Herc (NYSE:HRI - Get Free Report) had its target price hoisted by The Goldman Sachs Group from $178.00 to $204.00 in a research report issued to clients and investors on Wednesday, Benzinga reports. The firm currently has a "buy" rating on the transportation company's stock. The Goldman Sachs Group's price objective suggests a potential downside of 2.76% from the company's previous close.

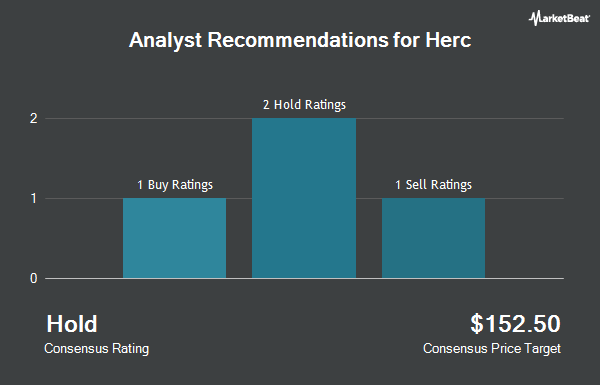

Several other analysts have also recently weighed in on the stock. Robert W. Baird reaffirmed a "neutral" rating and set a $155.00 price objective on shares of Herc in a research note on Tuesday, July 23rd. Barclays raised their price target on Herc from $175.00 to $250.00 and gave the company an "overweight" rating in a report on Wednesday. StockNews.com downgraded Herc from a "buy" rating to a "hold" rating in a research report on Friday, July 12th. Finally, JPMorgan Chase & Co. increased their target price on Herc from $200.00 to $240.00 and gave the stock a "neutral" rating in a report on Wednesday. Four equities research analysts have rated the stock with a hold rating and two have given a buy rating to the company. Based on data from MarketBeat.com, the stock has an average rating of "Hold" and a consensus target price of $199.80.

Get Our Latest Stock Report on Herc

Herc Price Performance

Shares of Herc stock traded up $11.19 during midday trading on Wednesday, hitting $209.79. 1,253,233 shares of the company were exchanged, compared to its average volume of 238,562. The firm has a 50 day simple moving average of $152.81 and a 200-day simple moving average of $146.81. The company has a debt-to-equity ratio of 2.91, a current ratio of 1.23 and a quick ratio of 1.23. The firm has a market cap of $5.96 billion, a P/E ratio of 17.32, a PEG ratio of 1.00 and a beta of 2.07. Herc has a 52 week low of $100.17 and a 52 week high of $210.93.

Herc (NYSE:HRI - Get Free Report) last issued its quarterly earnings data on Tuesday, October 22nd. The transportation company reported $4.35 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $4.48 by ($0.13). Herc had a net margin of 10.00% and a return on equity of 26.99%. The company had revenue of $965.00 million for the quarter, compared to the consensus estimate of $931.33 million. During the same period in the previous year, the business posted $4.00 earnings per share. The firm's revenue was up 6.3% compared to the same quarter last year. Research analysts forecast that Herc will post 13.68 earnings per share for the current year.

Insider Transactions at Herc

In related news, COO Aaron Birnbaum sold 10,000 shares of the firm's stock in a transaction dated Monday, August 26th. The stock was sold at an average price of $146.71, for a total value of $1,467,100.00. Following the transaction, the chief operating officer now owns 38,232 shares in the company, valued at $5,609,016.72. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. In related news, COO Aaron Birnbaum sold 10,000 shares of the stock in a transaction that occurred on Monday, August 26th. The shares were sold at an average price of $146.71, for a total value of $1,467,100.00. Following the transaction, the chief operating officer now directly owns 38,232 shares in the company, valued at $5,609,016.72. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Also, SVP Tamir Peres sold 5,821 shares of the firm's stock in a transaction that occurred on Wednesday, July 31st. The shares were sold at an average price of $159.03, for a total transaction of $925,713.63. Following the completion of the transaction, the senior vice president now directly owns 35,415 shares in the company, valued at approximately $5,632,047.45. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 1.80% of the stock is currently owned by corporate insiders.

Institutional Investors Weigh In On Herc

A number of institutional investors and hedge funds have recently added to or reduced their stakes in HRI. Signaturefd LLC grew its position in shares of Herc by 27.7% during the 3rd quarter. Signaturefd LLC now owns 281 shares of the transportation company's stock worth $45,000 after buying an additional 61 shares during the period. SummerHaven Investment Management LLC grew its holdings in Herc by 2.1% during the second quarter. SummerHaven Investment Management LLC now owns 5,147 shares of the transportation company's stock valued at $686,000 after purchasing an additional 108 shares during the period. Zurcher Kantonalbank Zurich Cantonalbank grew its holdings in Herc by 3.0% during the second quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 6,086 shares of the transportation company's stock valued at $811,000 after purchasing an additional 178 shares during the period. Mackenzie Financial Corp increased its stake in Herc by 5.2% in the second quarter. Mackenzie Financial Corp now owns 3,758 shares of the transportation company's stock valued at $501,000 after purchasing an additional 185 shares in the last quarter. Finally, Headlands Technologies LLC acquired a new stake in Herc in the first quarter worth $31,000. Institutional investors own 93.11% of the company's stock.

About Herc

(

Get Free Report)

Herc Holdings Inc, together with its subsidiaries, operates as an equipment rental supplier. It rents aerial, earthmoving, material handling, trucks and trailers, air compressors, compaction, and lighting equipment, as well as generators, and safety supplies and expendables; and provides ProSolutions, an industry specific solution based services, such as pumping solutions, power generation, climate control, remediation and restoration, and studio and production equipment.

Featured Stories

Before you consider Herc, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Herc wasn't on the list.

While Herc currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.