Healthcare Realty Trust (NYSE:HR - Get Free Report) issued an update on its FY24 earnings guidance on Wednesday morning. The company provided earnings per share (EPS) guidance of $1.55-1.56 for the period, compared to the consensus estimate of $1.55.

Analyst Ratings Changes

A number of analysts have recently weighed in on HR shares. Scotiabank upped their price target on shares of Healthcare Realty Trust from $17.00 to $18.00 and gave the stock a "sector perform" rating in a report on Wednesday, August 7th. Wells Fargo & Company reissued an "underweight" rating and set a $17.00 price target (up previously from $16.00) on shares of Healthcare Realty Trust in a report on Tuesday, October 1st. Finally, Wedbush raised their price objective on Healthcare Realty Trust from $15.00 to $18.00 and gave the company a "neutral" rating in a research note on Monday, August 5th. One investment analyst has rated the stock with a sell rating, four have given a hold rating and one has issued a buy rating to the company. According to data from MarketBeat, Healthcare Realty Trust currently has a consensus rating of "Hold" and a consensus target price of $17.17.

Get Our Latest Analysis on HR

Healthcare Realty Trust Stock Performance

Shares of HR traded down $0.51 during trading hours on Wednesday, reaching $17.63. The stock had a trading volume of 5,088,076 shares, compared to its average volume of 3,453,706. Healthcare Realty Trust has a 12 month low of $12.77 and a 12 month high of $18.90. The stock has a market capitalization of $6.67 billion, a PE ratio of -13.64 and a beta of 0.91. The company's 50-day moving average is $17.89 and its two-hundred day moving average is $16.88.

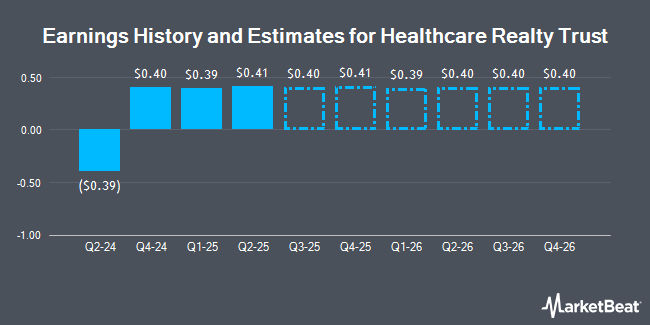

Healthcare Realty Trust (NYSE:HR - Get Free Report) last released its quarterly earnings data on Friday, August 2nd. The real estate investment trust reported ($0.39) earnings per share (EPS) for the quarter, missing the consensus estimate of $0.38 by ($0.77). The firm had revenue of $316.30 million during the quarter, compared to analyst estimates of $317.90 million. Healthcare Realty Trust had a negative net margin of 42.79% and a negative return on equity of 8.50%. The business's quarterly revenue was down 6.4% compared to the same quarter last year. During the same period in the prior year, the company earned $0.39 EPS. Equities analysts anticipate that Healthcare Realty Trust will post 1.55 earnings per share for the current fiscal year.

Insider Buying and Selling at Healthcare Realty Trust

In other news, Director Thomas N. Bohjalian bought 9,000 shares of the firm's stock in a transaction on Monday, August 12th. The stock was acquired at an average price of $17.39 per share, with a total value of $156,510.00. Following the transaction, the director now owns 22,252 shares of the company's stock, valued at $386,962.28. This trade represents a 0.00 % increase in their position. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. In other news, Director Thomas N. Bohjalian purchased 9,000 shares of the business's stock in a transaction on Monday, August 12th. The shares were acquired at an average price of $17.39 per share, with a total value of $156,510.00. Following the completion of the transaction, the director now owns 22,252 shares of the company's stock, valued at $386,962.28. The trade was a 0.00 % increase in their position. The purchase was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, Director John Knox Singleton acquired 6,500 shares of the stock in a transaction dated Thursday, September 5th. The stock was acquired at an average cost of $18.24 per share, with a total value of $118,560.00. Following the completion of the transaction, the director now owns 57,082 shares in the company, valued at approximately $1,041,175.68. This represents a 0.00 % increase in their position. The disclosure for this purchase can be found here. In the last quarter, insiders have purchased 15,728 shares of company stock worth $279,069. Insiders own 0.56% of the company's stock.

Healthcare Realty Trust Company Profile

(

Get Free Report)

Healthcare Realty NYSE: HR is a real estate investment trust (REIT) that owns and operates medical outpatient buildings primarily located around market-leading hospital campuses. The Company selectively grows its portfolio through property acquisition and development. As the first and largest REIT to specialize in medical outpatient buildings, Healthcare Realty's portfolio includes more than 700 properties totaling over 40 million square feet concentrated in 15 growth markets.

Read More

Before you consider Healthcare Realty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Healthcare Realty Trust wasn't on the list.

While Healthcare Realty Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.