Huntsman (NYSE:HUN - Get Free Report) is scheduled to be issuing its quarterly earnings data after the market closes on Monday, November 4th. Analysts expect the company to announce earnings of $0.09 per share for the quarter. Parties that are interested in participating in the company's conference call can do so using this link.

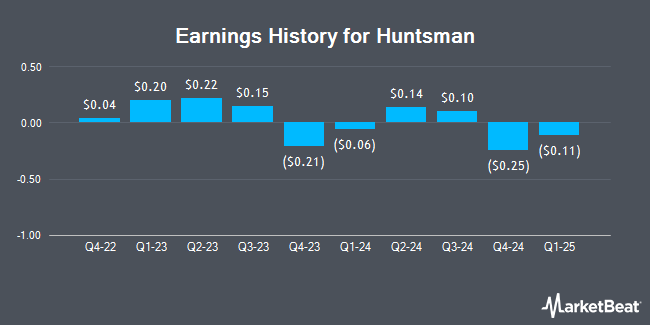

Huntsman (NYSE:HUN - Get Free Report) last posted its quarterly earnings results on Monday, August 5th. The basic materials company reported $0.14 earnings per share (EPS) for the quarter, hitting the consensus estimate of $0.14. Huntsman had a positive return on equity of 0.26% and a negative net margin of 1.44%. The firm had revenue of $1.57 billion during the quarter, compared to analyst estimates of $1.61 billion. During the same quarter in the previous year, the firm earned $0.22 EPS. Huntsman's quarterly revenue was down 1.4% compared to the same quarter last year. On average, analysts expect Huntsman to post $0 EPS for the current fiscal year and $1 EPS for the next fiscal year.

Huntsman Stock Performance

NYSE:HUN traded up $0.18 during mid-day trading on Monday, reaching $22.63. The company's stock had a trading volume of 911,450 shares, compared to its average volume of 1,871,957. The company has a current ratio of 1.30, a quick ratio of 0.77 and a debt-to-equity ratio of 0.40. The stock has a market cap of $3.91 billion, a P/E ratio of -43.52 and a beta of 1.00. The firm's fifty day moving average price is $22.69 and its two-hundred day moving average price is $23.14. Huntsman has a 12-month low of $19.91 and a 12-month high of $27.01.

Huntsman Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Monday, September 30th. Shareholders of record on Friday, September 13th were paid a dividend of $0.25 per share. This represents a $1.00 annualized dividend and a yield of 4.42%. The ex-dividend date of this dividend was Friday, September 13th. Huntsman's dividend payout ratio is currently -192.31%.

Wall Street Analyst Weigh In

Several research firms have issued reports on HUN. Wells Fargo & Company lowered their target price on shares of Huntsman from $28.00 to $26.00 and set an "overweight" rating on the stock in a research note on Wednesday, August 7th. UBS Group lowered their price objective on shares of Huntsman from $23.00 to $22.00 and set a "neutral" rating on the stock in a research note on Tuesday, August 6th. JPMorgan Chase & Co. lowered their price objective on shares of Huntsman from $27.00 to $25.00 and set an "overweight" rating on the stock in a research note on Wednesday, August 7th. Finally, Royal Bank of Canada increased their price objective on shares of Huntsman from $21.00 to $24.00 and gave the stock a "sector perform" rating in a research note on Friday, October 11th. One equities research analyst has rated the stock with a sell rating, four have assigned a hold rating and three have given a buy rating to the company. Based on data from MarketBeat, the company currently has an average rating of "Hold" and a consensus target price of $25.75.

View Our Latest Stock Report on Huntsman

Huntsman Company Profile

(

Get Free Report)

Huntsman Corporation manufactures and sells diversified organic chemical products worldwide. The company operates in three segments: Polyurethanes, Performance Products, and Advanced Materials. The Polyurethanes segment offers polyurethane chemicals, including methyl diphenyl diisocyanate, polyether and polyester polyols, and thermoplastic polyurethane; and aniline, benzene, nitrobenzene and other co-products.

Further Reading

Before you consider Huntsman, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Huntsman wasn't on the list.

While Huntsman currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.