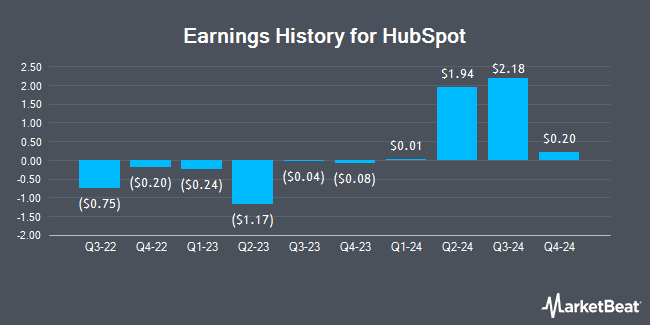

HubSpot (NYSE:HUBS - Get Free Report) is scheduled to be releasing its earnings data after the market closes on Wednesday, November 6th. Analysts expect HubSpot to post earnings of $1.89 per share for the quarter. Persons interested in registering for the company's earnings conference call can do so using this link.

HubSpot (NYSE:HUBS - Get Free Report) last released its quarterly earnings data on Wednesday, August 7th. The software maker reported $1.94 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.64 by $0.30. HubSpot had a negative return on equity of 2.33% and a negative net margin of 1.15%. The company had revenue of $637.20 million during the quarter, compared to the consensus estimate of $619.28 million. During the same quarter in the prior year, the firm posted ($1.17) earnings per share. The firm's revenue was up 20.4% compared to the same quarter last year.

HubSpot Stock Performance

Shares of HubSpot stock traded up $3.88 on Wednesday, hitting $567.09. The stock had a trading volume of 30,045 shares, compared to its average volume of 588,027. The stock has a 50 day moving average of $520.74 and a 200 day moving average of $548.17. HubSpot has a twelve month low of $408.62 and a twelve month high of $693.85. The firm has a market capitalization of $28.90 billion, a P/E ratio of -212.67, a PEG ratio of 7,068.33 and a beta of 1.64.

Insider Buying and Selling

In related news, CEO Yamini Rangan sold 116 shares of HubSpot stock in a transaction dated Wednesday, September 4th. The stock was sold at an average price of $491.19, for a total value of $56,978.04. Following the completion of the sale, the chief executive officer now owns 67,203 shares of the company's stock, valued at approximately $33,009,441.57. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. In related news, CEO Yamini Rangan sold 116 shares of HubSpot stock in a transaction dated Wednesday, September 4th. The stock was sold at an average price of $491.19, for a total value of $56,978.04. Following the completion of the sale, the chief executive officer now owns 67,203 shares of the company's stock, valued at approximately $33,009,441.57. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Also, CFO Kathryn Bueker sold 1,136 shares of the company's stock in a transaction dated Wednesday, October 2nd. The shares were sold at an average price of $525.84, for a total value of $597,354.24. Following the sale, the chief financial officer now owns 41,259 shares in the company, valued at approximately $21,695,632.56. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders sold 6,321 shares of company stock valued at $3,374,089. 4.50% of the stock is owned by insiders.

Analysts Set New Price Targets

Several research firms have recently issued reports on HUBS. Raymond James lowered their price objective on HubSpot from $725.00 to $675.00 and set an "outperform" rating for the company in a research note on Thursday, August 8th. BMO Capital Markets reaffirmed an "outperform" rating and issued a $570.00 price objective on shares of HubSpot in a research note on Thursday, September 19th. Piper Sandler reaffirmed an "overweight" rating and issued a $570.00 price objective on shares of HubSpot in a research note on Thursday, September 19th. Royal Bank of Canada reissued an "outperform" rating and set a $700.00 target price on shares of HubSpot in a research report on Thursday, September 19th. Finally, Oppenheimer reissued an "outperform" rating and set a $625.00 target price on shares of HubSpot in a research report on Thursday, September 19th. Four research analysts have rated the stock with a hold rating and twenty-one have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $614.33.

View Our Latest Analysis on HubSpot

About HubSpot

(

Get Free Report)

HubSpot, Inc, together with its subsidiaries, provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific. The company's CRM platform includes Marketing Hub, a toolset for marketing automation and email, social media, SEO, and reporting and analytics; Sales Hub offers email templates and tracking, conversations and live chat, meeting and call scheduling, lead and website visit alerts, lead scoring, sales automation, pipeline management, quoting, forecasting, and reporting; Service Hub, a service software designed to help businesses manage, respond, and connect with customers; and Content Management Systems Hub enables businesses to create new and edit existing web content.

Featured Stories

Before you consider HubSpot, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HubSpot wasn't on the list.

While HubSpot currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.