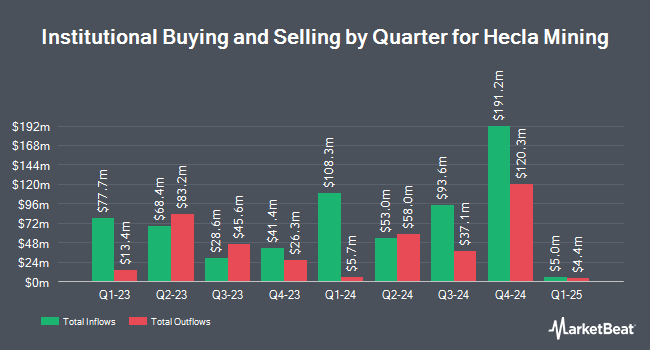

Integrated Advisors Network LLC bought a new stake in shares of Hecla Mining (NYSE:HL - Free Report) in the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm bought 130,600 shares of the basic materials company's stock, valued at approximately $871,000.

Other large investors have also bought and sold shares of the company. Tidal Investments LLC acquired a new position in shares of Hecla Mining in the 1st quarter valued at $42,576,000. Encompass Capital Advisors LLC acquired a new stake in Hecla Mining during the 2nd quarter worth about $19,714,000. Vanguard Group Inc. boosted its position in Hecla Mining by 2.6% during the 1st quarter. Vanguard Group Inc. now owns 59,420,114 shares of the basic materials company's stock worth $285,811,000 after acquiring an additional 1,506,573 shares during the period. Marshall Wace LLP acquired a new stake in Hecla Mining during the 2nd quarter worth about $6,280,000. Finally, Ninety One UK Ltd boosted its position in Hecla Mining by 17.0% during the 2nd quarter. Ninety One UK Ltd now owns 8,219,231 shares of the basic materials company's stock worth $39,863,000 after acquiring an additional 1,196,515 shares during the period. Institutional investors own 63.01% of the company's stock.

Wall Street Analysts Forecast Growth

A number of equities research analysts have commented on the company. Roth Mkm decreased their price objective on Hecla Mining from $6.25 to $6.00 and set a "buy" rating for the company in a research report on Thursday, August 8th. HC Wainwright reaffirmed a "buy" rating and set a $10.25 price target on shares of Hecla Mining in a research note on Thursday, August 8th. Finally, StockNews.com downgraded Hecla Mining from a "hold" rating to a "sell" rating in a research note on Thursday, October 17th. One research analyst has rated the stock with a sell rating, two have assigned a hold rating, three have assigned a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average target price of $7.56.

View Our Latest Research Report on HL

Hecla Mining Stock Down 4.1 %

Shares of HL traded down $0.28 during midday trading on Thursday, reaching $6.49. 13,191,952 shares of the stock were exchanged, compared to its average volume of 8,926,140. Hecla Mining has a 12-month low of $3.33 and a 12-month high of $7.68. The firm has a 50 day simple moving average of $6.51 and a 200-day simple moving average of $5.79. The company has a quick ratio of 0.58, a current ratio of 1.29 and a debt-to-equity ratio of 0.29. The company has a market cap of $4.09 billion, a price-to-earnings ratio of -81.13 and a beta of 2.01.

Hecla Mining (NYSE:HL - Get Free Report) last issued its quarterly earnings data on Tuesday, August 6th. The basic materials company reported $0.02 earnings per share for the quarter, beating analysts' consensus estimates of $0.01 by $0.01. Hecla Mining had a negative return on equity of 0.42% and a negative net margin of 5.56%. The business had revenue of $245.66 million for the quarter, compared to the consensus estimate of $208.80 million. During the same period last year, the business earned $0.03 EPS. Research analysts forecast that Hecla Mining will post 0.07 EPS for the current year.

Hecla Mining Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Thursday, September 5th. Investors of record on Monday, August 26th were paid a $0.0138 dividend. This represents a $0.06 dividend on an annualized basis and a dividend yield of 0.85%. This is an increase from Hecla Mining's previous quarterly dividend of $0.00. The ex-dividend date was Monday, August 26th. Hecla Mining's dividend payout ratio (DPR) is presently -62.50%.

Insider Activity at Hecla Mining

In related news, VP Kurt Allen sold 108,612 shares of the firm's stock in a transaction that occurred on Tuesday, September 17th. The stock was sold at an average price of $6.77, for a total value of $735,303.24. Following the transaction, the vice president now directly owns 173,700 shares of the company's stock, valued at approximately $1,175,949. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this link. 1.40% of the stock is owned by company insiders.

Hecla Mining Company Profile

(

Free Report)

Hecla Mining Company, together with its subsidiaries, provides precious and base metal properties in the United States, Canada, Japan, Korea, and China. The company mines for silver, gold, lead, and zinc concentrates, as well as carbon material containing silver and gold for custom smelters, metal traders, and third-party processors; and doré containing silver and gold.

Featured Stories

Before you consider Hecla Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hecla Mining wasn't on the list.

While Hecla Mining currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.