International Assets Investment Management LLC boosted its position in The Hartford Financial Services Group, Inc. (NYSE:HIG - Free Report) by 31,680.4% in the third quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 694,084 shares of the insurance provider's stock after purchasing an additional 691,900 shares during the quarter. International Assets Investment Management LLC owned approximately 0.23% of The Hartford Financial Services Group worth $816,310,000 at the end of the most recent reporting period.

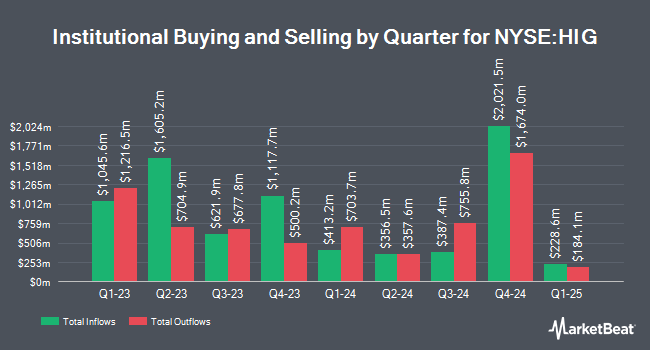

A number of other institutional investors have also modified their holdings of HIG. DGS Capital Management LLC purchased a new stake in shares of The Hartford Financial Services Group during the first quarter valued at $417,000. Wealthcare Advisory Partners LLC acquired a new stake in The Hartford Financial Services Group during the 1st quarter worth about $274,000. AMF Tjanstepension AB raised its stake in shares of The Hartford Financial Services Group by 2.2% during the 1st quarter. AMF Tjanstepension AB now owns 81,070 shares of the insurance provider's stock valued at $8,354,000 after buying an additional 1,770 shares during the last quarter. Kathmere Capital Management LLC lifted its holdings in shares of The Hartford Financial Services Group by 15.6% in the 1st quarter. Kathmere Capital Management LLC now owns 6,277 shares of the insurance provider's stock valued at $647,000 after buying an additional 849 shares during the period. Finally, Winthrop Advisory Group LLC purchased a new stake in shares of The Hartford Financial Services Group in the first quarter worth about $220,000. 93.42% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

A number of research analysts have issued reports on the company. Piper Sandler boosted their price target on The Hartford Financial Services Group from $112.00 to $125.00 and gave the company an "overweight" rating in a report on Monday, July 29th. Morgan Stanley dropped their price target on shares of The Hartford Financial Services Group from $109.00 to $107.00 and set an "equal weight" rating on the stock in a research report on Wednesday, July 10th. Barclays started coverage on shares of The Hartford Financial Services Group in a research report on Wednesday, September 4th. They issued an "equal weight" rating and a $130.00 price objective for the company. Keefe, Bruyette & Woods lifted their price target on The Hartford Financial Services Group from $120.00 to $133.00 and gave the company an "outperform" rating in a research note on Thursday, August 1st. Finally, UBS Group increased their price target on The Hartford Financial Services Group from $134.00 to $135.00 and gave the stock a "buy" rating in a research report on Tuesday, October 15th. Ten investment analysts have rated the stock with a hold rating, seven have given a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat, the company has an average rating of "Moderate Buy" and a consensus price target of $120.59.

Check Out Our Latest Report on The Hartford Financial Services Group

The Hartford Financial Services Group Price Performance

HIG traded up $0.62 on Thursday, reaching $120.47. 1,474,451 shares of the company's stock were exchanged, compared to its average volume of 1,594,171. The stock has a market cap of $35.63 billion, a PE ratio of 13.69, a P/E/G ratio of 0.96 and a beta of 0.93. The company has a debt-to-equity ratio of 0.28, a current ratio of 0.32 and a quick ratio of 0.32. The Hartford Financial Services Group, Inc. has a twelve month low of $68.92 and a twelve month high of $123.23. The stock's fifty day moving average price is $116.06 and its 200-day moving average price is $106.71.

The Hartford Financial Services Group (NYSE:HIG - Get Free Report) last posted its quarterly earnings results on Thursday, July 25th. The insurance provider reported $2.50 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.24 by $0.26. The Hartford Financial Services Group had a return on equity of 21.20% and a net margin of 11.44%. The business had revenue of $6.49 billion during the quarter, compared to analyst estimates of $6.02 billion. During the same period in the prior year, the business earned $1.88 earnings per share. The business's revenue was up 7.2% compared to the same quarter last year. Sell-side analysts expect that The Hartford Financial Services Group, Inc. will post 10.09 EPS for the current year.

The Hartford Financial Services Group declared that its board has approved a stock repurchase program on Thursday, July 25th that authorizes the company to buyback $3.30 billion in outstanding shares. This buyback authorization authorizes the insurance provider to buy up to 10.9% of its stock through open market purchases. Stock buyback programs are often an indication that the company's leadership believes its shares are undervalued.

About The Hartford Financial Services Group

(

Free Report)

The Hartford Financial Services Group, Inc, together with its subsidiaries, provides insurance and financial services to individual and business customers in the United States, the United Kingdom, and internationally. Its Commercial Lines segment offers insurance coverages, including workers' compensation, property, automobile, general and professional liability, package business, umbrella, fidelity and surety, marine, livestock, accident, health, and reinsurance through regional offices, branches, sales and policyholder service centers, independent retail agents and brokers, wholesale agents, and reinsurance brokers.

See Also

Before you consider The Hartford Financial Services Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Hartford Financial Services Group wasn't on the list.

While The Hartford Financial Services Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.