 to $144.00 and set an "equal weight" rating for the company in a research note on Friday. Macquarie dropped their price target on Hyatt Hotels from $165.00 to $164.00 and set an "outperform" rating for the company in a research note on Friday. Sanford C. Bernstein dropped their price target on Hyatt Hotels from $185.00 to $178.00 and set an "outperform" rating for the company in a research note on Thursday, August 29th. Morgan Stanley dropped their price target on Hyatt Hotels from $161.00 to $153.00 and set an "equal weight" rating for the company in a research note on Wednesday, August 7th. Finally, Evercore ISI increased their price target on Hyatt Hotels from $145.00 to $155.00 and gave the company an "in-line" rating in a research note on Monday, October 21st. One research analyst has rated the stock with a sell rating, fourteen have assigned a hold rating and seven have assigned a buy rating to the company's stock. According to MarketBeat, the company currently has an average rating of "Hold" and an average target price of $151.62.

Read Our Latest Analysis on H

Hyatt Hotels Company Profile

(

Get Free Report)

Hyatt Hotels Corporation operates as a hospitality company in the United States and internationally. It operates through Owned and Leased Hotels, Americas Management and Franchising, ASPAC Management and Franchising, EAME Management and Franchising, and Apple Leisure Group segments. The company manages, franchises, licenses, owns, and leases portfolio of properties, consisting of full-service hotels and resorts, select service hotels, and other properties, including timeshare, fractional, residential, vacation, and condominium units.

Further Reading

Before you consider Hyatt Hotels, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hyatt Hotels wasn't on the list.

While Hyatt Hotels currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.