Herbalife Ltd. (NYSE:HLF - Free Report) - Equities researchers at B. Riley dropped their FY2025 EPS estimates for Herbalife in a note issued to investors on Thursday, October 31st. B. Riley analyst J. Van. Sinderen now expects that the company will post earnings of $1.83 per share for the year, down from their prior forecast of $1.93. B. Riley has a "Buy" rating and a $12.00 price objective on the stock. The consensus estimate for Herbalife's current full-year earnings is $1.34 per share.

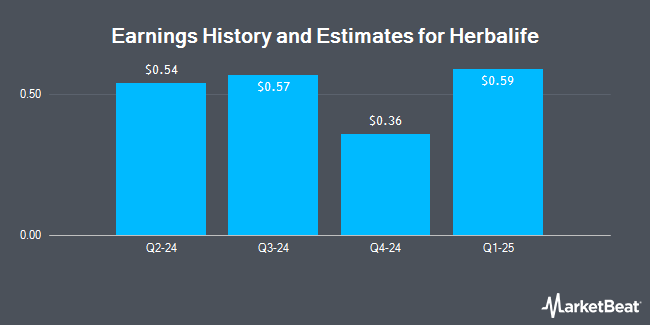

Herbalife (NYSE:HLF - Get Free Report) last released its earnings results on Wednesday, October 30th. The company reported $0.57 earnings per share for the quarter, topping the consensus estimate of $0.19 by $0.38. Herbalife had a net margin of 1.73% and a negative return on equity of 18.25%. The company had revenue of $1.24 billion during the quarter, compared to the consensus estimate of $1.23 billion.

HLF has been the subject of a number of other reports. Citigroup reduced their price objective on shares of Herbalife from $16.00 to $13.00 and set a "buy" rating for the company in a research report on Friday, October 25th. Mizuho raised their target price on Herbalife from $8.00 to $9.00 and gave the stock a "neutral" rating in a research report on Friday. DA Davidson decreased their price target on shares of Herbalife from $13.00 to $7.50 and set a "neutral" rating for the company in a report on Thursday. Finally, StockNews.com downgraded shares of Herbalife from a "buy" rating to a "hold" rating in a research note on Tuesday, October 22nd. One equities research analyst has rated the stock with a sell rating, four have given a hold rating and two have assigned a buy rating to the company. According to MarketBeat, Herbalife currently has an average rating of "Hold" and a consensus target price of $10.42.

Get Our Latest Report on HLF

Herbalife Stock Performance

Shares of Herbalife stock traded up $0.31 during trading on Friday, hitting $7.86. 5,074,810 shares of the stock were exchanged, compared to its average volume of 2,116,499. The stock's fifty day moving average is $7.33 and its 200 day moving average is $9.29. Herbalife has a 12 month low of $6.59 and a 12 month high of $15.66. The stock has a market cap of $791.66 million, a PE ratio of 9.18, a P/E/G ratio of 0.26 and a beta of 1.19.

Institutional Trading of Herbalife

Hedge funds and other institutional investors have recently modified their holdings of the stock. Mirae Asset Global Investments Co. Ltd. lifted its stake in Herbalife by 13.1% in the first quarter. Mirae Asset Global Investments Co. Ltd. now owns 57,182 shares of the company's stock valued at $575,000 after buying an additional 6,607 shares during the period. BNP Paribas Financial Markets increased its stake in Herbalife by 24.5% in the 1st quarter. BNP Paribas Financial Markets now owns 100,790 shares of the company's stock valued at $1,013,000 after buying an additional 19,862 shares during the last quarter. Capstone Investment Advisors LLC bought a new stake in Herbalife during the 1st quarter worth about $1,397,000. Hollencrest Capital Management boosted its position in Herbalife by 21.3% during the first quarter. Hollencrest Capital Management now owns 17,100 shares of the company's stock valued at $172,000 after purchasing an additional 3,000 shares during the last quarter. Finally, Sei Investments Co. boosted its holdings in shares of Herbalife by 2.8% in the 1st quarter. Sei Investments Co. now owns 278,932 shares of the company's stock valued at $2,803,000 after buying an additional 7,635 shares during the last quarter.

Insider Activity at Herbalife

In other news, Director Juan Miguel Mendoza bought 10,000 shares of the company's stock in a transaction that occurred on Monday, September 9th. The stock was acquired at an average price of $7.11 per share, for a total transaction of $71,100.00. Following the transaction, the director now directly owns 120,000 shares of the company's stock, valued at $853,200. This trade represents a 0.00 % increase in their position. The transaction was disclosed in a filing with the SEC, which is available through this link. 0.94% of the stock is currently owned by corporate insiders.

Herbalife Company Profile

(

Get Free Report)

Herbalife Ltd. provides health and wellness products in North America, Mexico, South and Central America, Europe, the Middle East, Africa, China, and the Asia Pacific. It offers products in the areas of weight management; targeted nutrition; energy, sports, and fitness; outer nutrition; and literature and promotional items.

Featured Stories

Before you consider Herbalife, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Herbalife wasn't on the list.

While Herbalife currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.