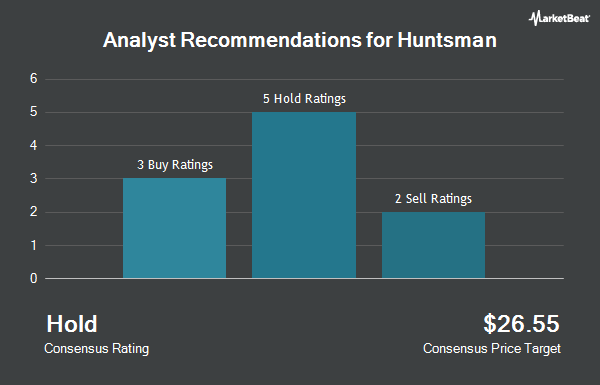

Shares of Huntsman Co. (NYSE:HUN - Get Free Report) have been assigned a consensus rating of "Hold" from the eight brokerages that are presently covering the stock, MarketBeat reports. One equities research analyst has rated the stock with a sell recommendation, four have issued a hold recommendation and three have issued a buy recommendation on the company. The average 1 year price target among brokers that have updated their coverage on the stock in the last year is $25.75.

Several brokerages recently issued reports on HUN. Wells Fargo & Company reduced their price objective on Huntsman from $28.00 to $26.00 and set an "overweight" rating for the company in a report on Wednesday, August 7th. Royal Bank of Canada lifted their price target on Huntsman from $21.00 to $24.00 and gave the stock a "sector perform" rating in a research note on Friday, October 11th. UBS Group decreased their price objective on shares of Huntsman from $23.00 to $22.00 and set a "neutral" rating on the stock in a research report on Tuesday, August 6th. Finally, JPMorgan Chase & Co. dropped their target price on shares of Huntsman from $27.00 to $25.00 and set an "overweight" rating for the company in a report on Wednesday, August 7th.

Read Our Latest Research Report on Huntsman

Institutional Trading of Huntsman

A number of hedge funds have recently bought and sold shares of HUN. Pallas Capital Advisors LLC lifted its stake in shares of Huntsman by 7.5% during the 3rd quarter. Pallas Capital Advisors LLC now owns 34,230 shares of the basic materials company's stock worth $782,000 after purchasing an additional 2,397 shares during the period. Nisa Investment Advisors LLC increased its stake in Huntsman by 21.4% in the third quarter. Nisa Investment Advisors LLC now owns 64,615 shares of the basic materials company's stock valued at $1,564,000 after purchasing an additional 11,400 shares during the last quarter. Wealth Enhancement Advisory Services LLC lifted its position in Huntsman by 257.4% during the third quarter. Wealth Enhancement Advisory Services LLC now owns 37,396 shares of the basic materials company's stock worth $905,000 after buying an additional 26,934 shares during the period. Mirae Asset Global Investments Co. Ltd. boosted its stake in Huntsman by 11.2% in the 3rd quarter. Mirae Asset Global Investments Co. Ltd. now owns 98,103 shares of the basic materials company's stock worth $2,408,000 after buying an additional 9,876 shares during the last quarter. Finally, Shayne & Jacobs LLC grew its holdings in Huntsman by 1.2% in the 3rd quarter. Shayne & Jacobs LLC now owns 94,316 shares of the basic materials company's stock valued at $2,282,000 after buying an additional 1,140 shares during the period. Institutional investors and hedge funds own 84.81% of the company's stock.

Huntsman Price Performance

Shares of HUN traded up $0.13 during trading hours on Wednesday, reaching $22.36. The company had a trading volume of 1,743,190 shares, compared to its average volume of 1,869,508. The company has a current ratio of 1.30, a quick ratio of 0.77 and a debt-to-equity ratio of 0.40. Huntsman has a 12-month low of $19.91 and a 12-month high of $27.01. The firm has a 50 day simple moving average of $22.72 and a 200-day simple moving average of $23.13. The company has a market capitalization of $3.87 billion, a price-to-earnings ratio of -43.60 and a beta of 1.00.

Huntsman (NYSE:HUN - Get Free Report) last issued its earnings results on Monday, August 5th. The basic materials company reported $0.14 earnings per share (EPS) for the quarter, meeting analysts' consensus estimates of $0.14. The company had revenue of $1.57 billion during the quarter, compared to analysts' expectations of $1.61 billion. Huntsman had a negative net margin of 1.44% and a positive return on equity of 0.26%. The firm's quarterly revenue was down 1.4% compared to the same quarter last year. During the same period last year, the company posted $0.22 earnings per share. Research analysts expect that Huntsman will post 0.19 earnings per share for the current year.

Huntsman Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Monday, September 30th. Shareholders of record on Friday, September 13th were issued a $0.25 dividend. The ex-dividend date of this dividend was Friday, September 13th. This represents a $1.00 dividend on an annualized basis and a yield of 4.47%. Huntsman's dividend payout ratio (DPR) is -192.31%.

About Huntsman

(

Get Free ReportHuntsman Corporation manufactures and sells diversified organic chemical products worldwide. The company operates in three segments: Polyurethanes, Performance Products, and Advanced Materials. The Polyurethanes segment offers polyurethane chemicals, including methyl diphenyl diisocyanate, polyether and polyester polyols, and thermoplastic polyurethane; and aniline, benzene, nitrobenzene and other co-products.

Featured Articles

Before you consider Huntsman, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Huntsman wasn't on the list.

While Huntsman currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.