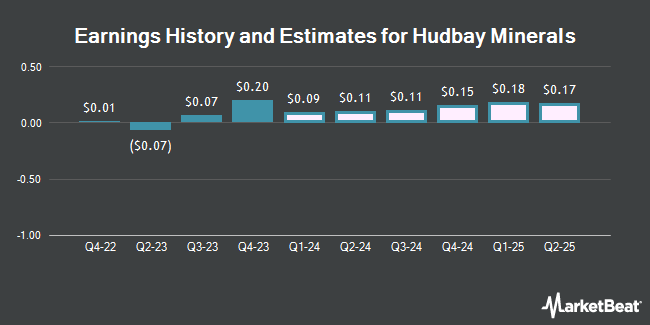

Hudbay Minerals Inc. (NYSE:HBM - Free Report) TSE: HBM - Haywood Securities reduced their Q4 2024 earnings per share estimates for shares of Hudbay Minerals in a report released on Monday, October 21st. Haywood Securities analyst P. Vaillancourt now anticipates that the mining company will earn $0.23 per share for the quarter, down from their previous estimate of $0.26. The consensus estimate for Hudbay Minerals' current full-year earnings is $0.49 per share.

HBM has been the subject of several other reports. StockNews.com cut Hudbay Minerals from a "buy" rating to a "hold" rating in a research note on Tuesday, August 13th. Jefferies Financial Group upgraded Hudbay Minerals from a "hold" rating to a "buy" rating in a research note on Wednesday, August 14th. Finally, Stifel Canada upgraded Hudbay Minerals to a "strong-buy" rating in a research note on Monday, July 22nd. One research analyst has rated the stock with a hold rating, four have assigned a buy rating and two have assigned a strong buy rating to the stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Buy" and a consensus price target of $11.17.

Check Out Our Latest Analysis on Hudbay Minerals

Hudbay Minerals Stock Up 2.1 %

Shares of Hudbay Minerals stock traded up $0.20 on Thursday, hitting $9.53. 3,991,956 shares of the company's stock traded hands, compared to its average volume of 3,113,162. The stock has a market cap of $3.75 billion, a P/E ratio of 41.04 and a beta of 1.77. The company has a quick ratio of 1.49, a current ratio of 1.86 and a debt-to-equity ratio of 0.47. The firm's 50-day moving average is $8.35 and its 200 day moving average is $8.53. Hudbay Minerals has a 52-week low of $3.94 and a 52-week high of $10.49.

Hudbay Minerals Cuts Dividend

The company also recently disclosed a Semi-Annual dividend, which was paid on Friday, September 20th. Investors of record on Tuesday, September 3rd were paid a dividend of $0.007 per share. This represents a yield of 0.2%. The ex-dividend date was Tuesday, September 3rd. Hudbay Minerals's dividend payout ratio (DPR) is presently 4.35%.

Hedge Funds Weigh In On Hudbay Minerals

Large investors have recently added to or reduced their stakes in the company. Register Financial Advisors LLC bought a new position in Hudbay Minerals during the first quarter worth $35,000. Exchange Traded Concepts LLC bought a new stake in Hudbay Minerals in the third quarter valued at $53,000. Banque Cantonale Vaudoise lifted its stake in Hudbay Minerals by 38.7% in the first quarter. Banque Cantonale Vaudoise now owns 6,471 shares of the mining company's stock valued at $45,000 after buying an additional 1,806 shares during the last quarter. Clear Harbor Asset Management LLC bought a new stake in Hudbay Minerals in the third quarter valued at $92,000. Finally, Ritholtz Wealth Management bought a new stake in Hudbay Minerals in the second quarter valued at $96,000. 57.82% of the stock is currently owned by institutional investors.

Hudbay Minerals Company Profile

(

Get Free Report)

Hudbay Minerals Inc, a diversified mining company, focuses on the exploration, development, operation, and optimization of properties in North and South America. It produces copper concentrates containing gold, silver, and molybdenum; gold concentrates containing zinc; zinc concentrates; molybdenum concentrates; and silver/gold doré.

Featured Articles

Before you consider Hudbay Minerals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hudbay Minerals wasn't on the list.

While Hudbay Minerals currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.