Fort Pitt Capital Group LLC purchased a new position in shares of The Hershey Company (NYSE:HSY - Free Report) in the 3rd quarter, according to the company in its most recent 13F filing with the SEC. The firm purchased 17,862 shares of the company's stock, valued at approximately $3,426,000.

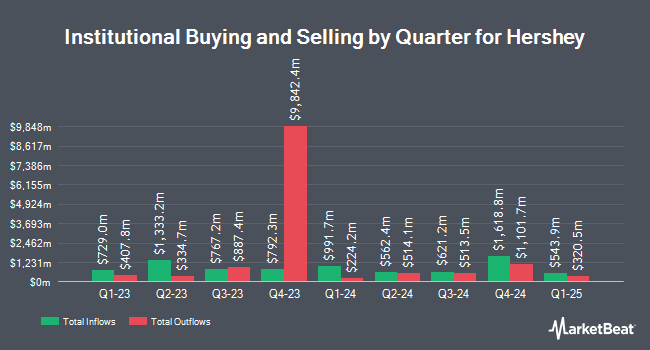

A number of other hedge funds also recently modified their holdings of the stock. Capital Advisors Ltd. LLC grew its stake in Hershey by 218.2% in the 2nd quarter. Capital Advisors Ltd. LLC now owns 140 shares of the company's stock valued at $26,000 after buying an additional 96 shares in the last quarter. GHP Investment Advisors Inc. grew its position in shares of Hershey by 55.0% in the second quarter. GHP Investment Advisors Inc. now owns 155 shares of the company's stock valued at $28,000 after purchasing an additional 55 shares in the last quarter. OFI Invest Asset Management bought a new stake in shares of Hershey during the 2nd quarter valued at $29,000. Crewe Advisors LLC purchased a new stake in Hershey during the 1st quarter worth about $35,000. Finally, Gradient Investments LLC boosted its stake in Hershey by 71.9% in the 2nd quarter. Gradient Investments LLC now owns 251 shares of the company's stock worth $46,000 after purchasing an additional 105 shares during the period. Institutional investors own 57.96% of the company's stock.

Hershey Trading Up 0.9 %

Hershey stock traded up $1.68 during trading hours on Friday, reaching $179.26. The stock had a trading volume of 1,360,471 shares, compared to its average volume of 1,200,953. The stock has a market cap of $36.26 billion, a PE ratio of 19.92, a PEG ratio of 4.09 and a beta of 0.38. The company has a fifty day simple moving average of $190.76 and a 200-day simple moving average of $192.53. The company has a debt-to-equity ratio of 0.87, a current ratio of 0.86 and a quick ratio of 0.48. The Hershey Company has a 52 week low of $176.78 and a 52 week high of $211.92.

Hershey (NYSE:HSY - Get Free Report) last posted its earnings results on Thursday, August 1st. The company reported $1.27 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.44 by ($0.17). Hershey had a return on equity of 45.36% and a net margin of 16.76%. The business had revenue of $2.07 billion during the quarter, compared to the consensus estimate of $2.30 billion. During the same period in the previous year, the business earned $2.01 earnings per share. The firm's revenue for the quarter was down 16.7% compared to the same quarter last year. Analysts forecast that The Hershey Company will post 9.42 EPS for the current fiscal year.

Insider Transactions at Hershey

In related news, CAO Jennifer Mccalman sold 538 shares of the company's stock in a transaction that occurred on Monday, August 12th. The stock was sold at an average price of $199.17, for a total transaction of $107,153.46. Following the completion of the transaction, the chief accounting officer now owns 3,238 shares in the company, valued at $644,912.46. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Corporate insiders own 0.34% of the company's stock.

Analyst Ratings Changes

Several brokerages have recently weighed in on HSY. Jefferies Financial Group decreased their price target on Hershey from $163.00 to $161.00 and set an "underperform" rating on the stock in a research report on Thursday. Stifel Nicolaus lowered their target price on shares of Hershey from $195.00 to $180.00 and set a "hold" rating on the stock in a research note on Friday, October 25th. Sanford C. Bernstein downgraded shares of Hershey from an "outperform" rating to a "market perform" rating and cut their price target for the company from $230.00 to $205.00 in a report on Monday, October 7th. Royal Bank of Canada decreased their price target on shares of Hershey from $209.00 to $205.00 and set a "sector perform" rating on the stock in a report on Friday, August 2nd. Finally, Redburn Atlantic initiated coverage on Hershey in a research note on Tuesday, October 22nd. They set a "sell" rating and a $165.00 price objective for the company. Five research analysts have rated the stock with a sell rating and fourteen have given a hold rating to the company. According to data from MarketBeat, Hershey currently has an average rating of "Hold" and a consensus target price of $191.61.

View Our Latest Analysis on Hershey

Hershey Profile

(

Free Report)

The Hershey Company, together with its subsidiaries, engages in the manufacture and sale of confectionery products and pantry items in the United States and internationally. The company operates through three segments: North America Confectionery, North America Salty Snacks, and International. It offers chocolate and non-chocolate confectionery products; gum and mint refreshment products, including mints, chewing gums, and bubble gums; protein bars; pantry items, such as baking ingredients, toppings, beverages, and sundae syrups; and snack items comprising spreads, bars, snack bites, mixes, popcorn, and pretzels.

Further Reading

Before you consider Hershey, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hershey wasn't on the list.

While Hershey currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.