Old North State Wealth Management LLC boosted its stake in Huntington Ingalls Industries, Inc. (NYSE:HII - Free Report) by 60.6% in the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 11,790 shares of the aerospace company's stock after acquiring an additional 4,450 shares during the quarter. Huntington Ingalls Industries comprises about 1.7% of Old North State Wealth Management LLC's holdings, making the stock its 21st largest holding. Old North State Wealth Management LLC's holdings in Huntington Ingalls Industries were worth $3,122,000 at the end of the most recent reporting period.

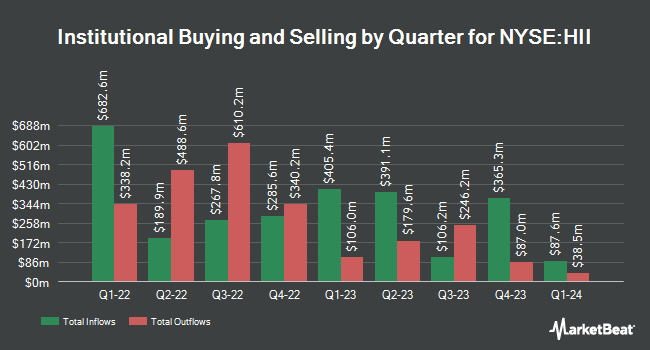

Other large investors also recently bought and sold shares of the company. CWM LLC grew its position in shares of Huntington Ingalls Industries by 142.8% during the third quarter. CWM LLC now owns 5,251 shares of the aerospace company's stock worth $1,388,000 after buying an additional 3,088 shares in the last quarter. SteelPeak Wealth LLC bought a new stake in shares of Huntington Ingalls Industries in the 2nd quarter worth about $1,769,000. SG Americas Securities LLC increased its position in shares of Huntington Ingalls Industries by 950.1% in the 1st quarter. SG Americas Securities LLC now owns 38,454 shares of the aerospace company's stock worth $11,208,000 after purchasing an additional 34,792 shares during the last quarter. Mitsubishi UFJ Asset Management Co. Ltd. raised its stake in shares of Huntington Ingalls Industries by 30.5% in the 1st quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 49,805 shares of the aerospace company's stock valued at $14,517,000 after purchasing an additional 11,647 shares in the last quarter. Finally, Virtu Financial LLC bought a new position in shares of Huntington Ingalls Industries during the first quarter worth about $1,821,000. Institutional investors and hedge funds own 90.46% of the company's stock.

Huntington Ingalls Industries Price Performance

Shares of NYSE:HII traded up $1.81 during trading on Monday, reaching $191.04. The company had a trading volume of 849,569 shares, compared to its average volume of 324,798. Huntington Ingalls Industries, Inc. has a twelve month low of $184.29 and a twelve month high of $299.50. The company has a debt-to-equity ratio of 0.41, a quick ratio of 0.76 and a current ratio of 0.79. The firm has a market capitalization of $7.49 billion, a PE ratio of 10.79, a price-to-earnings-growth ratio of 1.62 and a beta of 0.56. The firm's fifty day moving average is $260.62 and its 200 day moving average is $258.77.

Huntington Ingalls Industries (NYSE:HII - Get Free Report) last released its earnings results on Thursday, October 31st. The aerospace company reported $2.56 earnings per share for the quarter, missing analysts' consensus estimates of $3.84 by ($1.28). Huntington Ingalls Industries had a return on equity of 16.89% and a net margin of 5.99%. The firm had revenue of $2.75 billion during the quarter, compared to analyst estimates of $2.87 billion. During the same quarter last year, the company earned $3.70 earnings per share. The business's revenue for the quarter was down 2.4% on a year-over-year basis. On average, equities analysts forecast that Huntington Ingalls Industries, Inc. will post 16.49 EPS for the current year.

Huntington Ingalls Industries Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, December 13th. Investors of record on Friday, November 29th will be issued a dividend of $1.35 per share. This is a positive change from Huntington Ingalls Industries's previous quarterly dividend of $1.30. This represents a $5.40 dividend on an annualized basis and a yield of 2.83%. The ex-dividend date of this dividend is Friday, November 29th. Huntington Ingalls Industries's payout ratio is presently 29.36%.

Analyst Upgrades and Downgrades

Several analysts have issued reports on the company. TD Cowen cut Huntington Ingalls Industries from a "buy" rating to a "hold" rating and set a $180.00 price objective on the stock. in a research note on Friday. StockNews.com lowered Huntington Ingalls Industries from a "buy" rating to a "hold" rating in a research report on Friday. Deutsche Bank Aktiengesellschaft reduced their price objective on Huntington Ingalls Industries from $273.00 to $191.00 and set a "hold" rating on the stock in a research note on Friday. Alembic Global Advisors lowered shares of Huntington Ingalls Industries from an "overweight" rating to a "neutral" rating and set a $210.00 price target for the company. in a report on Friday. Finally, Vertical Research downgraded Huntington Ingalls Industries from a "buy" rating to a "hold" rating and set a $275.00 price target on the stock. in a report on Thursday, October 10th. One investment analyst has rated the stock with a sell rating, eight have given a hold rating and one has issued a buy rating to the stock. According to MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average target price of $233.13.

Read Our Latest Stock Report on HII

About Huntington Ingalls Industries

(

Free Report)

Huntington Ingalls Industries, Inc designs, builds, overhauls, and repairs military ships in the United States. It operates through three segments: Ingalls, Newport News, and Mission Technologies. The company is involved in the design and construction of non-nuclear ships comprising amphibious assault ships; expeditionary warfare ships; surface combatants; and national security cutters for the U.S.

Read More

Before you consider Huntington Ingalls Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Huntington Ingalls Industries wasn't on the list.

While Huntington Ingalls Industries currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.